Crypto’s ’Inverse Cramer’ Phenomenon Racks Up Millions—Because of Course It Did

Move over, Wall Street—crypto traders have found their own twisted version of the ’Inverse Cramer’ strategy, and it’s printing money like a meme coin at peak hype.

Forget fundamentals—this is pure schadenfreude trading, where betting against financial punditry pays off harder than a DeFi yield farm rug pull. The numbers don’t lie: seven-figure gains are stacking up for those flipping conventional wisdom the bird.

Because nothing screams ’healthy market’ like profiting from the collective wrongness of talking heads. Just don’t look at the tax implications—this is crypto, after all.

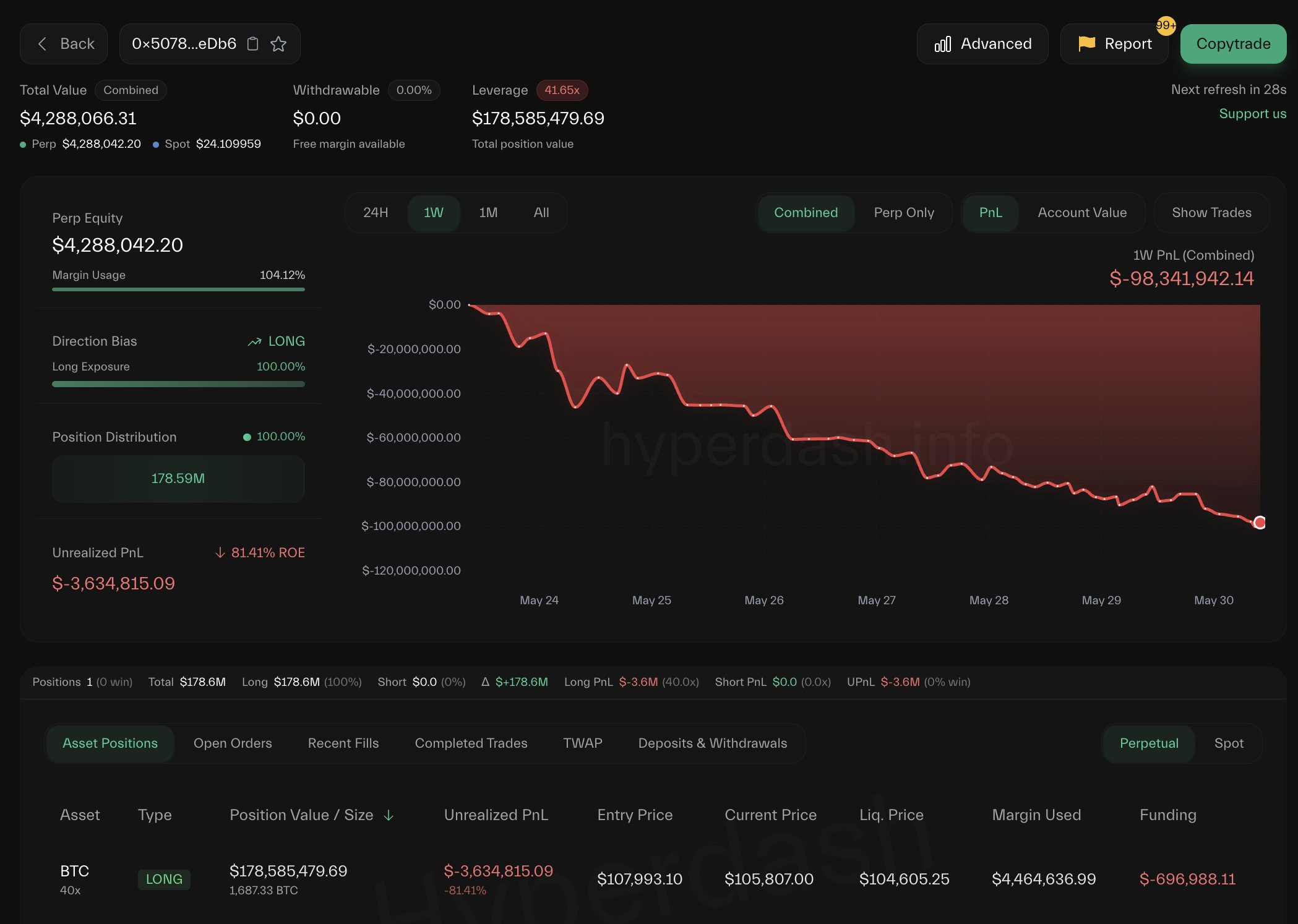

"0x2258 has been counter-trading James Wynn—shorting when James Wynn goes long, and going long when James Wynn shorts. In the past week, 0x2258 has made ~$17M, while James Wynn has lost ~$98M," Lookonchain said in the post.

Seventeen million dollars in a week just by inverse-betting on one trader is not a bad payday. However, this might be a short-term trade, and one should be very cautious as things can change lightning fast in the trading world, leaving punters millions in losses if not hedged properly.

Even James Wynn said, "I’ll run it back, I always do. And I’ll enjoy doing it. I like playing the game,” after the trader got fully liquidated over the weekend.

So, maybe this Reddit gem: "How much money WOULD you have made if you did the exact opposite of Jim Cramer?" would never translate to include James Wynn. But the sentiments, though, are loud and clear: in a market where perception is half the trade, even your PnL can get memed!