Markets.xyz Disrupts Commodity Trading with $USOIL Launch—Onchain US Oil Market Now Open

Forget paper barrels. Markets.xyz just dropped $USOIL—a tokenized gateway to the US crude market—directly onchain. This isn't just another synthetic asset; it's a direct shot at traditional commodity trading desks.

Oil Goes Onchain: What It Actually Means

The platform bypasses the usual intermediaries—no futures rollovers, no brokerage fees, just a digital token pegged to the real-world price of West Texas Intermediate. Trade it 24/7. Settle it near-instantly. It turns the world's most politically charged commodity into a liquid crypto asset.

Why Traders Are Paying Attention

This move unlocks oil exposure for the decentralized finance crowd. Think portfolio diversification beyond crypto volatility or sophisticated hedging strategies—all without leaving the blockchain. It pulls a massive, traditional market into the DeFi orbit, offering a level of access and composability that physical markets can't match. (Take that, slow-moving commodity ETFs.)

The Bigger Picture: A New Era for Real-World Assets

$USOIL represents a critical test. Can onchain infrastructure handle the scale and scrutiny of global oil markets? Success here paves the way for tokenized everything—metals, grains, even carbon credits. Failure? Well, let's just say it would be a very expensive, very public experiment.

One thing's clear: the line between Wall Street and Crypto Street is blurring fast. Whether this makes oil trading more efficient or just gives speculators a new, volatile toy remains to be seen. After all, what's the point of decentralizing finance if we're just going to reinvent the same old boom-bust cycles?

The USOIL listing marks another step in bringing traditional commodities to onchain markets. Traders can now hedge against oil price volatility, even outside standard trading hours.

The MOVE builds on Markets’ earlier tokenization of real-world assets (RWA), including USBOND and the USOR token launched in January 2026 for direct US oil-reserve tokens exposure.

How USOIL Works and Fundings Rate Explained

USOIL is a perpetual contract with no expiry dates, which can be held forever. To keep prices in line with the US oil-market onchain, a funding rate system is used by the exchange.

Positive funding rates: Long traders pay Shorts, a common scenario seen in bullish sentiments.

Negative funding rates: Short traders pay longs. This is common during the bearish sentiments.

Investment on the Hyperliquid platform, where the Markets.xyz website is located, is done on an hourly basis and is derived from an 8-hour base rate. The base rate of the coin is 5% on an annual basis.

Practical Impact for Traders

Going long on the token: You pay funding in bullish oil market, similar to a borrowing cost.

Going short on the token: You may earn funding if the market is bullish.

Traders can monitor live financing rates via Markets.xyz’s dashboard to manage positions effectively.

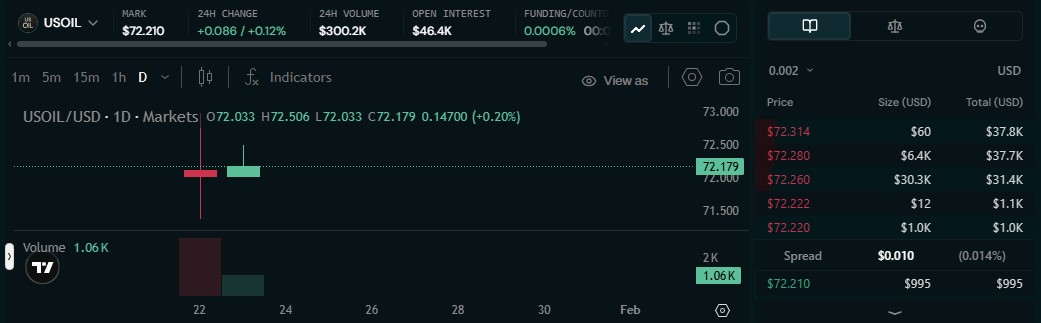

USOIL Price & Trading Stats

The token is currently trading at $72.40, showing a 24-hour change of +0.38%. Its 24-hour trading volume has reached $296.6K, with open interest at $43.9K.

Why USOIL Matters for OnchainTrading

The coin gives crypto users direct access to US oil reserve tokens and participation in the US oil market onchain. Transparent trading, real-time financing, and the token's listing price updates enhance exposure to real-world commodities while staying fully onchain.

This article is for informational purposes only and does not constitute financial or investment advice.