Litecoin (LTC) Price Prediction: Liquidity Sweep Above $80 Ignites New Bullish Targets, Defying Wider Downtrend

Litecoin just pulled off a classic crypto move—it swept liquidity above $80. That's not just a technical blip; it's a signal flare for traders watching the charts.

The Setup: A Bullish Break in Bearish Times

While the broader market slumps, LTC carved its own path. The move past $80 wasn't an accident. It was a calculated purge of sell-side orders, clearing the runway for the next leg up. Forget the macro gloom for a second—this is pure price action talking.

What the Sweep Really Means

Liquidity sweeps are the market's way of resetting the board. They trap late sellers and stop out the weak hands, often right before a reversal. Hitting that $80+ zone suggests a hidden pool of buy-side demand was waiting. Now that it's been triggered, the path of least resistance shifts.

New Targets on the Horizon

With that key level cleared, chartists are already plotting the next destinations. The sweep establishes a new support base, turning former resistance into a potential launchpad. The focus isn't on the wider downtrend anymore—it's on the specific bullish structure LTC is building against it.

Of course, in a world where 'fundamentals' can mean a celebrity tweet, a clean chart pattern sometimes feels like the only honest signal left. Litecoin's price action, for now, is doing the talking—and it's saying the trend might be changing from the inside out.

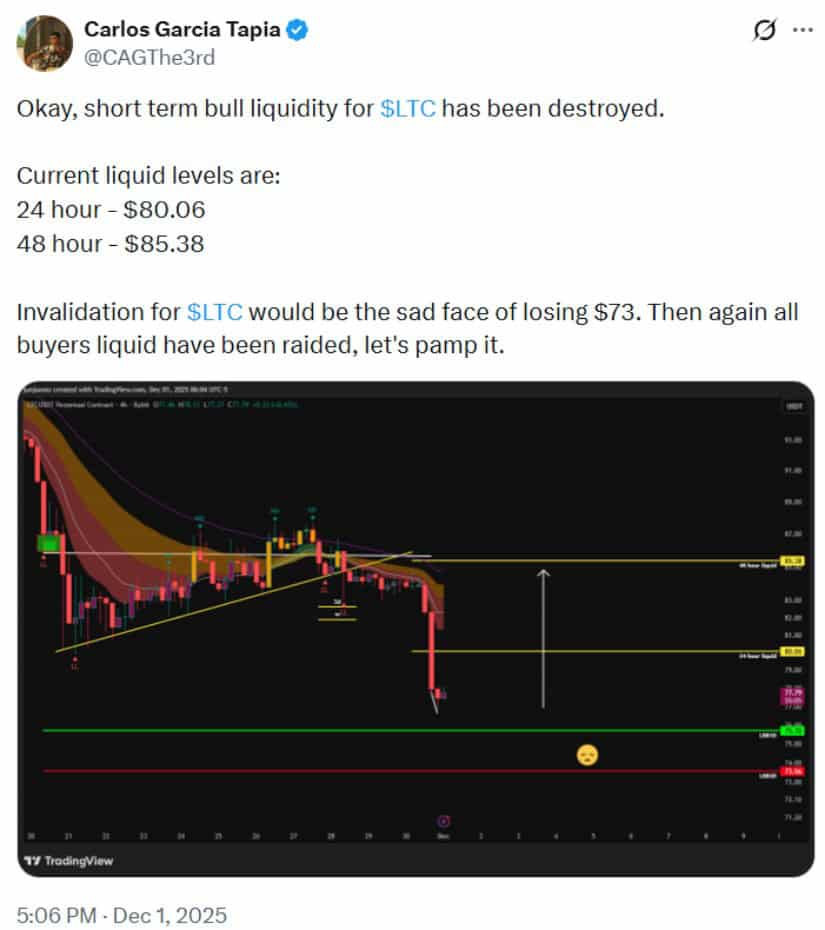

The move, captured on the 4-hour Bybit perpetual futures chart, cleared a key pocket of short-term buy-side liquidity and exposed new upside markers at $80.06 and $85.38. According to recent exchange data, traders are now weighing whether this shift indicates an early recovery attempt or a temporary interruption within a broader downtrend.

At the time of analysis, Litecoin (LTC) was trading in the $77.50–$77.80 area. Technical readings place $73 as the key invalidation level for the current bullish structure. A sustained move below this region typically increases downside risk by triggering forced liquidations in overleveraged positions—something many short-term traders monitor closely during periods of volatility.

Analyst Insights and Long-Term Value Models

Alongside short-term trading dynamics, some analysts are revisiting Litecoin’s long-term valuation models. One perspective gaining attention comes from a long-time Litecoin researcher known as @MASTERBTCLTC, recognized within the community for developing open-source tools that compare Litecoin’s network fundamentals to Bitcoin’s historical valuation trends.

The researcher noted that LTC’s movement NEAR $82 aligned with an eight-year logarithmic accumulation trendline, a level historically referenced by some analysts to gauge long-term value zones. According to their commentary, Litecoin may appear “undervalued relative to network usage,” though this view is not universally held.

Short-term bullish liquidity on LTC has been cleared, leaving $80.06 and $85.38 as the next upside targets, with $73 as the key invalidation level. Source: @CAGThe3rd via X

The model also outlines highly optimistic long-term paths, including an extrapolated scenario projecting potential price levels far above the current market, such as $240,000 by 2030. However, these projections assume unprecedented capital inflows of $4 trillion to $8 trillion over the next year, far exceeding historical precedents in the crypto market. Analysts caution that such extreme targets are based on mathematical extensions of past cycles rather than verifiable economic indicators.

Specialists in digital asset research emphasize that long-term Litecoin forecasts should be interpreted cautiously. Forecasting models relying solely on trendlines or fractal patterns can produce wide variance when applied to volatile assets like LTC. As a result, market observers generally recommend pairing such technical ideas with fundamental drivers such as transaction activity, market liquidity, regulatory conditions, and broader macroeconomic sentiment.

Trading Outlook and Market Sentiment

Short-term traders remain focused on technical zones, emphasizing support and resistance levels while managing risk carefully. A recent trading note highlighted that LTC had retested a known support region, making it “a potential interest zone for long positions,” provided stop-loss orders are placed beyond the lower support boundary. This reflects common range-trading approaches used during periods of consolidation.

This setup highlights a straightforward range-trading approach: buying at support with a stop below the level and targeting profits as the price moves between established zones. Source: Elimzo on TradingView

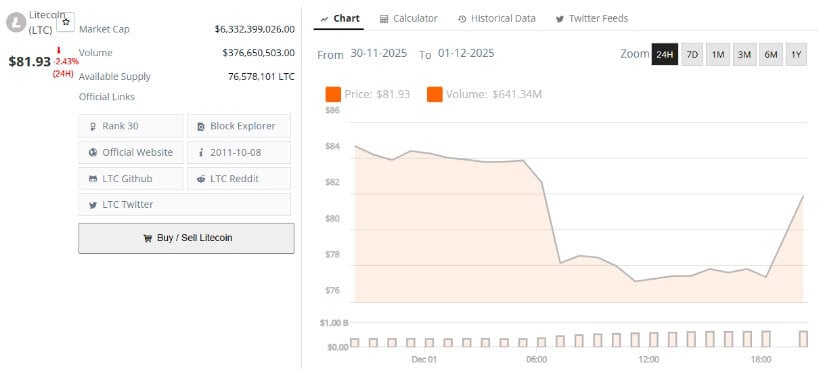

According to aggregated exchange metrics from December 1, 2025, Litecoin traded between $77.03 and $84.75 within 24 hours. Despite active intraday movement, the asset has experienced sustained downward pressure:

-

−7.75% over 24 hours

-

−6.88% over 7 days

-

−20.66% over 30 days

-

More than −20% year-over-year

These declines align with broader risk-off conditions in the crypto market and ongoing regulatory uncertainty.

Market Factors: ETF Withdrawal and Institutional Behavior

Market sentiment weakened further in late November after CoinShares withdrew its application for a Litecoin ETF, citing regulatory challenges and low margins for single-asset products. According to regulatory filings, the firm concluded that current U.S. requirements made approval unlikely in the near term. The decision contributed to a dip in investor confidence, particularly among those tracking LTC ETF developments as a potential catalyst.

Litecoin has returned to its 8-year accumulation trendline, signaling DEEP value relative to its network activity with a multi-trillion-dollar upside thesis over the next year. Source: @MASTERBTCLTC via X

Despite the setback, selective institutional participation has continued. Some corporate treasury disclosures indicate that individual companies have added small amounts of LTC to diversify digital asset holdings, though these purchases are modest relative to the wider market. Analysts note that institutional engagement remains limited compared to major cryptocurrencies like Bitcoin and Ethereum.

On the network side, Litecoin’s technical development continues to advance. The rollout of LitVM in 2025 expanded the protocol’s smart contract capabilities, while the ongoing adoption of MWEB strengthened optional privacy features. These upgrades have reinforced Litecoin’s role as a fast, low-fee settlement layer—an area where some businesses continue exploring LTC for payments and everyday transactional use.

Outlook and Conclusion

Litecoin’s near-term price direction will depend largely on whether the recent liquidity sweep above $80 results in sustained accumulation or fails to hold above key support levels. The short-term upside markers at $80.06 and $85.38 provide reference points for momentum traders, while $73 remains the critical invalidation zone for bullish scenarios in current market conditions.

Litecoin was trading at around $81.93, down 2.43% in the last 24 hours. Source: Brave New Coin

Investor sentiment around Litecoin remains divided. Some analysts view the asset as undervalued due to steady network activity and ongoing development, while others highlight persistent macro and technical headwinds that could limit upside potential. Given this environment, Litecoin price predictions continue to vary widely, reflecting both market uncertainty and the influence of speculative technical models.

This analysis is intended for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and readers are encouraged to conduct their own research and consider risk factors before making investment decisions.