🚀 Dogwifhat Price Prediction: Cup-and-Handle Breakout Targets $1.82 as Memecoin Mania Heats Up

Dogwifhat (WIF) is flashing a textbook bullish signal—and traders are betting it’s primed to explode.

The Solana-based memecoin has formed a cup-and-handle pattern, a classic chart setup that often precedes explosive upside. If history repeats, WIF could surge toward $1.82 in the coming weeks.

Why the Cup-and-Handle Matters

This technical formation suggests consolidation before a breakout. The 'cup' represents steady accumulation, while the 'handle' signals a final shakeout of weak hands. Once resistance breaks, momentum traders pile in.

Memecoins Defying Gravity

Despite critics calling them 'useless casino chips,' Solana memecoins keep printing life-changing gains. WIF’s 24-hour volume just topped $200M—proof that degenerate gambling, er, 'speculative interest' remains strong.

Will this breakout stick? In crypto, even horoscopes get more respect than TA. But with Bitcoin holding $60K and Solana’s ecosystem buzzing, the dumb money looks smart again—for now.

This structure, often associated with strong bullish continuation, aligns with current price movements and volume behavior.

Traders are watching the $1.368 level as a key resistance that could unlock further upside. At the time of writing, technical indicators on the daily chart also suggest rising accumulation and buyer strength.

Dogwifhat Price Pattern Formation Points to Breakout Continuation

The 3-day WIF/USDT chart, as highlighted by analyst Rafaela Rigo, reveals a well-formed cup-and-handle pattern. The rounded base began in late 2024 and completed its “cup” in May 2025.

A subsequent pullback shaped the “handle” during June and July, forming a series of higher lows. This handle represents a consolidation phase, which often precedes upward continuation if confirmed with a breakout above the neckline.

Source: X

The neckline lies at $1.368, with WIF currently trading at $1.13 after reclaiming support at $1.11. Rafaela Rigo has designated $1.368 as Take Profit 1 (TP1), while a secondary target of $1.828 (TP2) aligns with historical resistance zones from late 2024.

The projected MOVE from current price to TP1 represents a potential 21% increase, while a full extension to TP2 offers a 60% upside. These projections are based on the depth of the cup and historical reaction levels.

Volume and Short-Term Price Action Confirm Buyer Control

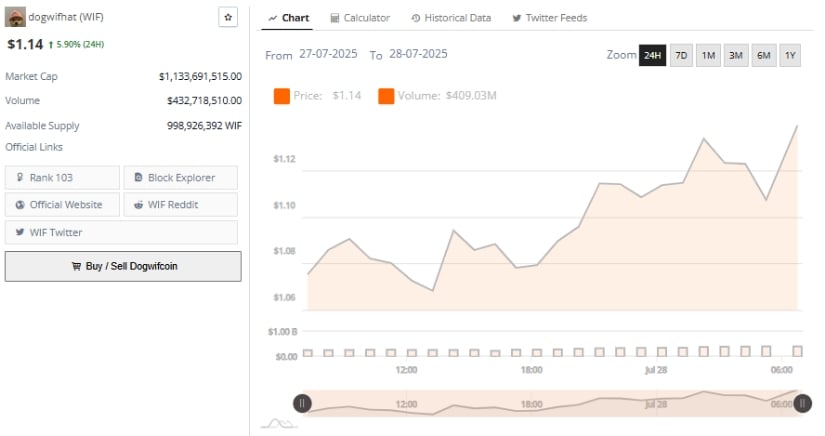

On the 24-hour chart, dogwifhat has maintained a strong intraday uptrend. The price climbed from around $1.06 to a session high of $1.14, reflecting a 5.90% gain.

Price movement was characterized by higher highs and higher lows, with strong upward momentum during the final trading hours. The structure indicates growing buying pressure and suggests a possible attempt to break above the $1.368 resistance zone.

Source: BraveNewCoin

Volume dynamics further support this bullish setup. WIF recorded $432.7 million in daily trading volume, with $409 million transacted during the latest 24-hour window. The correlation between price increase and stable volume implies sustained accumulation rather than short-lived speculation. With a circulating supply of 998.9 million WIF and a market capitalization above $1.13 billion, Dogwifhat now ranks within the top 110 cryptocurrencies by market size.

If momentum continues and price maintains above the $1.11 support, technical conditions may favor another upward push. Conversely, failure to break resistance could result in a minor pullback toward the handle base. For now, volume and price coordination lean toward a continuation.

WIF Indicators Suggest Underlying Strength at Key Levels

On the daily WIF/USDT chart, the token continues to show bullish momentum, currently trading at $1.138. The asset has climbed steadily from a low of $0.304 earlier in the year, establishing a consistent pattern of higher lows.

Recent price activity suggests that each pullback is being absorbed by buyers, reinforcing demand. A move toward the local high of $1.393 remains plausible if bullish momentum holds.

Source: TradingView

The Chaikin Money FLOW (CMF) is reading +0.08, suggesting that capital inflow remains dominant. This positive value, remaining above the zero line, confirms ongoing accumulation. Sustained CMF levels have historically coincided with trend continuation phases.

Similarly, the Bull and Bear Power (BBP) indicator stands at 0.051, showing that bulls retain a slight edge. While BBP values are moderate, they reflect stability in buying strength. If these readings remain positive, Dogwifhat could challenge the $1.368 resistance level in the NEAR term.