Whale Alert: How Self-Custody Could Capsize Bitcoin’s Biggest Players

The crypto seas are choppy—and Bitcoin's whales might be heading straight for the rocks. Self-custody, once a niche obsession for cypherpunks, is now a tidal wave threatening to drown centralized giants. Here's why the smart money's swimming for shore.

The custody trap: When 'not your keys' becomes 'not your profits'

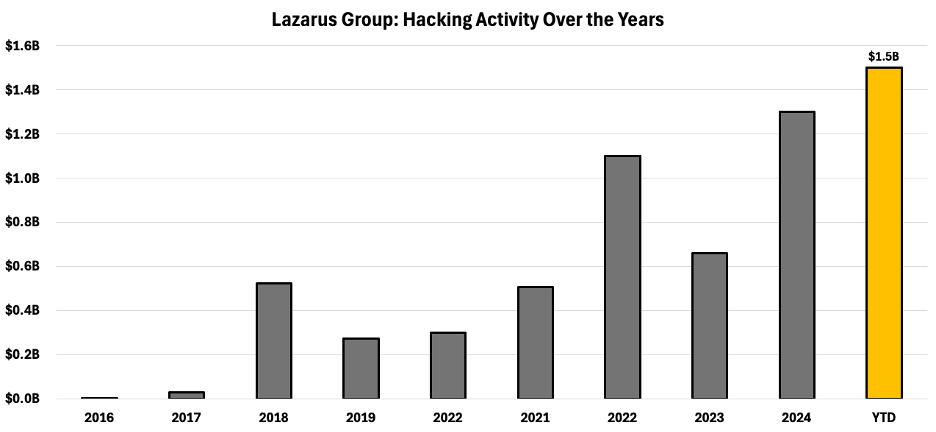

Exchanges built empires on convenience. But as regulators circle and hacks pile up, holding your own keys isn't just ideological—it's survival. The 2023-2025 bear market proved one brutal truth: exchanges fail. Always.

Whale watching 2.0: Tracking the migration to cold storage

Chain analytics don't lie. When nine-figure wallets start moving to hardware devices, it's not FUD—it's capital flight. The sharks can smell blood in the water (and the SEC's paperwork).

The irony department: Wall Street's 'safe' custodians getting devoured

BlackRock's Bitcoin ETF approval came with a caveat—their shiny new product still relies on the same brittle custody models. Nothing says 'financial innovation' like repackaging 2014's problems with a 2% management fee.

Bottom line? The whales are going rogue. And when enough of them dive into self-custody, the entire crypto ecosystem might just sink under their wake.

Source: Chainalysis

European ETPs allow in-kind transfers which enable investors to MOVE bitcoin directly into and out of the fund without triggering a taxable event. This is especially valuable in jurisdictions like Switzerland and Germany, where long-term holders can optimize capital gains treatment. For whales thinking long term, the flexibility of in-kind flow is a major upgrade. It also unlocks new financial optionality; rather than selling their bitcoin during a major life event like buying a home, investors can borrow against their ETP holdings and access liquidity without ever parting with the underlying asset and triggering capital gains.

Self-custody will always have a place, especially for users in unstable regions or those needing financial sovereignty. But for whales with scale, the trade-offs of holding spot BTC are increasingly hard to justify. Bitcoin ETPs are simply less of a headache: they reduce risk, improve liquidity access, simplify compliance and offer long-term infrastructure for serious capital allocators, allowing big investors to sleep easy at night. The future of bitcoin ownership isn’t about whether you can hold your keys, it’s about whether you should.