Wall Street’s Bitcoin Takeover: What’s Next for Crypto’s Rebel Asset?

Wall Street's suits have finally cracked Bitcoin's code—but at what cost to crypto's anarchic soul?

The Institutional Invasion

BlackRock's ETF approval wasn't just a milestone—it was the starting gun for finance's old guard to colonize crypto's wild west. Suddenly, your grandparents' pension fund holds more BTC than your favorite anarcho-capitalist blogger.

Liquidity vs. Ideology

Market depth has never been better. Trading volumes never higher. But somewhere, Satoshi's pseudonymous ghost is chain-smoking digital cigarettes over what his creation has become.

The Compliance Trap

KYC forms. Tax reporting. SEC filings. The very regulations Bitcoin was designed to bypass now form its golden cage. Irony doesn't begin to cover it.

What's Left for the OGs?

As Wall Street firms install mahogany trading desks in their Bitcoin divisions, true believers face a choice: adapt or retreat further into crypto's fringes.

One thing's certain—the revolution won't be decentralized if JPMorgan keeps buying up all the nodes.

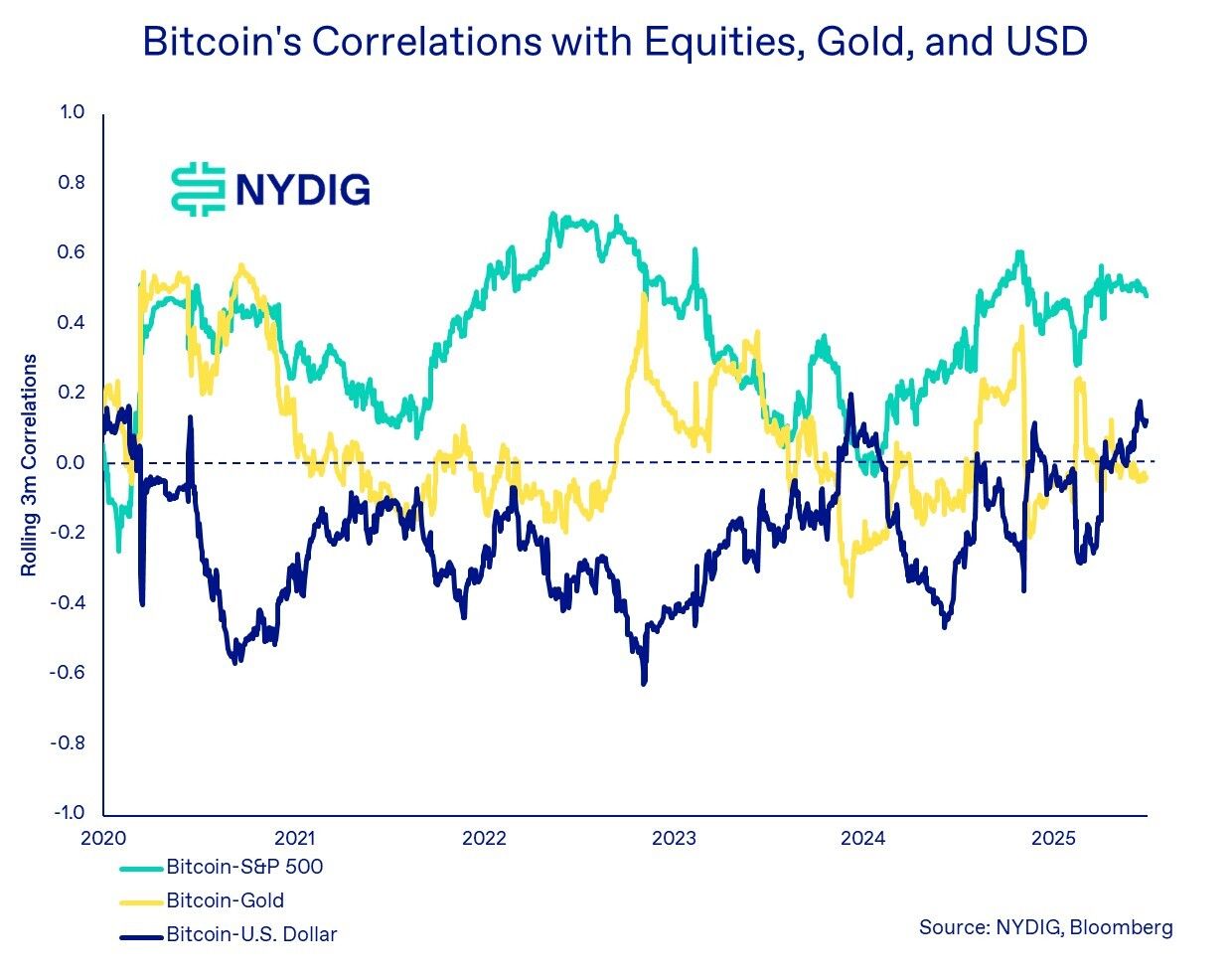

Simply put, when there is blood on the street (Wall Street that is), bitcoin bleeds too. When Wall Street sneezes, bitcoin catches a cold.

Even bitcoin's “digital gold” moniker is under pressure.

NYDIG notes that bitcoin’s correlation to physical Gold and the U.S. dollar is near zero. So much for the “hedge” argument—at least for now.

Risk asset

So why the shift?

The answer is simple: to Wall Street, bitcoin is just another risk asset, not digital gold, which is synonymous with "safe haven."

Investors are repricing everything from central bank policy whiplash to geopolitical tension—digital assets included.

"This persistent correlation strength with U.S. equities can largely be attributed to a series of macroeconomic and geopolitical developments, the tariff turmoil and the rising number of global conflicts, which significantly influenced investor sentiment and asset repricing across markets," said NYDIG.

And like it or not, this is here to stay—at least for a short to medium-term.

As long as central bank policy, macro, and war-linked red headlines hit the tape, bitcoin will likely move in tandem with equities.

"The current correlation regime may persist as long as global risk sentiment, central bank policy, and geopolitical flashpoints remain dominant market narratives," NYDIG's report said.

For the maxis and long-term holders, the original vision hasn't changed. Bitcoin's limited supply, borderless access, and decentralized nature remain untouched. Just don't expect them to impact price action just yet.

For now, the market sees bitcoin as just another stock ticker. Just balance your trade strategies accordingly.