FTX Fights Back: Moves to Dismiss Three Arrows Capital’s Billion-Dollar Lawsuit

FTX draws a line in the sand—bankrupt crypto hedge fund Three Arrows Capital (3AC) won’t get a free pass on its $1B claim. The exchange’s legal team just filed to toss the suit, calling it 'baseless' in classic corporate-speak.

Subheader: The Billion-Dollar Blame Game

3AC’s collapse during the 2022 crypto winter left scorched earth—now they’re clawing at FTX’s coffers like a bear market trader chasing leverage. But FTX isn’t playing nice: court docs reveal they’ve labeled the claim 'legally meritless' (translation: 'not our problem').

Subheader: Lawyers, Not Liquidity

While both firms should’ve hired more risk managers instead of yacht brokers, the real winner here? Law firms billing hourly while the crypto world burns. Stay tuned—this legal showdown could set precedents for post-bankruptcy free-for-alls.

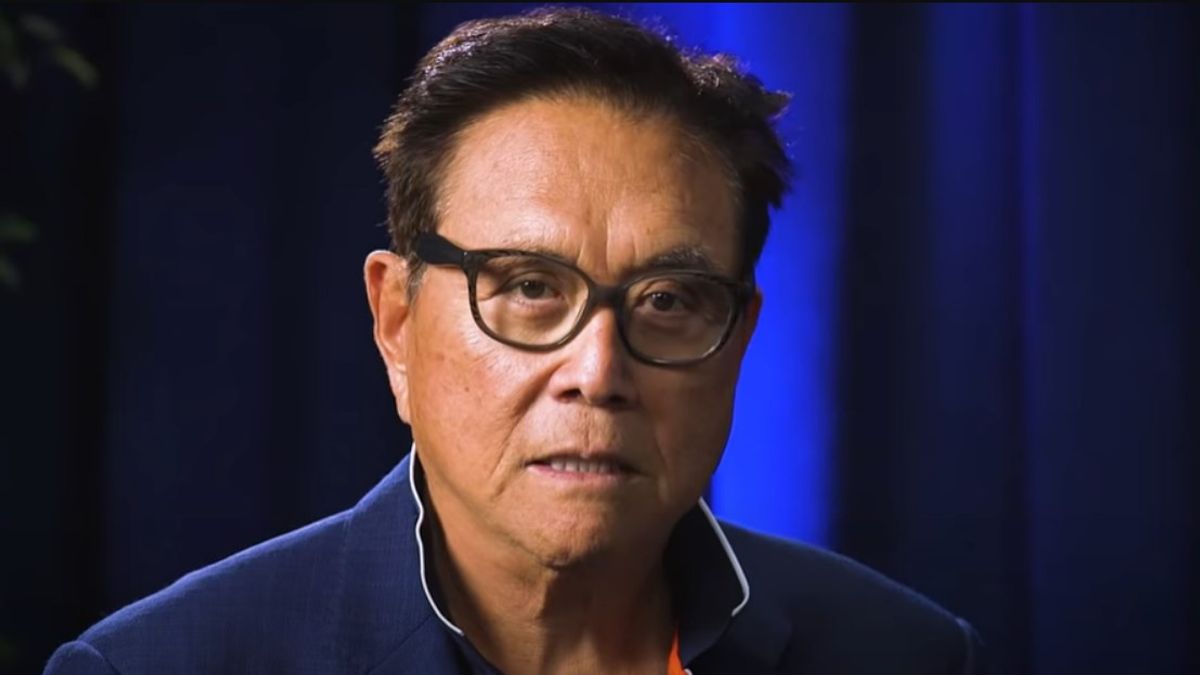

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

FTX’s lawyers argue that 3AC is trying to offload the costs of its failed strategy onto other creditors, and that the theory of “lost assets” has no legal or factual basis. The hearing is set for August 12, with 3AC’s response due by July 11.

Meanwhile, 3AC is also pursuing a separate $1.3 billion claim against Terraform Labs, accusing it of misleading marketing that led to massive losses during the LUNA and UST collapse. The hedge fund’s recovery efforts highlight the broader fallout from the 2022 crypto downturn, but courts may ultimately reject its claims as overreaching.

![]()