Hedera (HBAR) Tanks Hardest Among U.S.-Born Cryptos—What’s the Exit Strategy?

Another week, another bloodbath—Hedera just outpaced every ’Made in USA’ crypto in the race to the bottom. No surprises here: the ’enterprise-grade’ blockchain darling got smacked harder than your average DeFi degenerate’s portfolio.

So what now? Technicals look uglier than a SEC subpoena. The usual suspects—macro fears, vaporware partnerships, maybe even a whale dumping bags—all plausible culprits. Meanwhile, retail ’investors’ (read: gamblers) keep chasing the dream of institutional adoption like it’s 2021 all over again.

Here’s the kicker: if HBAR can’t claw back above key support levels soon, even the most delusional bulls might need to admit this isn’t a ’healthy correction’—it’s a full-blown flop. But hey, at least the staking rewards look pretty... assuming you ignore the double-digit percentage losses. Classic crypto: the math never works in your favor until suddenly—magically—it does.

Persistent Selling Pushes HBAR Below Key Technical Level

Hedera dropped over 10% in the past week, facing the worst loss among the top 10 made in USA coins.

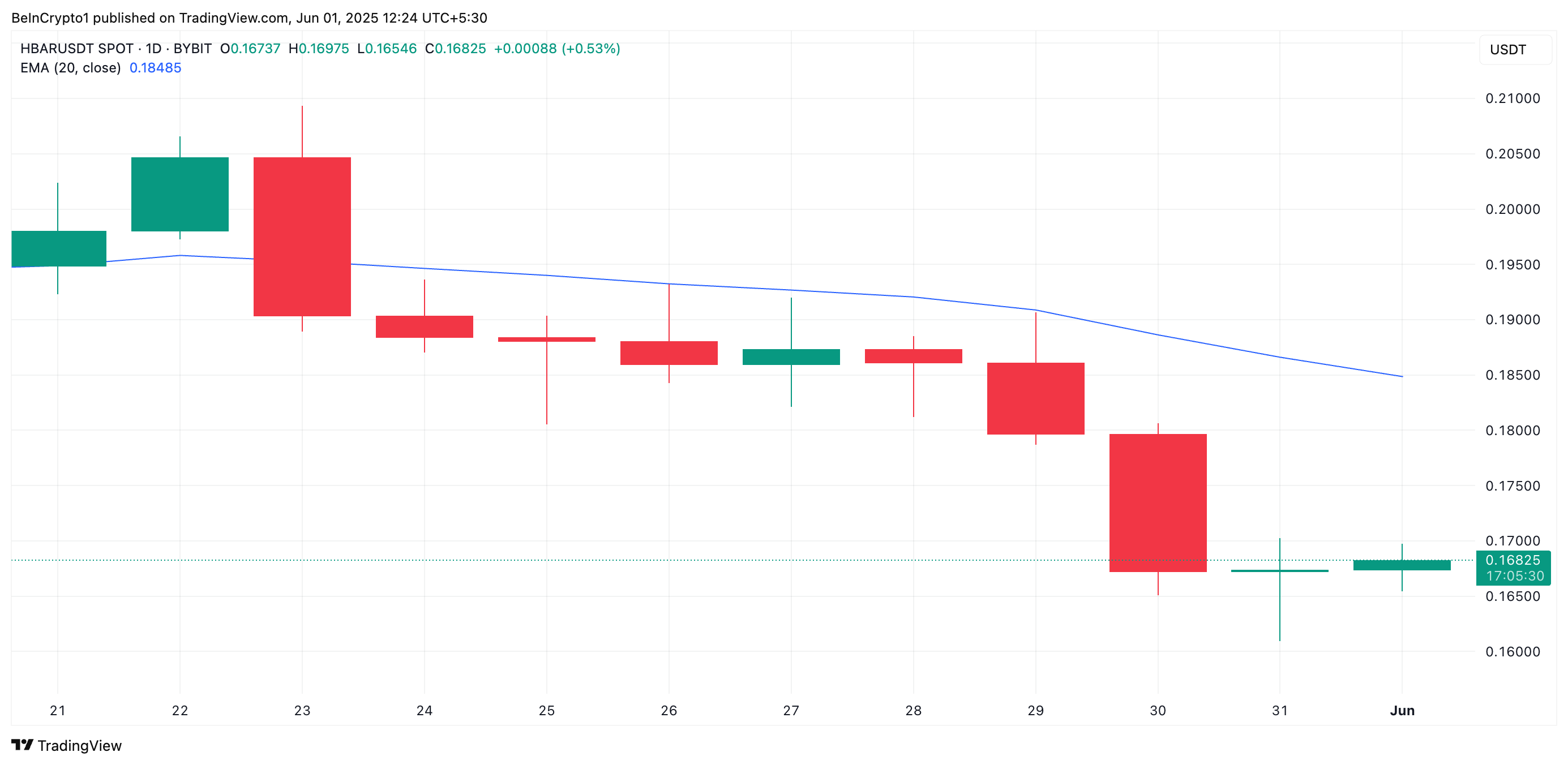

HBAR’s steady decline over the past week has pushed the token’s price below its 20-day exponential moving average (EMA). This breakdown confirms the presence of strong selling pressure among spot market participants.

The 20-day EMA measures an asset’s average trading price over the past 20 trading days, giving weight to recent price changes.

When an asset falls below this key moving average, it signals a shift in short-term momentum from bullish to bearish. This breach typically suggests that recent selling pressure in the market outweighs buying interest, potentially triggering further downside.

Therefore, for HBAR, slipping below this key support level reinforces bearish sentiment and increases the likelihood of continued price weakness.

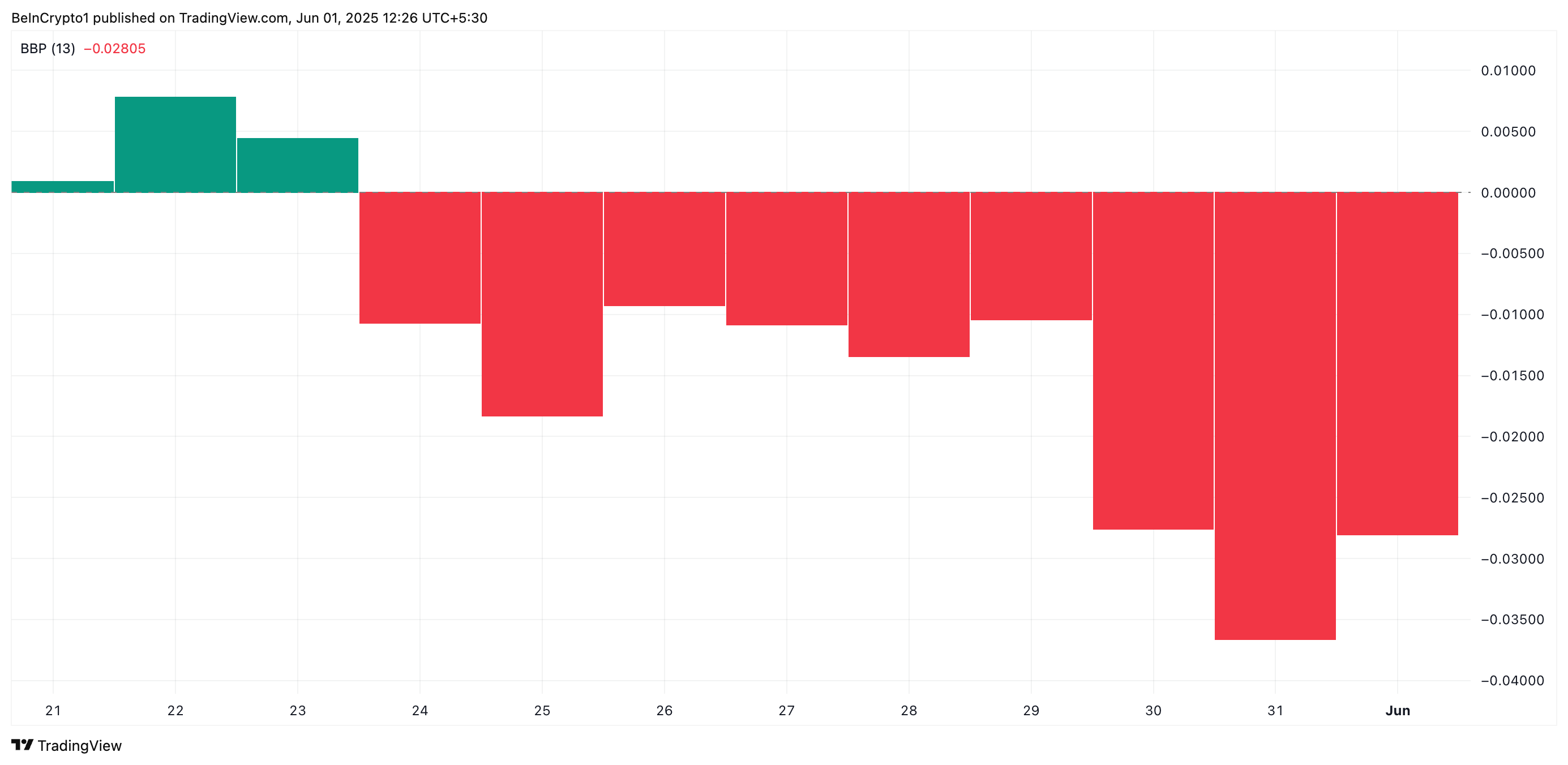

Further, the token’s Elder-Ray Index, which measures the strength of its bulls against the bears, shows continued dominance by sellers. The indicator’s red histogram bars remain below the zero line, printing -0.028 at press time.

The indicator has persistently returned negative values since May 24, highlighting a lack of bullish power even during the recent price uptick.

Can Bulls Save HBAR? Price Eyes Critical Support at $0.153

HBAR currently trades at $0.168, with its 20-day EMA forming a dynamic resistance above it at $0.184. This suggests that any uptrend may face strong rejection unless buying momentum strengthens significantly.

Without a strong demand for HBAR, it could resume its decline and fall toward the support floor at $0.153. Should the bulls fail to defend this level, the price fall could deepen to reach $0.124.

However, a resurgence in buying pressure will invalidate this bearish outlook. The token’s price could climb above the 20-day EMA to trade at $0.19 in that scenario.