June 2025’s Blockchain Titans: The Top 10 Networks Dominating Transaction Volume

The crypto rails are humming—here's who's moving the most value this summer.

Layer-1s battle for throughput supremacy

Solana's parallel processing cements its lead, while Ethereum's rollup ecosystem quietly processes Fortune 500-scale settlements. Meanwhile, BNB Chain's retail dominance shows no signs of slowing—even if its 'decentralization theater' still draws eye-rolls from OG cypherpunks.

Institutional adoption drives dark horse contenders

Watch for Avalanche's institutional subnet surge and Polygon's zkEVM quietly eating enterprise market share. Meanwhile, Bitcoin's Lightning Network finally cracks the top 10—just as Wall Street starts pretending they invented it.

The bottom line?

Transaction volume doesn't lie—these chains are the plumbing of Web3's financial revolution. Whether that plumbing lasts longer than your average ICO whitepaper? That's the real trillion-dollar question.

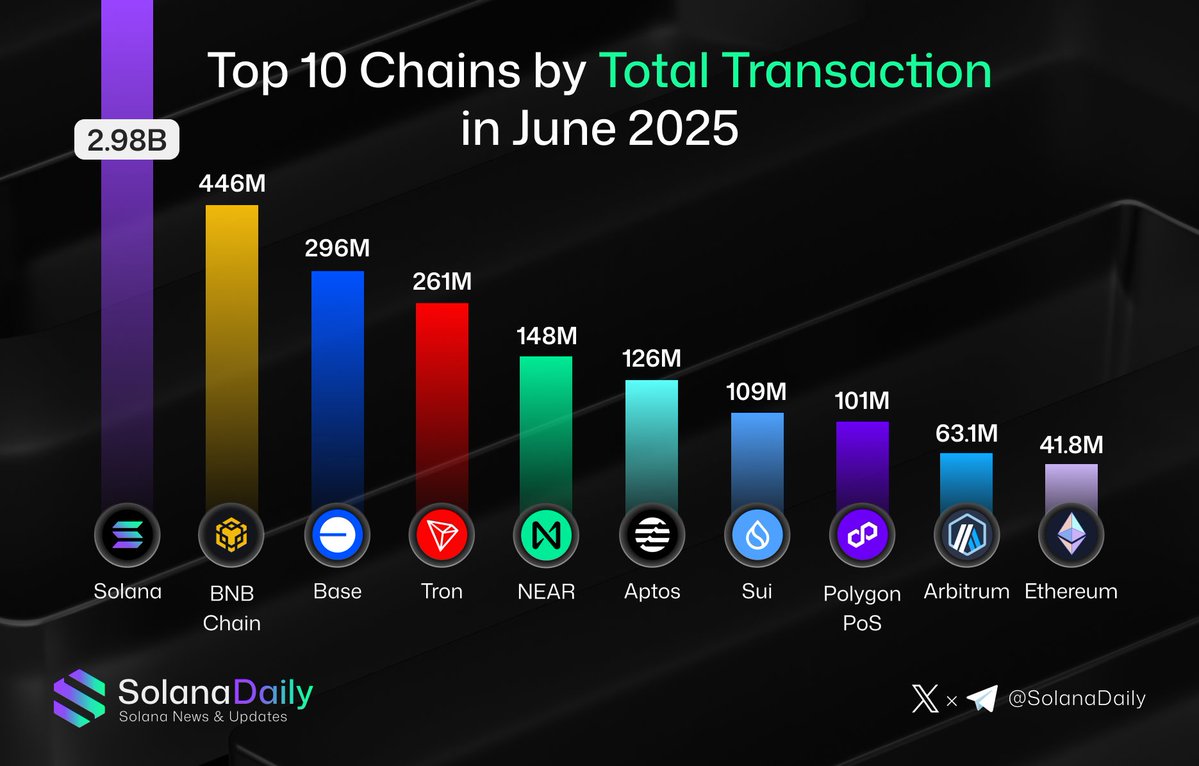

Full June 2025 transaction ranking

- Solana – 2.98B

- BNB Chain – 446M

- Base – 296M

- Tron – 261M

- NEAR Protocol – 148M

- Aptos – 126M

- Sui Network – 109M

- Polygon (PoS) – 101M

- Arbitrum – 63.1M

- Ethereum – 41.8M

The results reinforce Solana’s reputation for high throughput and low transaction costs—key features that have attracted developers and users to its ecosystem. With over six times more transactions than BNB Chain and more than 70 times that of Ethereum, Solana continues to benefit from its scalability-first architecture.

READ MORE:

Ethereum’s lagging transaction count raises questions

Ethereum, despite being the second-largest blockchain by market cap, came in last with just 41.8 million transactions in June. This comparatively low number reflects Ethereum’s ongoing transition toward LAYER 2 scaling solutions, as well as its higher transaction costs and slower speeds relative to newer chains.

While Ethereum remains dominant in DeFi and institutional trust, its mainnet’s lower raw transaction count signals a shifting user base toward more cost-efficient platforms.

Conclusion

Solana’s explosive growth in on-chain activity continues to position it as a leader in real-world blockchain usage. As newer chains like Base, Sui, and Aptos also gain momentum, the transaction volume leaderboard offers a clear snapshot of where user adoption is heading—and what networks are winning in day-to-day utility.

![]()