Avalanche (AVAX) Primed for $35 Surge: Golden Cross & Surging Network Demand Fuel Bullish Breakout

Avalanche’s AVAX isn’t just flirting with $35—it’s backed by a golden cross and network activity that screams momentum. Forget ‘if’—traders are debating ‘when.’

Technical Tailwinds Meet On-Chain Fire

The 50-day MA just sliced through the 200-day like a hot knife through institutional FUD. Meanwhile, developers are dumping spaghetti at the wall (and somehow, it’s all sticking).

Wall Street’s Watching—And They Hate That They Are

With gas fees still low enough to annoy ETH maxis, Avalanche’s ‘build first, apologize later’ ethos is pulling in defectors. Even the suits are peeking over their spreadsheets.

Prediction: A breakout past $35 turns AVAX into the altcoin that finally makes your uncle ask ‘Is this like Bitcoin?’ during Thanksgiving. Brace for takeoff—or yet another ‘learning opportunity’ in crypto’s endless drama.

AVAX is bouncing back from its weekly correction and is now reclaiming the $25 mark, with momentum starting to build once again. Market watchers are turning bullish as the AVAX price begins aligning with both on-chain strength and technical signals, especially after a standout Q2 performance.

AVAX Activity Surges in Q2 with Octane Upgrade Fueling Growth

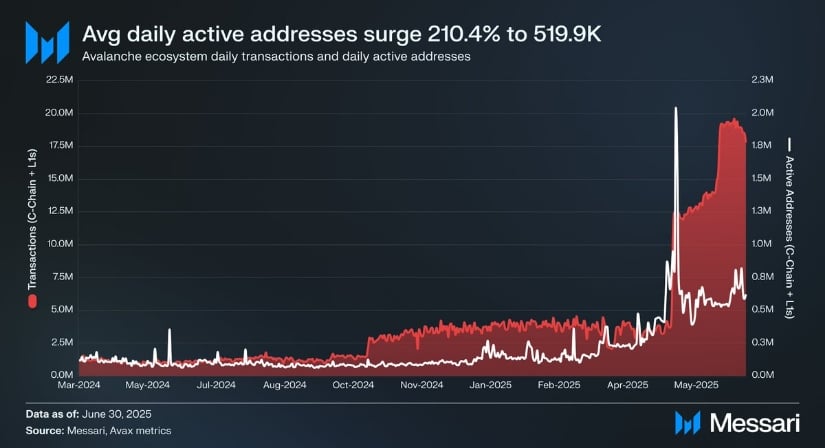

AVAX is starting Q3 with momentum after a standout Q2 performance, as detailed by Messari. The Octane upgrade, which lowered transaction costs across the board, appears to have kickstarted a wave of growth in DeFi, gaming, and enterprise usage. According to the latest metrics, average daily transactions on AVAX jumped 169.9% QoQ, while daily active addresses surged an eye-catching 210.4%, reaching over 519,000. These aren’t just headline numbers; they reflect real network expansion.

Avalanche’s daily active addresses and transactions surged triple digits in Q2, reflecting real adoption across DeFi and gaming. Source: Messari via X

Supporting this growth is a 37.1% increase in DeFi total value locked, suggesting capital is flowing back into the ecosystem alongside user activity. If this trend sustains, it may soon reflect in AVAX’s price structure as well, with fundamentals starting to echo what bullish traders have been positioning for on the charts.

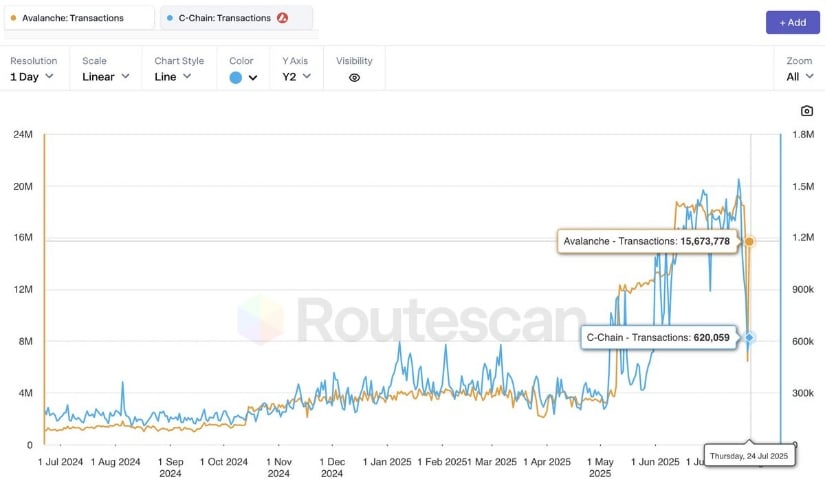

AVAX Daily Transactions Hold Strong Above 15 Million

Following the Q2 momentum highlighted by Messari, Avalanche’s transaction activity continues to show no signs of cooling. As shared by Steven9000, AVAX recorded 15.6 million transactions in a single day, with the C-Chain alone logging over 620,000.

Avalanche logs 15.6 million daily transactions, with the C-Chain alone crossing 620,000. Source: Steven9000 via X

This reinforces the idea that Avalanche’s Octane upgrade is actively enabling higher throughput and usability at scale, which could become a foundational driver for long-term growth.

AVAX Technical Setup Hints at Imminent $35 Breakout Zone

AVAX’s price action is beginning to align with its strong Q2 fundamentals, and now the technicals are catching up. As highlighted by Kelvin, AVAX is on the verge of printing a golden cross on the daily chart, with the 50-day moving average approaching the 200-day from below. While the crossover hasn’t triggered yet, however, it’s getting imminently close. Meanwhile, the Stochastic RSI has reset deeply into the oversold zone and is now curling upward.

AVAX nears a golden cross on the daily chart as technical momentum builds alongside strong network activity. Source: Kelvin via X

Pair that setup with Avalanche’s recent transaction activity holding above 15M per day and a Q2 network surge in daily users, and the ingredients for a breakout are building. If AVAX can clear the $27.5 resistance with strength, the door opens for a MOVE toward the $35 to $37 range.

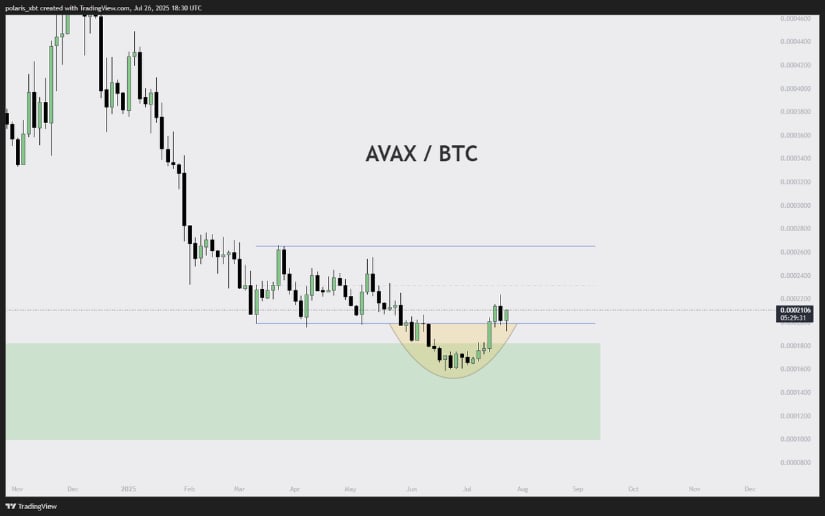

AVAX/BTC Chart Shows Rounding Bottom with Reversal Potential

The AVAX/BTC 3-day chart shared by polaris_xbt is shaping up into a textbook rounding bottom, an accumulation pattern that often precedes mid-term reversals. After months of weakness, AVAX has begun forming a base against Bitcoin within a well-defined support zone. The neckline of the formation sits just above current levels, and a clean breakout above it could trigger a move toward the upper resistance range around 0.00092 to 0.00100 BTC. Structurally, this kind of slow curvature often builds deeper strength than sharp V-shaped reversals.

AVAX/BTC forms a rounding bottom on the 3-day chart, hinting at a mid-term reversal toward key resistance. Source: polaris_xbt via X

From a broader perspective, this technical setup mirrors Avalanche’s growing strength across its ecosystem. As mentioned earlier, transaction activity remains consistently elevated, and the golden cross setup on the USD pair is nearing completion. If AVAX continues to show strength on its BTC pair, it WOULD signal that capital is not just rotating within altcoins but flowing into AVAX specifically.

Final Thoughts: AVAX Community Sentiment Shifts Toward ATH Optimism

Even beyond the charts and indicators, Avalanche’s recent resurgence seems to be igniting renewed belief across the broader community. As shown by Laar’s post, sentiment is shifting from cautious Optimism to confident conviction, with users openly speculating on a return to all-time highs.

AVAX community sentiment turns bullish as users increasingly speculate on a return to all-time highs. Source: Laar via X

This isn’t happening in a vacuum; it’s following a quarter of surging network activity, consistent on-chain metrics, and a technical structure that’s steadily strengthening. As AVAX holds above key support levels and retail chatter grows louder, the AVAX price prediction narrative is starting to solidify, especially if it breaks through the $35 to $37 range. In that case, a medium-term move towards $55 to $60 wouldn’t be out of reach heading deeper into Q3.