Why Is Bitcoin Down Today? 7 Key Reasons Behind the Latest Crypto Market Crash (2025 Update)

Why Trust BTCC

Introduction

Bitcoin price can shift quickly, sometimes just because nothing much appears to be going on, or because a number of negative pressures have built up simultaneously. If you looked at a price chart today and asked yourself, ‘Why is Bitcoin down?’ Don’t worry, you’re not alone. There has been a fresh spate of sales in crypto currencies in November 2025.

This article outlines and explains just why this is, and helps you with a number of recommendations related to this issue, drawing on up-to-date media reports that you can read about yourself through your own research online.

Table of Contents

- Quick snapshot (What occurred this week?)

- 1. Persistent ETF Outflows: Institutional Sales Exceed Retail Buying

- 2. Macro and Geopolitical Headwinds: Risk off Environment

- 3. Major Security Incidents and DeFi Exploits: The Problem of Renewal of Trust

- 4. Whale and Custody Moves: Concentrated Selling from Large Holders

- 5. Technical Analysis – Resistance Levels and Weak Support Structures

- 6. Liquidity Dwindle in Spot and Derivatives Markets (Leverage Unwinds)

- 7. News and Media Cycles : Headlines Amplify Emotion

- How These Factors Interact — The Contagion Effect

- Data Guideline – Key Indicators to Watch (Live Metrics You Can Check daily)

- FAQs on Why Is Bitcoin Down?

- Conclusion

- How to Trade Crypto on BTCC?

- BTCC FAQs

/ You can claim a welcome reward of up to 10,055 USDT\

Quick snapshot (What occurred this week?)

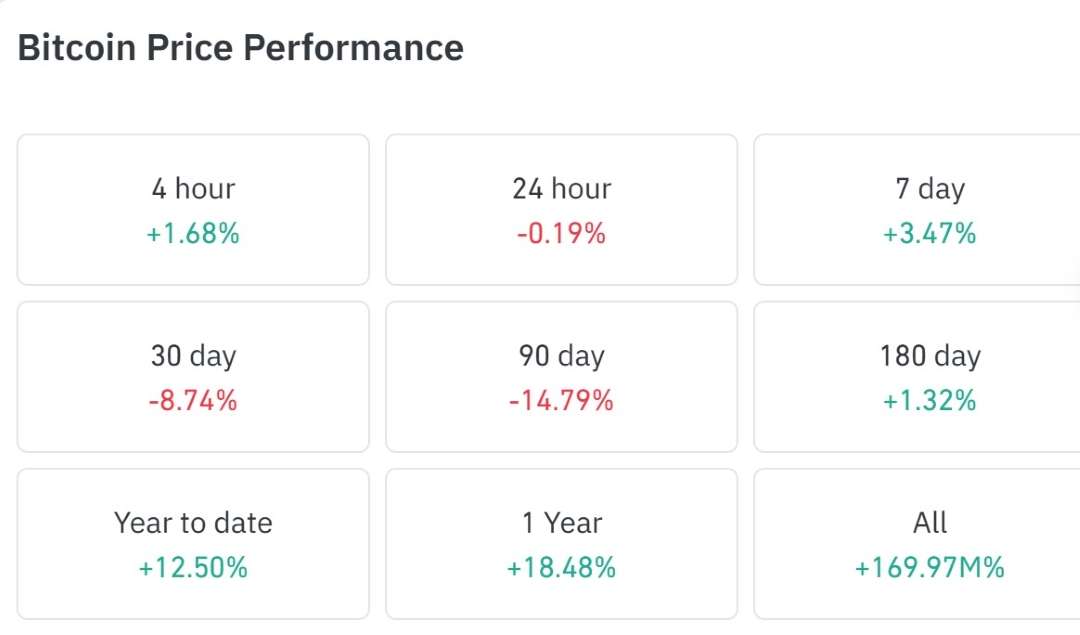

- Bitcoin retreated from its recent highs and tested near the region of $100k due to some days of net outflows from Spot-Bitcoin ETFs and a series of market shocks.

- U.S.-based spot Bitcoin ETFs have experienced back-to-back days of withdrawals, contributing to downward pressures on the market.

- Also, certain incidents related to DeFi, as well as geopolitical/macro uncertainty, have added to risk aversion on the part of investors.

These three themes of ETF flows, macro and regulatory uncertainty, and security incidents are what sustain this weakness on a daily basis. Seven more particular justifications are explored below.

1. Persistent ETF Outflows: Institutional Sales Exceed Retail Buying

Among the fair and most measurable drivers lately is the relentless net outflow from the U.S. Bitcoin spot ETFs. Net redemption over a multi-day period in early November 2025 shows custodial addresses sell BTC on the spot markets for redemption or rebalancing. This leads to plummeting prices due to the direct selling activity.

Why it matters: The outflows from ETFs are substantial and are largely concentrated. When funds like that of institutional, turn net negative, the effect is felt by the markets immediately. Even if retail investors are trying to buy the dip, their numbers cannot match the institutional sales, hence price gaps are created.

Register with BTCC Exchange to buy your Bitcoin and get first time bonus.

What to watch: ETF daily activity reports, big-picture movements in custody addresses. Collective big-picture outflows are a signal of potential future downside risks.

2. Macro and Geopolitical Headwinds: Risk off Environment

The ‘macro headwinds’ have contributed to the sell-off process too. The slow reduction in interest rate by central banks slowed down enthusiasm around the general crypto market. Similarly, activities around the tariffs war slows down global markets to opt for safer assets.

Why it matters: The correlation between Bitcoin and other risk assets (tech stocks, risk-on ETFs) is higher than before, thanks to the adoption of Bitcoin by institutions. When there is increased risk, money moves from risk assets to cash or bonds, leading to a decrease in the price of Bitcoin due to decreased demand.

Source: SEC

/ You can claim a welcome reward of up to 10,055 USDT\

What to watch: U.S. CPI data, jobs numbers, Fed rate-cut comments, and key trade announcements. When the bigger macro story switches to an obvious easing cycle, risk appetite will likely resume.

3. Major Security Incidents and DeFi Exploits: The Problem of Renewal of Trust

Security failures lead to the rapid loss of confidence. The early November 2025 period saw a significant exploit with a major DeFi protocol, with estimates ranging from tens to hundreds of million dollars. These raised risk concerns throughout the entire cryptocurrency market, including Bitcoin, as well as other markets, due to their heavy linkage with the cryptocurrency market.

Why it matters: Although Bitcoin’s chain is secured but not immune to system hacks. Whenever such occurs, fear enters into the general digital assets market. With market makers diversifying their interests while prices fall.

What to watch: on-chain activity related to the exchanges, audits of the major smart contracts in the DeFi space, and the sell dynamics of the hacked addresses.

4. Whale and Custody Moves: Concentrated Selling from Large Holders

There have also been some large custodial movements, including ETF custodian adjustment moves by large ETF custodians, as well as “whale” moves to exchanges, observed in the last few days. The greater visibility afforded by on-chain data also makes it simpler to identify these large transfer transactions. So, whenever custodian addresses holding assets for large funds or primes send assets to exchanges, trigger the notion on the markets that these are prep moves before selling. Some news sources, along with on-chain analytic platforms, noted large money movements in early November.

Why it matters: A few large market players can produce strong price movements if their dynamics change from accumulation to distribution. When the large wallet moves hundreds or thousands of BTC to the exchange hot wallets, the funds will be sold on the markets. Signup to BTCC Exchange to sell/buy Bitcoin swiftly and without hassle.

What to watch: Whale trackers, Exchange inflows, Large custodian address activity.

5. Technical Analysis – Resistance Levels and Weak Support Structures

Markets are a mixture of both psychology and numbers. Bitcoin, having had an extended period of growth, usually faces problems with respect to certain price levels. Such is the point where investors prefer to realize their profits or exit their trades. The price levels around $100k to $112k had played the role of support and resistance levels in the recent price fluctuations.

Whenever the number of sell orders exceeded the number of buy orders within these levels, the fall accelerated. A compression area was referred to by traders in the last month, which is said to result in a breakout on both sides in the short run due to its characteristics of having low volatility

What matters: Technical levels are important because many algorithms, funds, and traders will have stop-loss or limit order around these levels. When stops cascade, price movements can become nonlinear.

What to watch: on-chain price channels, open interest on the perpetuals, and the current support levels that kept being pointed out by analysts ($98k-$100k).

/ You can claim a welcome reward of up to 10,055 USDT\

6. Liquidity Dwindle in Spot and Derivatives Markets (Leverage Unwinds)

Volatility is lower, hence fewer liquidity providers participate. However, with the increase in selling pressure, the possibility of margin calls, derivatives, or other contracts expiring contributes to the decrease. Thus, creating the classic feedback mechanism that makes the fall steeper. There have been reports of large liquidation activities and positioning volatility in the options/derivative markets in early November.

Why it matters: Leverage is a force multiplier. When there are many long positions held with leverage, even the slightest downward pressure will trigger automatic selling. Pushing the price even lower due to the closure of positions.

What to watch: Futures open interest, heat maps of liquidation, and funding rate dynamics on the main markets.

7. News and Media Cycles : Headlines Amplify Emotion

Crypto markets are, in particular, sensitive to headlines. In the case of mainstream outlets running alarmist pieces about “market plunge” or “heavy institutional selling,” it triggers FOMO. in reverse: retail who bought the rally may panic-sell, and neutral holders may become sellers. Recent news cycles have emphasized both ETF outflows and security incidents, compounding market nervousness.

Why it matters: Sentiment is a self-fulfilling mechanism. Negative narratives lower the bar for sellers and make buyers more risk-averse.

What to watch: social sentiment metrics, headlines from major financial outlets, and shifts in Google search interest for “sell Bitcoin” or “is Bitcoin dead”.

How These Factors Interact — The Contagion Effect

These reasons seldom occur in isolation. For example: a large DeFi exploit (reason 3) causes risk aversion (reason 2) → ETFs experience redemptions (reason 1) → custodians adjust holdings (reason 4) → leveraged longs get liquidated (reason 6) → headlines amplify fear (reason 7) → technical supports break (reason 5).

That cascade is a common pattern in sharp drawdowns.

/ You can claim a welcome reward of up to 10,055 USDT\

Data Guideline – Key Indicators to Watch (Live Metrics You Can Check daily)

| Indicator | Why It Matters |

| Spot ETF flows (daily) | Large Outflows = Selling Pressure;

Inflow = Institutional Demand. |

| Exchange Inflows/outflows | Big inflows often precede heavy selloff ; outflows often signal accumulation |

| Futures Open Interest ( OI) and funding rate | Increasing open interest with negative funding → Leverage shorting risk; Falling open interest during sell-off often signifies deleveraging. |

| On-chain Whale Transfer | Transfers to exchange wallets often signal upcoming sales |

| DeFi Exploits/ Major Headlines | Hack or security incidents could create fear |

FAQs on Why Is Bitcoin Down?

Q1. Why is Bitcoin down today?

Bitcoin dropping is a result of several factors – such as institutional sell-off, FOMO, spot ETFs moving funds. Often market corrections might be near as used to, after heavy sell-off.

Q2. Is this a sign the bull market is over?

Not really. Short-term corrections happen across cycles. Movement of funds across assets – digital assets, stocks, forex, commodities – is a recurring event. Instead, track ETF demand, institutional custody and macro geopolitical activities.

Q3. Should I buy the dip?

It depends on your trading strategy. If you’re a long-term investor that is interested in chasing fundamentals, use DCA intermittently to reduce timing risk. If you’re a short term and experienced investor with deep technical analysis skills, you might wish to confirm support levels before adding risk.

Q4. Can governments make Bitcoin crash?

Significant government policies can impact Bitcoin – positively or negatively. But the long-term effect depends on sustenance of such policies or action. Incidents such as the tariffs trade war.

Conclusion

For those seeking an answer to the question: “why is Bitcoin down?”. The short answer is a convergence of factors such as institutional outflows, macro and geopolitical uncertainty, hacks and whales sell-off. Thus, Bitcoin falling is multi-faceted.

That said, Bitcoin falls and rises per time. It signifies buyers and sellers are negotiating for an equilibrium. Every moment presents an opportunity to leverage for experienced traders. For investors, the top defense against a sudden BTC crash includes having clear plans. Stay ahead of the curve with BTCC Academy free resources, tutorials and guides.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download