Crypto Market Plummets: Is the U.S. Government’s End to Blame?

Blood in the streets as Bitcoin and altcoins nosedive—just as Washington's wheels fall off. Coincidence? Wall Street's algo-traders don’t think so.

Why the panic? Three reasons traders are hitting 'sell':

1.

Political chaos = risk-off mode

No functioning government means no bailouts, no backstops—just pure, unfiltered market Darwinism. Crypto’s 'anti-fragile' narrative gets its brutal stress test.

2.

Liquidity ghosts haunting exchanges

With Treasury yields mooning, even degenerate money’s fleeing to 'safe' assets. (Note: 'safe' now means 12% FDIC-insured CDs at your local zombie bank.)

3.

Miners capitulating—again

Hash rate drops as energy costs spike. Those Texas mining farms? Suddenly less profitable than a Lemonade stand in December.

Silver lining? The dip-buyers are lurking. When nation-states fail, code-based money tends to… remember its purpose. Just ask the 1% stacking sats while Congress burns.

*Final thought: Maybe Satoshi timed this perfectly—right as the old system coughs its last breath.*

The crypto market continued with its recent bloodbath on Wednesday, November 12. Bitcoin (BTC) led the wider altcoin market in heightened selling pressure.

The total crypto market cap dropped by 2% to hover around $3.42 trillion at press time. BTC price slipped below $102k again after the bullish momentum failed to gain traction.

Main Reasons Why Crypto Dropped Today

Low market demand amid notable fear of further crypto capitulation

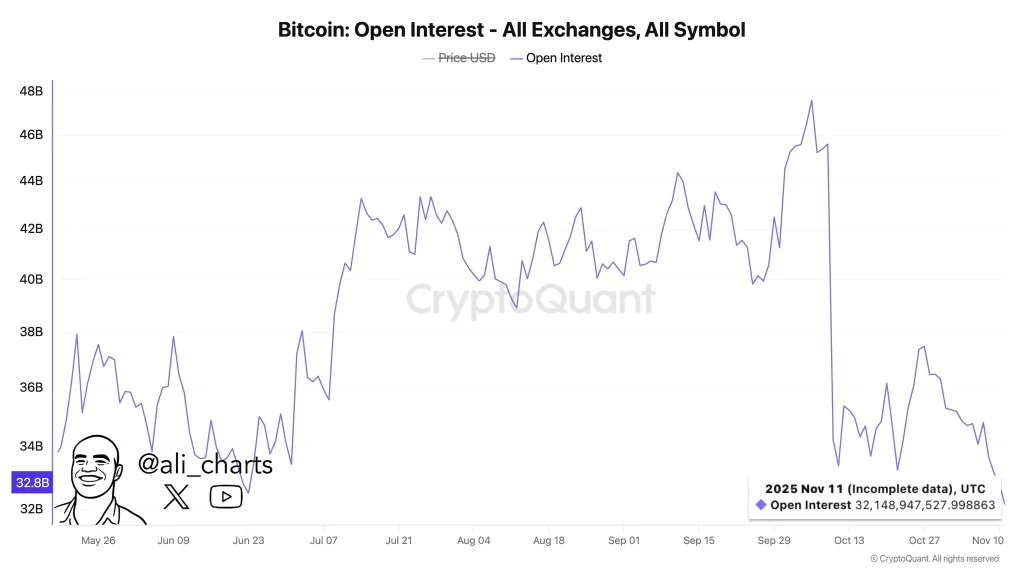

The overall capital inflow to the crypto market has significantly declined in the recent past, as shown by the spot Bitcoin and ethereum ETFs. Notably, Bitcoin’s Open Interest (OI) across all crypto exchanges has dropped to a seven-month low.

Source: X

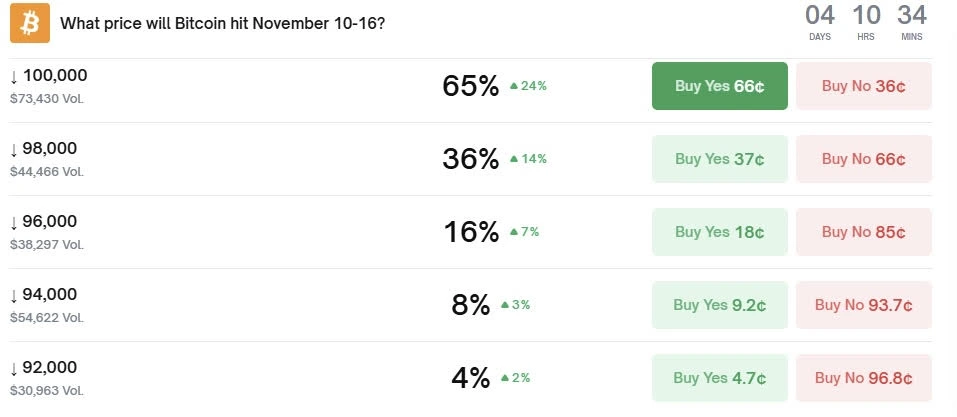

Meanwhile, Polymarket traders have been betting that the Bitcoin price will continue to drop further in the coming days, potentially below $100k.

Source: Polymarket

Heavy liquidation of long crypto traders amid fears of Hyperliquid attack

Following the wider crypto correction, more than $612 million was rekt from Leveraged traders, with around $502 million involving long traders. The crypto market was also gripped with fear of a potential attack on Hyperliquid, the largest DEX futures platform.

It appears that Hyperliquid bridge has stopped processing withdrawals. No activity in 21 minutes pic.twitter.com/NFSeVHhE1t

— Conor (@jconorgrogan) November 12, 2025Technical headwinds amid sell-the-news impact due to the reopening of the U.S. government

Bitcoin price has led the wider altcoin market in bearish sentiment as gold investors enjoy more gains. As the wider crypto market recorded bearish sentiment in the past 24 hours, the Gold price surged 2% to trade at about $4,200 per ounce at press time.

The technical headwinds in the wider crypto market coincided with the reopening of the U.S. government after 40 days of shutdown. Although the re-opening of the U.S. government is positive for the economy, the crypto market experienced a potential sell-the-news impact.

Is the Bull Market Over?

The crypto bull market 2025 is likely to resume in the coming weeks fueled by the Fed’s money printing. Furthermore, Gold price has likely topped out and has been forming a macro double top, which is bullish for the wider crypto bull market.