Pepe Price Teeters on Edge as Whales Bail—Is This the Bottom or Just the Beginning?

Meme coin Pepe (PEPE) faces a brutal reckoning as its biggest holders flee—sending prices spiraling toward new lows.

Whale wallets dump holdings

On-chain data shows top PEPE investors slashing positions, triggering panic among retail traders. Liquidity pools thin as sell pressure mounts.

Dead cat bounce or capitulation?

Some see blood in the water—others spy a fire sale. 'This is either the dumbest time to buy or the smartest,' quips one degenerate on Crypto Twitter.

Meanwhile, Bitcoin ETFs soak up all the institutional oxygen—because nothing says 'mature asset class' like gambling on frog memes while Wall Street plays with grown-up money.

Pepe (PEPE) price is on the verge of a further selloff. The top-tier frog-themed memecoin has been forming a potential macro reversal pattern year to date (YTD).

According to market analyst Aksel Kibar, Pepe Price is on the precipice of a major correction with a price target of $0.0000146. The crypto analyst noted that Pepe’s price, in the weekly timeframe, has been forming a potential head and shoulders (H&S) pattern coupled with a bearish divergence of the Relative Strength Index (RSI).

Source: X

Why is the Pepe Price Facinh Bearish Sentiment?

Top whale investors capitulate on heightened fear of further crypto capitulation

The overall demand for Pepe has significantly declined in the recent past. With the fear of further crypto capitulation at extreme levels, the overall demand for memecoins has remained relatively low.

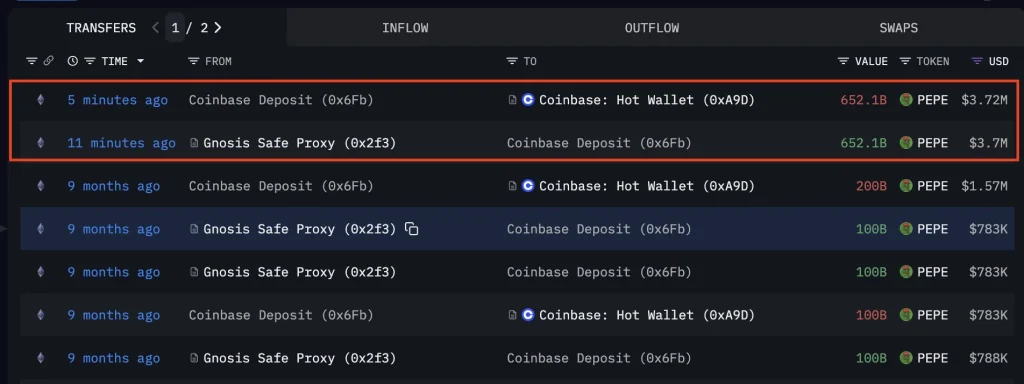

According to on-chain data analysis, whale investor 0x2f3 moved the final $3.7M worth of Pepe to Coinbase. As such, this whale investor has completely exited their Pepe position, which was once valued at $46 million, after holding since at least June 2024.

Source: X

Deleveraging market as Bitcoin further weakens against Gold

The PEPE Futures Open Interest (OI) has significantly dropped amid the ongoing crypto selloff. According to market data analysis from CoinGlass, Pepe’s OI has declined from nearly $1 billion to around $194 million in 2025.

Source: CoinGlass

The notable deleveraging of PEPE has coincided with the ongoing crypto liquidity crunch. Moreover, Bitcoin has been bleeding to Gold in the past few months, although the latter has signaled topping out.

What’s Next?

From a technical analysis standpoint, PEPE price is likely to rebound from its current support range and rally towards its new all-time high. With its correlation with Bitcoin and Ethereum still high, their potential rebound fueled by the Fed’s policy change will be a line of hope for the frog-themed meme.