🚀 XRP ETF on the Horizon? BlackRock Buzz Fuels Bullish Frenzy | July 2025 Update

Wall Street's favorite four-letter acronym might be coming to crypto. Rumors swirl that BlackRock—yes, the $10 trillion gorilla—is eyeing an XRP ETF. Cue the army of moon-bag holders.

### The Institutional Stampede

After Bitcoin and Ethereum ETFs got the green light, XRP bulls smell blood. A spot ETF would mean real-money investors could finally ride this rollercoaster—pension funds included. (God help them.)

### The Regulatory Elephant

SEC's lingering lawsuit still hangs like a sword of Damocles. But insiders whisper Ripple's legal team smells weakness—just in time for BlackRock's alleged paperwork.

### Trading Desk Reality Check

XRP liquidity pools already mimic ETF flows. The real question? Whether Wall Street will tolerate a token that still gets called 'banker coin' by crypto purists.

Bottom line: This isn't your 2017 meme rally. An XRP ETF would force institutions to put actual skin in the game—assuming they can stomach the volatility between martini lunches.

XRP has outperformed much of the market in July, and with BlackRock rumored to be preparing an XRP Trust, Optimism is building fast. A favorable SEC decision on July 31 could further open the door to regulatory clarity and institutional flows. With technicals flashing bullish and Wall Street watching closely, XRP may be on the verge of joining Bitcoin and Ethereum in the ETF spotlight.

BlackRock’s XRP Move? Market Anticipates ETF Expansion

The spotlight is once again on Ripple XRP, as speculation mounts that BlackRock—the world’s largest asset manager—may soon file for a spot XRP ETF. Following the success of its Bitcoin and ethereum ETF offerings, BlackRock appears poised to expand further into the crypto ETF arena, and XRP could be next on the list.

BlackRock’s influence is driving a new wave of XRP ETF filings, with major players like Franklin Templeton, WisdomTree, Grayscale, and others following suit—yet much of the market remains unaware. Source: @eminat_arthur via X

BlackRock’s iShares Bitcoin Trust (IBIT) has already amassed over $86 billion in assets, while the Ethereum Trust (ETHA) holds more than $10.6 billion. With these funds outperforming traditional ETFs in profitability, market analysts suggest XRP may be the logical next step.

The demand appears to be there. Teucrium’s XXRP and ProShares’ UXRP ETFs have collectively gathered nearly $470 million in assets within just a few months. Analysts from JPMorgan predict that XRP spot ETFs could attract $8 billion in their first year, matching the early momentum seen with Ethereum funds.

SEC Appeal Outcome Could Be the Trigger for XRP ETF Approval

Much of the optimism surrounding XRP’s price also hinges on developments in the SEC vs Ripple case. With the next closed-door SEC meeting scheduled for July 31, traders are watching closely for a possible vote on whether the agency will drop its appeal against Ripple Labs.

Three major crypto events to watch: the SEC’s XRP ETF decision on July 25, the FOMC meeting on July 29–30, and Bitwise’s multi-asset ETF ruling on July 31—all potential market movers. Source: @0xAkib via X

The outcome could play a pivotal role in the regulatory greenlighting of any XRP-spot ETF. An appeal withdrawal WOULD eliminate a key legal barrier and likely open the door for applications such as BlackRock’s potential iShares XRP Trust.

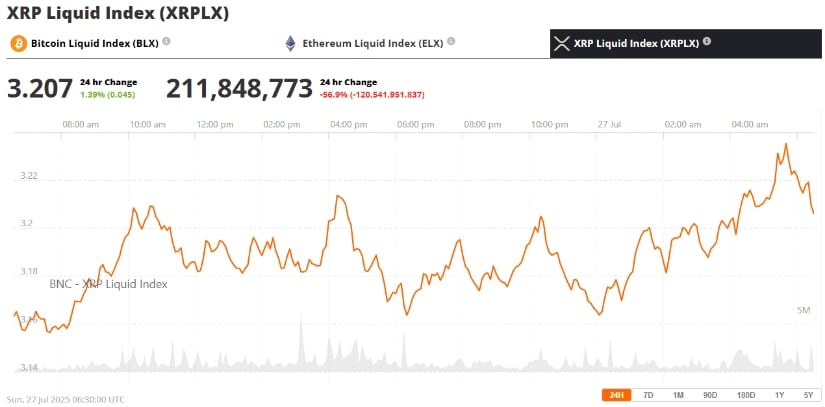

Market sentiment is already reacting. The price of XRP today has held strong above the $3 mark, supported by the belief that regulatory clarity is imminent. On July 26, XRP ROSE by 0.76%, closing at $3.1663, outpacing the broader crypto market’s gain of 0.31%.

XRP Price Prediction: Can Bulls Push Past $3.66?

From a technical standpoint, XRP’s chart shows a bullish structure, with the token trading above both its 50-day and 200-day Exponential Moving Averages. This confirms an ongoing uptrend and strong market support.

XRP is now forming the handle of a classic cup-and-handle pattern on the daily chart, beginning from its previous all-time high—a bullish setup that could signal a breakout ahead. Source: MetaShackle on TradingView

A breakout above $3.30 could signal a MOVE toward the $3.50 zone, and a sustained rally may retest the July 18 high of $3.66. Many analysts see this level as the final hurdle before XRP attempts a run toward $5.00, especially if a spot ETF is approved.

Adding to the bullish case is a possible cup-and-handle pattern forming on the daily chart—often considered a reliable indicator of upward continuation. If this pattern plays out, xrp price predictions suggest a medium-term target of $5.20, based on the depth of the cup formation.

Ripple’s Broader Ecosystem Adds Fuel to the Rally

Beyond ETFs, Ripple Labs continues to expand its product line. Its new RLUSD stablecoin has already surpassed $530 million in assets, reinforcing Ripple’s real-world utility and positioning XRP as more than just a speculative asset.

Institutional interest in Ripple XRP is growing as well. The company’s international remittance solutions and XRP Ledger technology continue to gain traction in financial markets, which may support long-term value even beyond short-term ETF-related news.

Macroeconomic Factors and Regulatory News Still Matter

Despite the bullish setup, traders are also keeping an eye on macroeconomic developments. Concerns about rising trade tensions and a potentially hawkish Federal Reserve could weigh on risk assets, including XRP crypto. Conversely, signs of monetary easing or favorable global trade deals could further boost sentiment.

XRP was trading at around $3.20, up 1.39% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

In the regulatory arena, the upcoming SEC appeal decision, the CLARITY Act, and other legislative developments remain crucial. These could define not only XRP’s legal status but also whether U.S. institutions can confidently invest in XRP through regulated ETFs.

Final Thoughts

The intersection of ETF speculation, regulatory optimism, and strong technicals is creating a perfect storm for XRP bulls. With BlackRock rumored to be eyeing an XRP ETF and a crucial SEC appeal decision just days away, XRP today stands at a potential turning point. Whether or not the token joins the ETF elite, the next few weeks could be pivotal for the XRP price and its future trajectory.