Chainlink Price Showdown: Will LINK Shatter $15 or Collapse to $10?

Chainlink's native token LINK is at a crossroads—bulls eye a breakout past $15 while bears lurk around $10. Which way will the oracle giant swing?

Market forces clash as Chainlink's price teeters between two critical thresholds. The crypto's recent volatility has traders split: some see a rocket to new highs, others predict a plunge back to double-digit support.

Technical indicators paint a mixed picture. LINK's price action shows both strong resistance above $15 and stubborn support near $10—leaving analysts divided about its next move.

Meanwhile, traditional finance pundits scoff at the drama, muttering about 'speculative assets' between sips of their overpriced lattes. But in crypto land, this battle could determine whether Chainlink maintains its oracle dominance or gets dethroned by hungry competitors.

One thing's certain: when LINK moves, it moves fast. Will this be a moonshot or a faceplant? The market's about to cast its vote.

LINK Crypto Records Increased Whale Activity

Amid the increasing volatility, the chainlink token has experienced a huge spike over the recent times. As per the latest data from Lookonchain, a well-known page among investors for whale activity has recently posted about a major transaction involving the Chainlink crypto.

Chainlink Noncirculating Supply wallets deposited 17.875M $LINK($149M) into #Binance again today.

Historically, #Chainlink has done 11 major unlocks—most were followed by price increases.https://t.co/edlAW6psdb pic.twitter.com/3NoK2yhDeo

Notably, non-circulating Chainlink wallets have deposited 17.85 million LINK tokens worth approximately $149 million into Binance cryptocurrency exchange. With this, LINK has successfully executed 11 major unlocks out of which most were followed by price pumps.

Chainlink Price to Witness Major Retest

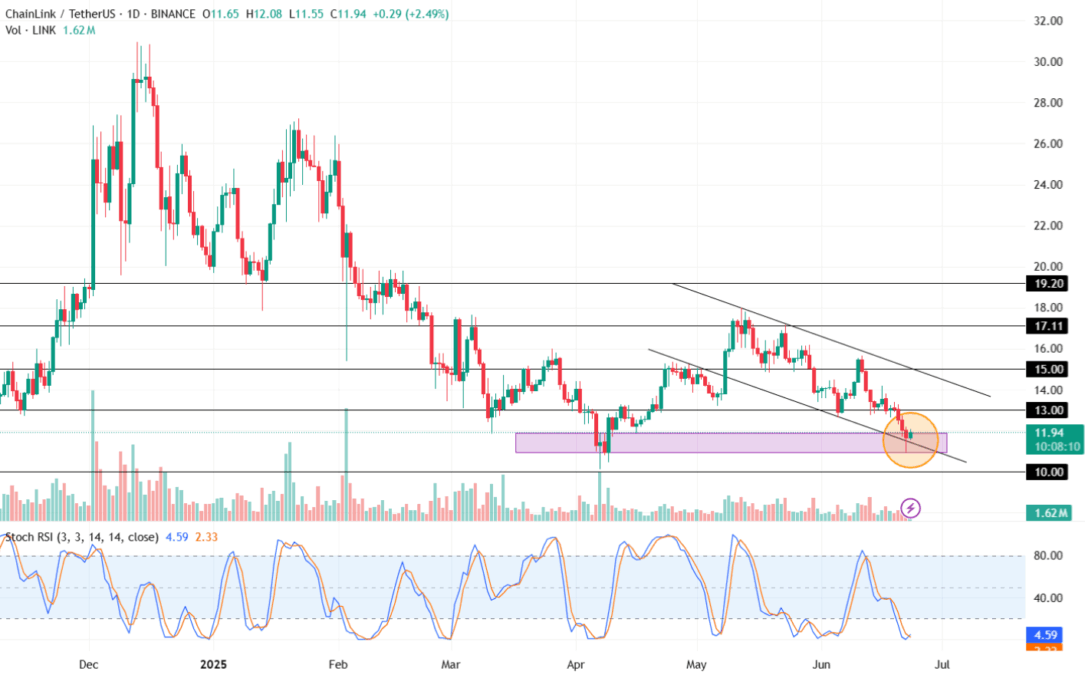

The Chainlink price has formed a descending channel pattern in the daily time frame and continues trading within it since May 2025. Moreover, it is on the verge of retesting its support trendline, highlighting increasing price action for LINK crypto in the market.

On the other hand, it has also formed a strong support zone around the $11.50 mark and has maintained its value above it since October 2024. With the ongoing market sentiments, the uncertainty for it is significantly rising.

The volume indicator displayed a sharp spike during April, however, it has witnessed a consolidated action since then. This shows a weak buying and selling pressure for the LINK price in the market.

The Stochastic Relative Strength Index (RSI) indicator has plunged below the oversold range as the market sentiments turn volatile. Positively, it shows a bullish convergence in its average trendline in the daily time frame. This hints at a high possibility of a reversal in the upcoming time.

If the Chainlink price successfully retests its support trendline this week, it could result in it heading back toward its resistance levels of $13 or $15 respectively.

Conversely, if the bears outrun the bulls, this could pull the price of LINK token toward its support trendline of the descending channel pattern around the $11.50 mark. Additionally, a sustained bearish action may plunge the value toward its crucial support of $10 shortly.

Also Read: Fartcoin Price Spikes 14%: Arkham Listing Factor or Something Else?