$1.2B Floods Into Crypto Funds—Market Plunge and Geopolitical Chaos Can’t Stop the Inflow

Crypto's proving its resilience again—while traditional markets flinch, digital asset funds just racked up $1.2 billion in fresh capital. Here's why smart money's stacking sats against all odds.

Blood in the streets? More like dollar-cost-averaging opportunities. Even with Bitcoin's recent 20% haircut and missiles flying in the Middle East, institutional players are treating dips like a Black Friday sale. (Meanwhile, your boomer uncle's still waiting for that 'blockchain bubble' to pop.)

The real kicker? This isn't retail FOMO—these are hedge funds and family offices deploying capital with surgical precision. They're not betting on memecoins; they're positioning for the next halving cycle while Wall Street analysts still struggle to explain what a hash rate is.

So much for 'risk-off' sentiment. While bond traders hyperventilate over yield curves, crypto's building its war chest. The takeaway? When the VIX spikes, decentralized networks keep printing. Game recognize game.

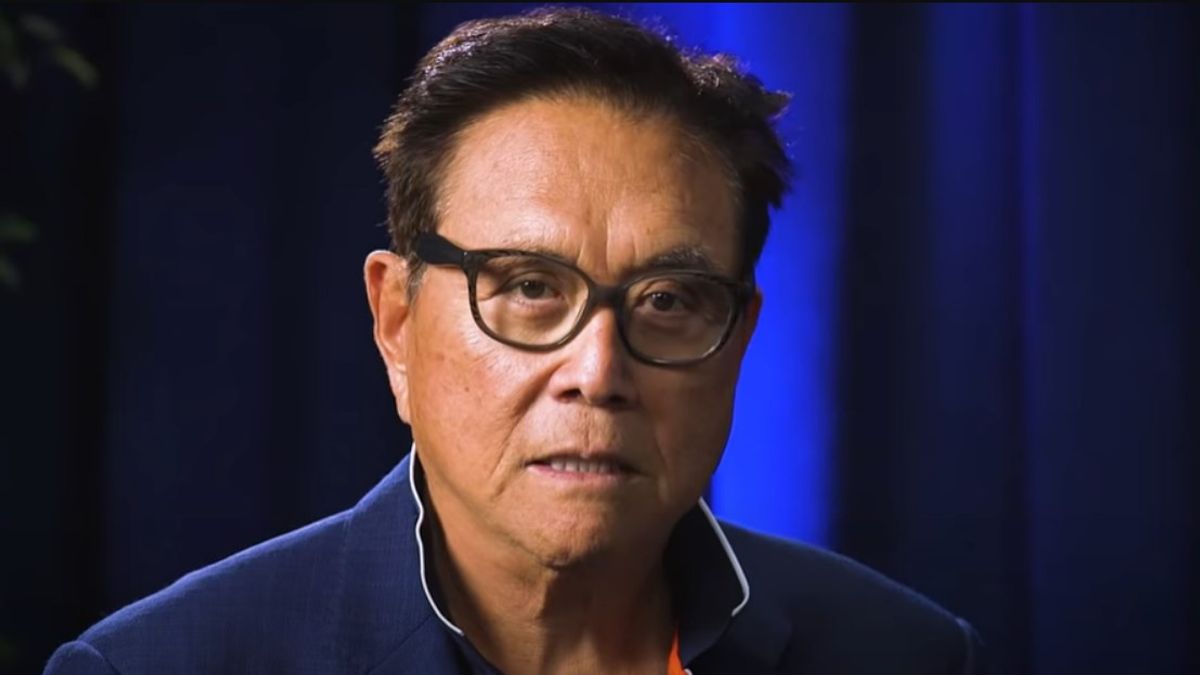

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

Prices, meanwhile, remain under pressure: bitcoin is down roughly 5 percent on the week near $101,600, and ether has shed nearly 14 percent to about $2,255. Still, analysts argue that steady institutional allocations—ranging from state treasuries in Texas to corporate balances at firms like Metaplanet—are creating a firmer long-term base.

Once the current bout of macro anxiety eases, they say, that underlying demand could set the stage for the next rebound, with some betting that high-beta assets such as solana might lead the charge.

![]()