XRP Stalls in May While Traders Double Down on Bullish Bets – Who’s Right?

XRP’s price action flatlined last month—no breakout, no collapse, just market purgatory. Meanwhile, open interest in derivatives surged. Someone’s betting big on a rally, even if the charts aren’t playing along.

Here’s the disconnect: Technicals scream sideways, yet futures traders keep piling in. Classic crypto—where hope and leverage outpace reality.

Will fundamentals catch up to the hype? Or is this another case of ‘buy the rumor, sell the news’? Either way, grab popcorn—Wall Street’s algorithmic traders are probably laughing into their spreadsheets.

The appearance of the doji suggests the recovery rally from the early April lows near $1.60 has likely run out of steam. Doji candles appearing after uptrends often prompt technical analysts to call for bull exhaustion and a potential turn lower.

Accordingly, last week, some traders purchased the $ 2.40 strike put option expiring on May 30. A put option offers insurance against price drops.

Bullish options open interest

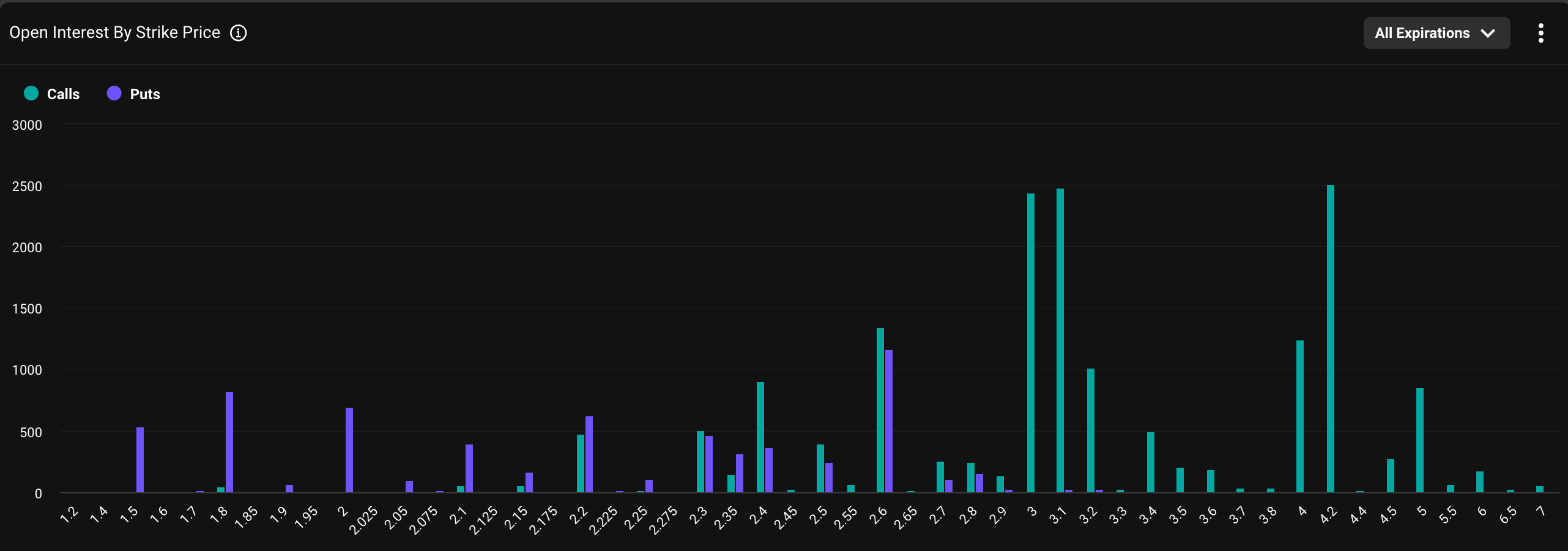

The overall picture remains bullish, with options open interest concentrated in higher-strike calls in a sign of persistent positive sentiment. Open interest refers to the number of active contracts at a given time. A call option gives the purchaser an asymmetric upside exposure to the underlying asset, in this case, XRP, representing a bullish bet.

"XRP open interest on Deribit is steadily increasing, with the highest concentration of strikes clustered on the upside between $2.60 and $3.0+, reflecting a notably bullish sentiment while the spot price currently trades at $2.16," Luuk Strijers, CEO of Deribit, told CoinDesk.

The chart shows that the $4 call option is the most popular, with a notional open interest of $5.39 million. Calls at the $3 and $3.10 strikes have an open interest (OI) of over $5 million each. Notional open interest refers to the dollar value of the number of active contracts.

"XRP option open interest is split across June and September expiries, with monthly notional volumes approximating $65–$70 million, of which over 95% is traded on Deribit," Strijers said.

The bullish mood likely stems from XRP’s positioning as a cross-border payments solution and mounting expectations of a spot XRP ETF listing in the U.S. Furthermore, the cryptocurrency is gaining traction as a corporate treasury asset.

Ripple, which uses XRP to facilitate cross-border transactions, recently highlighted its potential to address inefficiencies in SWIFT-based cross-border payments. The B2B cross-border payments market is projected to increase to $50 trillion by 2031, up 58% from $31.6 trillion in 2024.