Coinbase Faces Record 12,716 Government Requests in 2025—What It Means for Your Crypto

Coinbase just got hit with more government requests than ever before. The exchange fielded a staggering 12,716 demands for user data from authorities worldwide in 2025—a new record that signals regulators are turning up the heat.

The Compliance Crunch

Every request represents a legal tug-of-war. Governments want visibility; users want privacy. For a platform built on decentralized ideals, each subpoena forces a choice between principle and permission to operate. It's the cost of going mainstream—trading some crypto-anarchy for a seat at the financial table.

Behind the Numbers

Think of it as a global audit. The 12,716 figure isn't just a statistic—it's a map of regulatory pressure points. Law enforcement agencies, tax authorities, and financial watchdogs are all lining up, treating crypto exchanges like de facto data brokers. Forget "your keys, your crypto"—when you custody with a giant, you're also handing over a paper trail.

The Privacy Paradox

This surge creates a fundamental tension. Transparency builds trust with regulators but erodes it with privacy-focused users. Every complied request reinforces Coinbase's legitimacy as a regulated entity while quietly distancing it from crypto's libertarian roots. It's a balancing act more delicate than predicting the next market swing.

What's Next?

Expect this number to keep climbing. As digital assets weave deeper into the global economy, governments will demand more—not less—oversight. For investors, it's a stark reminder: the trade-off for convenience is surveillance. The very infrastructure bringing crypto to the masses is also making it easier to track. A cynical take? Wall Street always finds a way to monetize your freedom—even the digital kind.

Source: Coinbase

Source: Coinbase

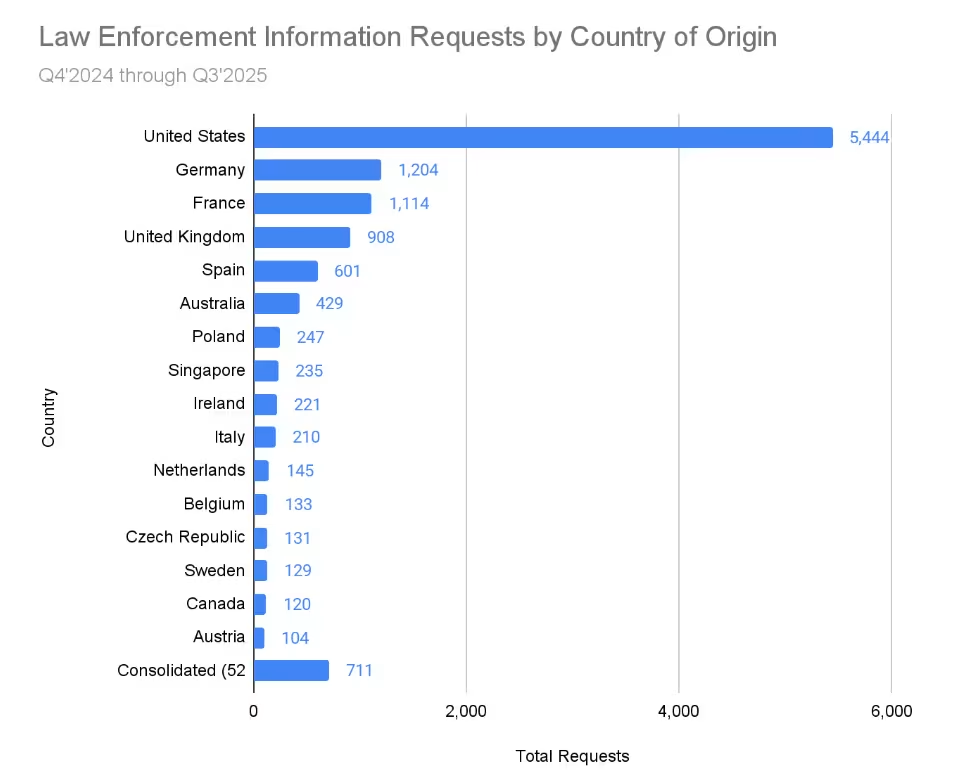

France Drives International Demand, U.S. Still Dominates

The United States remained the largest single source of requests, followed by Germany, the United Kingdom, France, Spain, and Australia.

These six countries combined accounted for roughly 80% of all law enforcement requests globally.

France saw the sharpest increase among major jurisdictions, with requests jumping 111% from the prior reporting period.

The U.K. and Spain also posted double-digit gains, rising 16% and 27% respectively. Germany, Sweden, and South Korea recorded decreases, with South Korea’s requests dropping 67%.

Requests from Moldova and Brazil increased by factors of 5.7 and 2.7, while Australia’s volume remained nearly flat with just a 1% uptick.

Despite fluctuations across different markets, total request volume has stayed within the 10,000 to 13,000 range annually over the past four years.

Compliance Under Fire After Fines and Data Breach

The rising demand for user data comes amid regulatory penalties and internal security lapses that have damaged Coinbase’s compliance reputation.

In November, the exchange’s European arm agreed to pay €21.5 million to Ireland’s Central Bank after coding errors left 31% of transactions, worth more than $202 billion, unscreened for money laundering between 2021 and 2022.

The malfunction affected five of 21 transaction-monitoring scenarios, forcing Coinbase to reanalyze 185,000 transactions and file 2,700 suspicious transaction reports.

![]() Coinbase Europe was fined €21.5M after tech errors left 30M transactions unmonitored, breaching AML rules. #Ireland #AML #Coinbasehttps://t.co/IdrCGSLhBp

Coinbase Europe was fined €21.5M after tech errors left 30M transactions unmonitored, breaching AML rules. #Ireland #AML #Coinbasehttps://t.co/IdrCGSLhBp

Just last year, Coinbase’s UK subsidiary was fined £3.5 million by the Financial Conduct Authority for onboarding over 13,000 high-risk customers in violation of a voluntary restriction, facilitating nearly $226 million in transfers.

In May, the exchange disclosed a cyberattack compromising the personal data of at least 69,461 customers, including government-issued IDs and email addresses, after hackers bribed customer service staff.

The breach, which was not disclosed until weeks after discovery, triggered at least six class-action lawsuits and a Justice Department investigation.

Shareholders later filed a separate suit alleging that Coinbase and its CEO, Brian Armstrong, failed to promptly disclose both the breach and the UK compliance violation, contributing to a 7.2% drop in the company’s stock.

Coinbase Expands Compliance as SEC Pressure Eases

Coinbase emphasized in its latest report that it reviews each request on a case-by-case basis and seeks to narrow overly broad demands.

The exchange stated that it seeks to provide anonymized or aggregated data whenever possible, rather than exposing individual customer information.

Requests received do not always result in data being produced, and the company maintains that it does not grant governments direct access to its systems.

The report arrives as Coinbase benefits from a dramatic shift in U.S. regulatory posture.

Great news!

After years of litigation, millions of your taxpayer dollars spent, and irreparable harm done to the country, we reached an agreement with SEC staff to dismiss their litigation against Coinbase. Once approved by the Commission (which we're told to expect next week)… pic.twitter.com/IlnoBs7N6n

In March, the Securities and Exchange Commission agreed to drop its years-long enforcement action against the exchange, which had accused Coinbase of operating as an unregistered securities platform.

The dismissal followed similar moves by the SEC to abandon cases against Kraken, Robinhood, and Consensys after Paul Atkins replaced Gary Gensler as chair in January.

Additionally, back in September, Atkins pledged to replace what he called a “” approach with advance notices and clearer guidance for crypto firms.