Peter Brandt’s Bitcoin Paradox: Bullish But Warning Traders—What’s Next?

Veteran trader Peter Brandt just dropped a bombshell on crypto Twitter—his Bitcoin holdings are stacked, but his tone screams caution. Why the mixed signals as BTC flirts with all-time highs?

The Contrarian's Dilemma

Brandt’s track record for calling market turns is legendary, yet even he’s hedging his bets. ‘This isn’t 2021,’ his analysis hints—pointing to parabolic curves that historically precede brutal corrections. But his portfolio? Still 60% BTC. Classic trader cognitive dissonance.

Market Whiplash Ahead?

Liquidity’s flooding back into crypto, yet institutional players are quietly rolling out short positions. Retail FOMO meets Wall Street’s stealthy puts—someone’s about to get squeezed. ‘The dumb money’s always last to the party,’ quipped one hedge fund quant (between sips of a $28 artisanal cold brew).

Brandt’s Bottom Line

His final advice? ‘Trade the chart, not the cheerleading.’ Translation: Those moon-boy memes won’t pay your margin call when the leverage resets. The old guard’s playing both sides—maybe you should too.

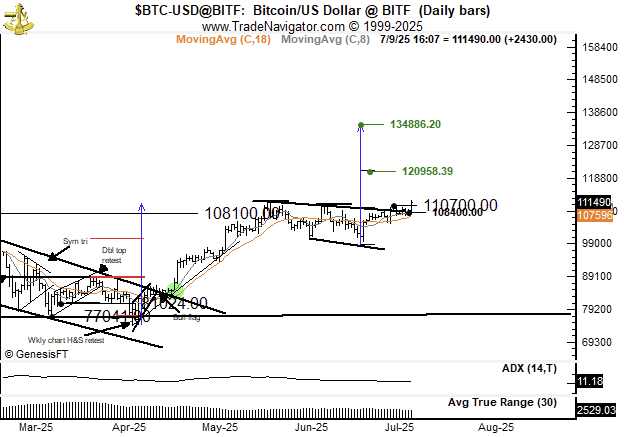

Key level: $107,000 as structural support

Brandt highlighted the $107,000 level as a crucial support zone. A breakdown below this threshold would, in his view, “suggest morphology”—a term he uses to describe pattern breakdowns or evolving market structures. For now, BTC is trading NEAR $111,490, just above the $110,700 resistance-turned-support line.

Price targets: $120K to $135K still in sight

Despite his reservations about the pattern’s reliability, Brandt’s chart outlines potential bullish targets. The next major upward projections are $120,958 and $134,886.20—levels that align with the measured MOVE from the previous breakout zone around $108,100.

READ MORE:

Brandt’s position: Long but alert

Known for his no-nonsense approach to technical analysis, Brandt’s latest commentary signals a mix of Optimism and caution. While he maintains a long position in Bitcoin, he warns traders not to place blind faith in chart patterns, especially those with a high rate of failure. His broader message seems clear: bullish continuation is possible, but price structure integrity remains key.

As Bitcoin navigates the mid-$110K range, traders and analysts alike are watching closely to see whether this triangle resolves upward or confirms Brandt’s warnings with a deeper correction.

![]()