Ethereum Price Prediction: BlackRock and Fidelity’s Big Bets Signal Major ETH Rally Ahead

Wall Street giants are loading up on Ethereum—and they don't make moves without reason. BlackRock and Fidelity's escalating crypto positions suggest institutional conviction in ETH's next leg up.

When trillion-dollar asset managers place their chips, retail traders should pay attention. Their accumulation strategy often precedes explosive price action—though of course, they'll deny front-running the market.

Key indicators to watch: Exchange reserves shrinking while derivatives open interest climbs. This classic setup preceded ETH's last 3 major rallies.

Remember: 'Institutional adoption' means your 2 ETH bag gets traded against their 200,000 ETH position. The game hasn't changed—just the players.

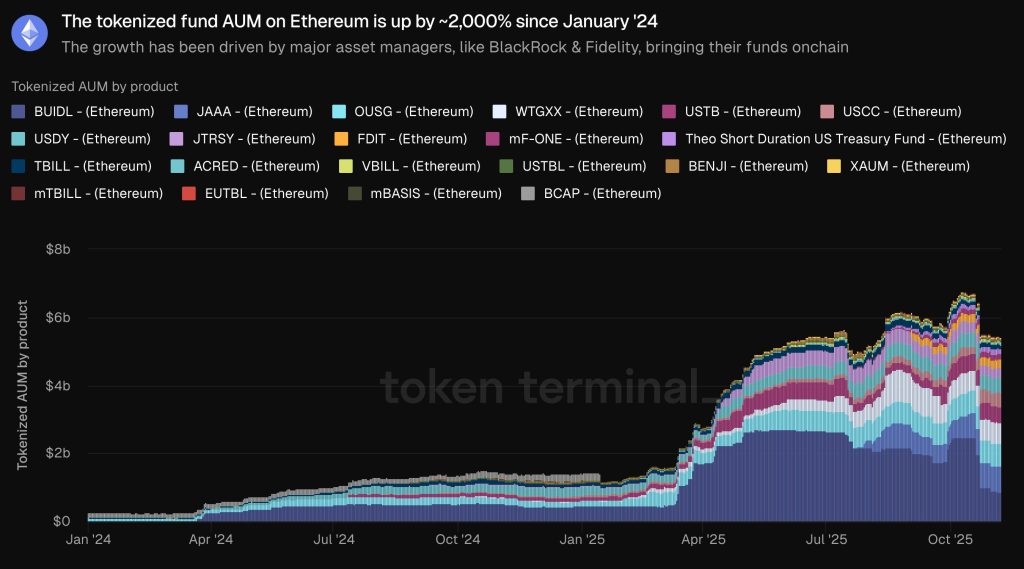

The total assets under management (AUM) of these products have increased by an eye-popping 2,000% since January 2024, according to data from Token Terminal. This emphasizes institutions’ growing interest in tokenization.

A report from Fidelity Digital Assets in early October highlighted that “beyond Bitcoin and Ethereum, some of the most noteworthy developments in digital assets are happening in stablecoins and tokenized real-world assets (RWAs).”

Ethereum’s lead in this market gives it a unique edge that favors a bullish outlook for its native asset.

Ethereum Price Prediction: ETH Needs a Clean Breakout Above $3,700 to Resume Its Rally

ETH found support at the $3,200 level in the past few days. Market volatility has spiked, and trading volumes have exceeded the average as the token struggles to recapture the $4,000 area.

The price has retested the 200-day exponential moving average (EMA) multiple times lately but has failed to MOVE above it multiple times. A descending price channel has also been forminig since early October as ETH failed to make it to $5,000.

The end of the U.S. government shutdown could help Ethereum break out of its descending price channel and

The Relative Strength Index (RSI) just sent a buy signal upon crossing above the 14-day moving average. If positive momentum accelerates, a break above $3,700 WOULD mark the beginning of its next leg up.

As crypto markets bounce back, early presales with strong utility like bitcoin Hyper ($HYPER) could deliver the biggest upside.

This ambitious project brings Solana-level speed and low fees to Bitcoin, unlocking the network’s full potential with the first true scaling solution.

Bitcoin Hyper ($HYPER) Presale Nears $27M – A New Way for BTC Holders to Earn Safely and Efficiently

For years, Bitcoin has been limited to just one thing — holding.

Bitcoin Hyper ($HYPER) changes that.

By building a lightning-fast Layer-2 solution on solana tech, it unlocks real DeFi tools like smart contracts, staking, lending, and payments, all while keeping the Bitcoin network at its core.

The Hyper Bridge makes it seamless. BTC holders send their coins to a secure wallet and instantly receive wrapped assets on the Hyper L2, ready to use across a growing list of decentralized apps.

No more switching chains or giving up control — everything stays anchored to Bitcoin.

With nearly, investor demand is surging ahead of launch.

And as major wallets and exchanges onboard this tech, $HYPER could become one of the most valuable assets in the BTC ecosystem.

To buy $HYPER before its next price increase, visit the official Bitcoin Hyper website and connect a compatible wallet like Best Wallet.

You can swap USDT or SOL, or use a bank card to secure tokens at the current price.