Rainbow Airdrop Listing Feb 5: $RNBW PreMarket Price on MEXC Outlook

Rainbow's $RNBW token hits MEXC's pre-market on February 5—traders scramble for position before the official listing floodgates open.

Pre-Market Mechanics: How It Works

The pre-market phase lets traders place orders before live trading begins—creating an initial price discovery layer separate from the main market frenzy. MEXC's system aggregates these orders, setting an unofficial opening bell that often predicts the first hour's volatility.

Price Discovery Without the Circus

This controlled environment filters out some of the typical listing day chaos—no instant 1000% pumps followed by 80% corrections (usually). Instead, it establishes a baseline sentiment gauge from committed capital rather than hype-driven market orders.

The Airdrop Factor

With airdropped tokens hitting wallets simultaneously, sell pressure becomes the elephant in the room. Early pre-market bids often reflect how heavily recipients will dump—or diamond-hand—their free allocations. Watch for bid-ask spreads widening as listing approaches.

Historical Pre-Market Patterns

Recent similar listings show pre-market prices averaging 30-50% below first-hour highs but 200-300% above initial developer valuations. The smart money uses this window to accumulate positions before retail FOMO kicks in.

Risk Parameters in Play

Limited liquidity during pre-market means slippage can be brutal—a large market order might move the needle 20% in thin order books. Professional desks use limit orders exclusively here, avoiding the market-order trap that burns overeager traders.

Regulatory Shadow Boxing

Pre-market trading operates in regulatory gray zones—exchanges tout it as 'innovative price discovery' while regulators side-eye it as unregulated securities trading. It's the crypto version of 'ask for forgiveness, not permission'—until the SEC sends a forgiveness-optional subpoena.

Final Outlook: Speculation With Training Wheels

The $RNBW pre-market offers a tempered speculation arena—all the adrenaline of a new listing with slightly fewer ways to obliterate your portfolio in three seconds. It's finance's version of a 'controlled burn'—unless someone forgets to control it. Watch the order book depth, ignore the influencer pump squads, and remember: in crypto, 'price discovery' often means discovering how low it can go after the whales take profits.

Every trade, swap, bet, and even collectible app icon activity is building a user’s share of the upcoming Rainbow listing date.

At the same time, the $RNBW Premarket price has already started trading on MEXC, giving the market its first real signal about how the token could behave once launch day arrives.

Rainbow Snapshot Jan 26 and How the $RNBW Airdrop Supply Works

According to the official X account, the snapshot will be taken on 6 Jan. The project plans to distribute 15% of the total token supply through the Rainbow airdrop listing. That equals 150 million tokens. Distribution is expected to follow a NEAR pro-rata model.

This means your share depends on how many points you hold compared to the total points in circulation. The total supply is 1 billion tokens. The token price for the sale is set at $0.10. The fully diluted value is $100 million.

Only the rewards and token sale supply will enter circulation at TGE. Everything else stays locked, keeping early circulating supply very low. For non-US users, the unlocked market cap at TGE is estimated around $18 million. This low supply is critical for early price discovery and could create sharp moves once trading begins.

$RNBW Premarket Price on MEXC Shows Early Market Behavior

MEXC confirmed Rainbow premarket listing on January 22, 2026. The $RNBW Premarket price is trading around $0.115, slightly below the highs with a mild decline near 4%.

The price is moving between $0.110 support and $0.120 resistance. This narrow range shows balance. Buyers and sellers are testing fair value, but real volume is still missing.

Low volume tells an important story. The market has not chosen a direction yet. Once the official airdrop launch starts, volume will rise, and real price discovery will begin. The current movement looks like calm consolidation, not panic selling.

RNBW Tokenomics and Why Supply Control Matters

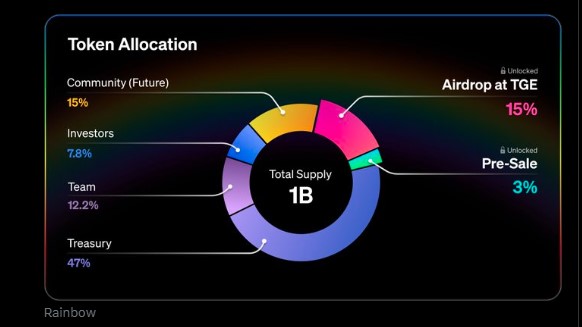

The CoinList officially shared the tokenomics with a long-term structure:

-

Treasury: 47%

-

Community (Future): 15%

-

Airdrop at TGE: 15%

-

Team: 12.2%

-

Investors: 7.8%

-

Pre-Sale: 3%

The Foundation will hold 20% equity at TGE, aligning token holders with company growth. This structure reduces sudden dumping risk and improves long-term stability.

Rainbow Airdrop Listing Feb 5: What Will Be RNBW Price Prediction

One confirmed exchange for February listing is MEXC. Other names like Binance, Bybit, OKX, BitMart, and Gate.io are only speculation for now.

Rainbow listing price expectations stay realistic:

-

Listing price: $0.11–$0.13, possible spike to $0.15

-

Short term: $0.08–$0.18 volatility

-

Long term:

-

Strong adoption: $0.25–$0.40

-

Weak interest: $0.05–$0.08

These prediction targets are based on MEXC pre-market trading charts, solid tokenomics, and token unlock strong schedule. The estimates might change according to the industry sentiment upon launch day.

Conclusion

The Rainbow airdrop and the $RNBW token Premarket price on MEXC together show how carefully this launch is being shaped. A limited circulating supply, active user rewards, and calm pre-market behavior create a balanced setup. February 5 is not just a new token listing date, it is the start of real market discovery for the project.