Layer 2 Solutions: The Next Crypto Gold Rush or Just Another Bubble?

Scaling blockchains was supposed to be boring infrastructure—until the money started flowing. Layer 2 networks now handle over 60% of Ethereum transactions, but are they the future or just a temporary fix?

Gas fees got you down? Layer 2s promise relief

Every major chain is racing to build its own scaling solution, from Arbitrum to zkSync. Transaction speeds are up 100x, costs down 90%. The tech works—but the economics remain shaky.

The VC trap: Built for users or exits?

While developers tout decentralization, most L2 tokens sit in venture capital wallets. 'It's infrastructure, we swear' says every team that then airdrops a tradable token. Wink, wink.

Will the real L2 winner please stand up?

Optimistic rollups dominate today, but zero-knowledge proofs are coming fast. The battle isn't just about tech—it's about which chain can attract the most mercenary capital. Because in crypto, we don't build ecosystems—we launch financial products and call them innovation.

The numbers are impressive: LAYER 2 solutions are capturing billions in investment, representing explosive growth from virtually zero just three years ago. These “highway bypass” solutions promise to solve Ethereum’s and Bitcoin’s notorious congestion problems by processing transactions off the main chain while inheriting its security.

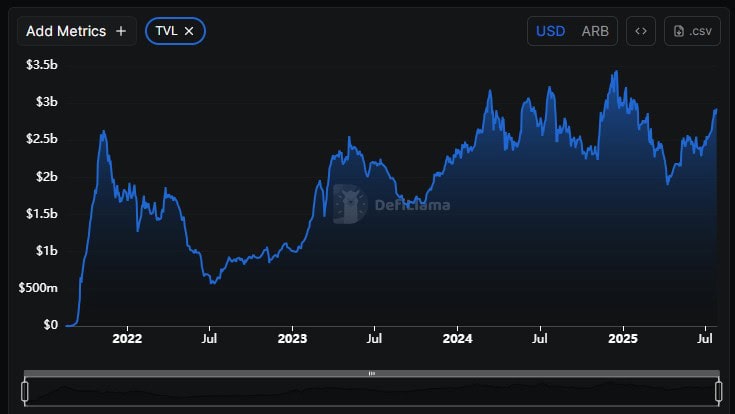

After an early surge in 2023, the Arbitrum TVL has remained somewhat rangebound for 18 months. Source DefiLlama

Yet as the money pours into L2 infrastructure and tokens, a critical question emerges: are these revolutionary scaling solutions destined to become crypto’s next goldmine, or are they complex technical fixes searching for sustainable business models – or worse, vulnerable to total collapse at the whims of the chain they’re built on?

The Technical Foundation Behind the Hype

Layer 2 solutions operate by bundling hundreds or thousands of transactions off-chain before submitting compressed proofs back to Ethereum’s mainnet (there are some Layer 2s built for Bitcoin, but not many). This approach theoretically solves Ethereum’s scaling trilemma by maintaining security and decentralization while improving transaction throughput.

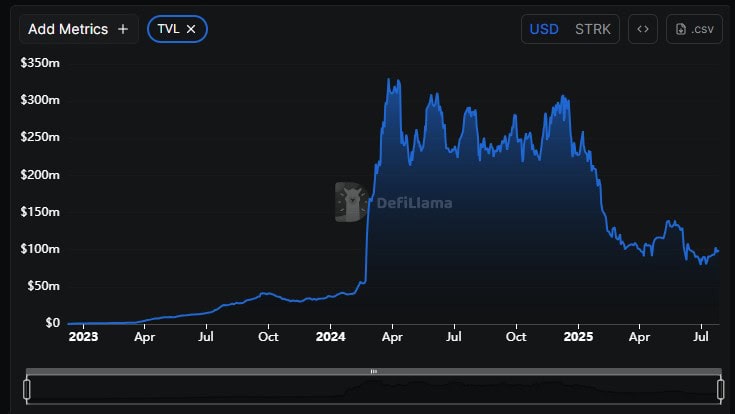

The two dominant technical approaches have emerged with distinct trade-offs. Optimistic rollups like Arbitrum and Optimism assume transactions are valid by default (hence the ‘optimism’), requiring a challenge period for withdrawals that can last up to seven days. Meanwhile, zero-knowledge rollups such as Starknet use cryptographic proofs to instantly verify transaction validity, enabling faster finality but requiring more complex technology.

The market has spoken decisively about which approach currently dominates. Arbitrum leads with almost $3 billion in TVL], and Optimism holds around $350 million. However, zk-rollups have shown promise at times, with Starknet’s TVL growing significantly throughout 2024, before crashing hard early in 2025.

Market Leadership and Ecosystem Development

The Layer 2 landscape has consolidated around several major players, each pursuing different strategies for capturing market share. Arbitrum has maintained its position as the leading L2 by most metrics, processing the highest transaction volumes and hosting the most diverse DeFi ecosystem.

The ARB price is currently $0.45, but has struggled to hold above $0.40 all year. Source: Mooloo ARB price data.

Its ARB token was launched in March 2023 through one of crypto’s largest airdrops , hitting an all-time-high of $2.40 in mid-2023. In 2025 its price performance has been poor, declining consistently throughout the year at a time when Bitcoin, alts and the meme sector have seen phenomenal growth.

Optimism has differentiated itself through governance innovation and its “Superchain” vision, aiming to create an interconnected network of L2s. The OP token serves dual purposes as both a governance mechanism and potential value accrual tool, though its price performance has been mixed since launch and like ARB has been trending down for most of this year.

At $0.72, the OP price is slightly up in the last 24 hours but has slid badly throughout 2025

Polygon has adopted a multi-faceted approach, operating both as a sidechain and developing zk-rollup solutions. The September 2024 transition/rebranding from MATIC to POL tokens reflects the project’s evolution toward a more complex ecosystem architecture, though this pivot has created uncertainty among investors and after a spike upwards, like ARB and OP, its price performance has been dismal all year.

Layer 2 Tokens – The Investment Reality Check

Despite impressive TVL growth, the investment thesis for L2 tokens remains murky. Most Layer 2 solutions struggle with a fundamental challenge: their tokens often serve governance functions rather than capturing direct value from network activity. Transaction fees on L2s are typically paid in ETH, not native tokens, limiting direct revenue accrual to token holders.

The fee revenue model presents additional concerns. As ethereum implements Proto-Danksharding and other scaling improvements, the cost of data availability could decrease significantly, potentially compressing L2 profit margins. This technological progression raises questions about the long-term economic moats of current L2 solutions.

Transaction volume data reveals mixed adoption patterns. While total transactions across major L2s have grown substantially, much of this activity consists of low-value transactions and bot activity rather than meaningful economic use. The challenge of converting transaction volume into sustainable revenue streams remains largely unsolved.

Risk Assessment and Historical Failures

Layer 2 solutions face several categories of risk that potential investors must consider. Technical risks have materialized in dramatic fashion, with bridge exploits resulting in hundreds of millions in losses. For example, the Ronin bridge hack, which resulted in over $600 million in losses, demonstrated the vulnerability of cross-chain infrastructure.

Centralization risks persist across major L2 solutions. Most optimistic rollups rely on centralized sequencers, creating single points of failure and potential censorship vectors. While projects promise eventual decentralization, the timeline and feasibility of these transitions remain uncertain.

Economic sustainability presents perhaps the greatest long-term risk. Most L2 tokens trade below their launch prices, suggesting market skepticism about their value proposition. The lack of clear value accrual mechanisms means token prices often depend more on speculation than fundamental metrics.

Several L2 projects have effectively failed or pivoted away from their original visions. Projects like Loopring have seen significant decline in usage and market relevance, while others have been absorbed into larger ecosystems or abandoned entirely.

Conclusion: Infrastructure Growth With Investment Uncertainty

Layer 2 solutions represent genuine technological progress in blockchain scaling, with some impressive TVL, transaction volume, and ecosystem development. The infrastructure being built is real, valuable, and likely a necessary feature of the crypto landscape for some time to come.

However, the investment case for L2 tokens remains complicated by unclear value accrual mechanisms, intense competition, and the evolving underlying technology of the foundational chains. While the infrastructure may prove revolutionary, the current token models may not effectively capture that value for investors. Success in building useful technology does not automatically translate to successful token investments, a distinction that may define the Layer 2 space in the coming years.