Fed and BOJ Policy Shifts Trigger Crypto Market Rout - Losses Widen as Central Banks Flex

Central banks just threw a bucket of ice water on the crypto party.

The One-Two Punch from Washington and Tokyo

Forget subtle signals. The Federal Reserve and the Bank of Japan aren't whispering anymore—they're shouting through their policy indicators. And the crypto market heard it loud and clear, tumbling deeper into the red. It's the old-world financial guard reminding the new digital frontier who still controls the liquidity taps.

When Macro Trumps Micro

Traders glued to on-chain analytics and protocol upgrades got a brutal lesson: global macro moves faster. The market's reaction wasn't a gentle nudge—it was a sharp, cascading sell-off. All those carefully plotted support levels? They vanished like a mirage when institutional money started recalculating risk against a shifting interest rate landscape.

The Liquidity Lifeline Gets Tugged

This is the core vulnerability laid bare. Crypto's explosive growth has been fueled by a tide of cheap capital. Now, as the world's most powerful financial institutions adjust their sails, that tide is receding. It turns out digital assets aren't an island—they're a peninsula, firmly attached to the mainland of traditional finance. A classic case of 'risk-off' hitting the riskiest assets first, proving that even decentralized finance hasn't quite figured out how to decentralize away from the Fed's balance sheet.

The sell-off deepens. It's a stark, necessary reminder that in the high-stakes game of global finance, crypto is still playing on someone else's board—and they just decided to shake it.

Bitcoin Under Policy Pressure

The Bank of Japan has been preparing markets for a shift away from ultra-easy settings, with Governor Kazuo Ueda indicating that a policy change meeting is scheduled for December, contingent on wage data. Traders have read that guidance as a potential end to the negative-rate era, which tightened financial conditions into the weekend and helped set off the slide.

On the U.S. side, Federal Reserve officials have leaned cautious on additional easing. Boston Fed President Susan Collins said she WOULD be “hesitant to ease policy further,” describing a “relatively high bar” for further moves without clearer labor-market deterioration.

The remarks of the Federal Reserve and the talk of a policy shift in Japan have pushed yields higher and firmed the dollar; the combination raises funding costs, softens futures basis toward neutral, and reduces tolerance for leverage that had supported rallies during stronger tapes.

Outflows from some spot vehicles on risk-off sessions compound that pressure because they drain cash that would otherwise stabilize closes.

What Would Ease The Strain

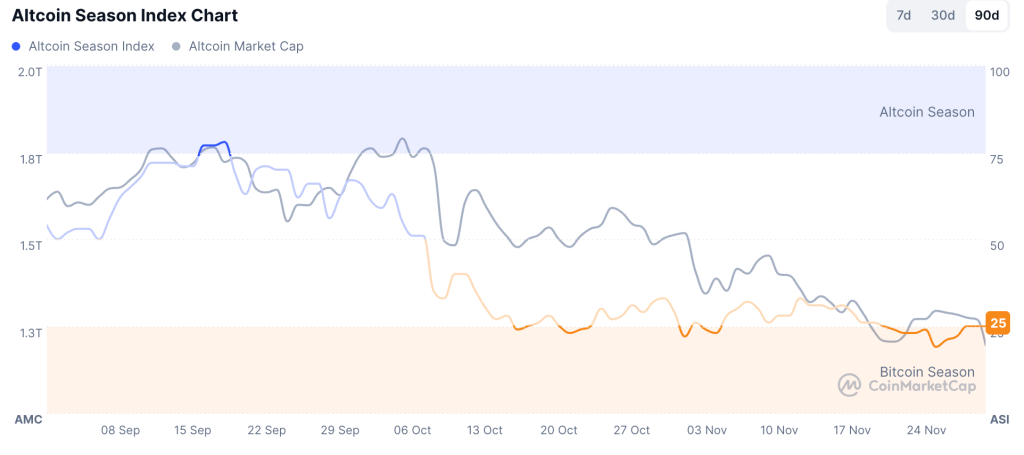

Crypto markets shed billions as the global market enters December 2025. More than $637 million in long positions were liquidated during the slide, and the Altcoin Season Index fell to 25, pointing to weak breadth beyond Bitcoin.

Altcoin Season Index (Source: CoinMarketCap)

A credible turn would show up together rather than in fragments. Order-book depth on the largest BTC and ETH pairs would rebuild into and after the United States session, while spreads would stay contained during moderate selling, and funding would stabilize without leaning on short squeezes that exhaust by the close.

Spot product creations would need to improve alongside a rise in net stablecoin issuance, since that pairing signs fresh cash coming in rather than transient covering. When those flows persist for several sessions, rebounds tend to settle more cleanly at the end of the day.

Central bank remarks that push yields higher or firm the dollar can keep bids soft, and relief rallies risk fading when depth thins and exchange-traded flow does not offset de-risking. The tone across majors still follows Bitcoin, and bitcoin remains one policy headline away from another test of support.