🚀 Ethereum (ETH) Price Prediction: Eric Trump Fuels $8,000 Rally as Bulls Take Control

Ethereum's momentum builds toward a staggering $8,000 target—and now it's got political firepower. Eric Trump just threw gasoline on the crypto bull market, backing ETH's surge with a tweet that sent traders scrambling.

### The $8K Domino Effect

Institutional money's flooding in, retail FOMO is ticking up, and the charts scream breakout. Forget 'slow and steady'—this is a liquidity tsunami with altcoins riding its wake.

### Smart Money vs. Dumb Money

Whales are accumulating while Wall Street analysts still call it a 'bubble.' Meanwhile, DeFi protocols quietly hit new ATHs. Classic.

Will ETH hit $8,000? The market's voting yes—with its wallet. And if it stalls? Well, there's always another 'Trump pump' tweet waiting in the drafts.

The latest market Optimism stems from renewed institutional interest and macroeconomic indicators, with Eric Trump reigniting bullish sentiment by backing Ethereum’s trajectory toward $8,000. His remarks come amid historic inflows into Ethereum ETFs and a rising correlation with global liquidity expansion.

ETH Price Stabilizes as Bulls Eye Higher Targets

After briefly dipping to $3,500, ETH has reclaimed the $3,600 zone, showing resilience despite profit-taking and recent market-wide corrections. Analysts note that Ethereum’s RSI today reflects ongoing consolidation rather than breakdown, while on-chain data suggests that selling pressure remains subdued compared to Bitcoin.

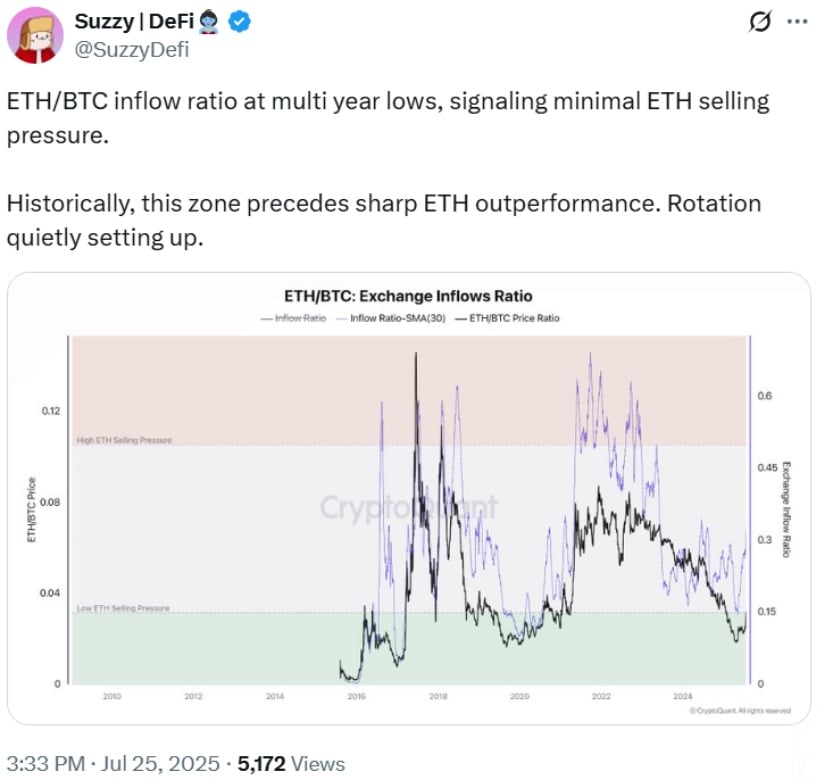

ETH/BTC inflow ratio hits multi-year lows, hinting at low ETH selling pressure and a quiet rotation ahead. Source: @SuzzyDefi via X

Suzzy DeFi highlighted that the ETH/BTC inflow ratio has dropped to multi-year lows, signaling minimal selling pressure for ETH. Historically, this zone precedes sharp ETH outperformance, suggesting that a quiet rotation may be setting up.

Eric Trump’s $8,000 Ethereum Call Gains Traction

One of the most talked-about developments is Eric Trump’s renewed bullish stance on ETH, tied to the expansion of global liquidity. Referencing a post by crypto analyst Ted Pillows, Trump echoed the claim that Ethereum’s price should be trading above $8,000 when compared with the growth of the global M2 money supply.

ETH is catching up with global liquidity—and by M2 standards, it should already be above $8,000! Source: Eric TRUMP via X

Ted Pillows noted that ethereum is “catching up with global liquidity,” and based on historical trends, ETH appears heavily undervalued. He wrote, “Comparing with M2 supply growth, ETH should be trading above $8,000 by now. This shows how undervalued ETH is right now, and is probably one of the best trades out here.” In response, Eric Trump simply replied, “Agreed! $ETH,” signaling his continued support for Ethereum’s long-term potential.

This comes as the U.S. M2 money supply—a measure of total liquid assets—grew by 4.5% year-over-year in June, reaching a record $22.02 trillion. Trump believes this liquidity backdrop should have already propelled Ethereum far higher, and many market watchers are beginning to take his view seriously.

Institutional Investors Are All In on Ethereum

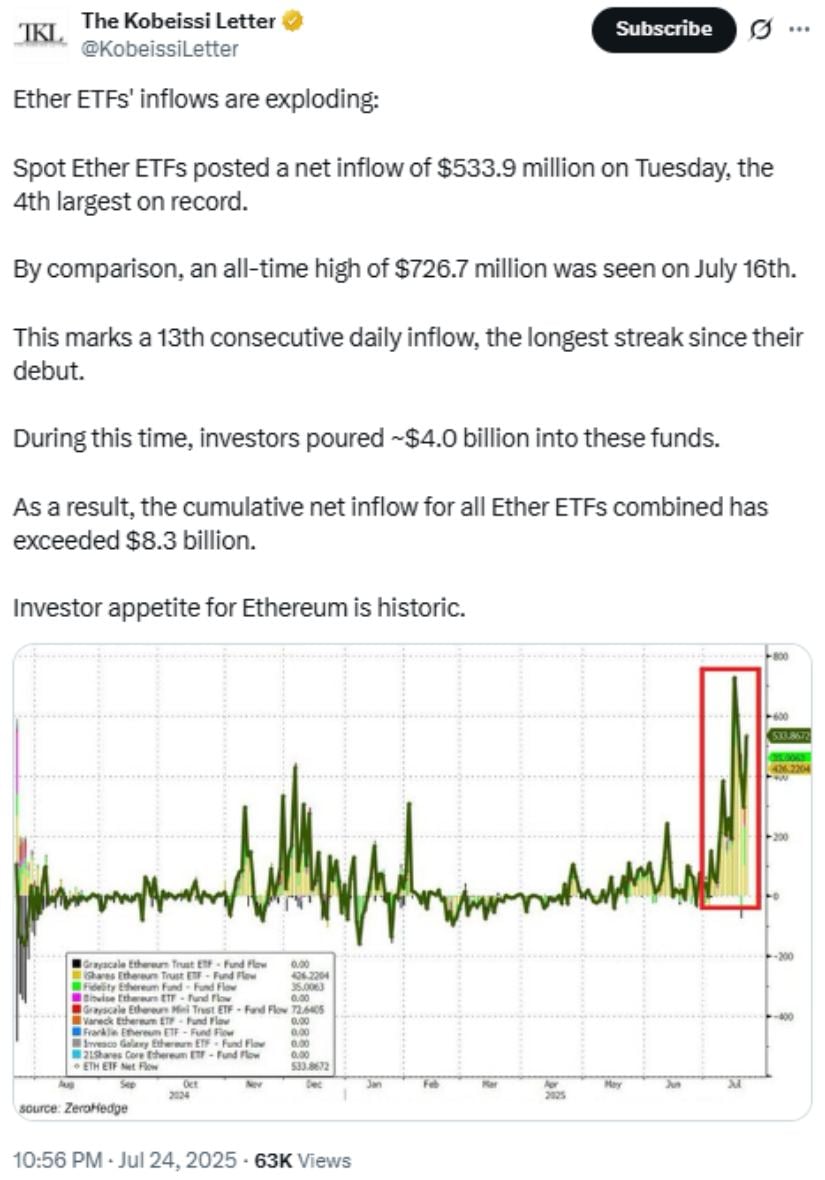

The recent rally has been strongly fueled by institutional demand. On July 24, spot Ethereum ETFs recorded $214 million in inflows—marking the 15th consecutive day of positive momentum. This surge in capital has brought cumulative inflows for ETH-based ETFs close to $8.8 billion, with BlackRock’s ETHA fund hitting $10 billion in assets, making it the third-fastest-growing ETF in U.S. history.

Ethereum ETFs keep the momentum rolling with $533.9M inflow Tuesday—pushing total inflows beyond $8.3B during a 13-day winning streak. Source: The Kobeissi Letter via X

ETF analyst Eric Balchunas commented on the remarkable pace, pointing out that ETHA doubled from $5 billion to $10 billion in just 10 days—comparing it to a “God candle” in the world of ETF flows. Meanwhile, Fidelity’s FETH ETF led daily inflows with $203 million, underscoring how institutional confidence in Ethereum continues to rise faster than in Bitcoin.

Technical Outlook: Can ETH Overcome the $4,500 Barrier?

From a technical standpoint, Ethereum remains in a consolidation zone but shows signs of building strength. ETH is now forming a bullish pennant pattern, and analysts expect a breakout if the price moves past $3,860, which is the immediate resistance level.

Ethereum nears the apex of a 4-year triangle—breaking the trendline could trigger a powerful rally toward the $8,000 Fibonacci target. Source: TradingShot on TradingView

According to Glassnode, a major resistance level lies at $4,500, which is Ethereum’s active realized price pushed one standard deviation above the average. This level has historically acted as a ceiling, notably in both the 2021 bull run and early 2024. In a recent report, Glassnode stated that “$4,500 can be identified as a critical level to watch on the upside, especially if Ethereum’s uptrend continues and speculative froth builds further.”

A successful break above this resistance could trigger a sharp rally toward $5,000, and eventually pave the way for testing the $8,000 target if the macro backdrop and ETF flows continue aligning.

Layer 2 Growth and Real-World Use Cases Add Fuel

Beyond charts and ETFs, Ethereum continues to dominate the core infrastructure of Web3. Its LAYER 2 ecosystem, featuring Arbitrum, Optimism, and zkSync, is scaling rapidly, helping to reduce Ethereum gas fees and improve network efficiency. Additionally, Ethereum remains the preferred platform for real-world asset tokenization, NFT infrastructure, and DeFi protocols.

Andrew Keys, CEO of Ether Machine, likened Ethereum’s dominance in tokenization to Google’s grip on internet search, emphasizing that “90% of all tokenized assets and stablecoins are deployed on Ethereum.” He believes Ethereum will benefit the most from regulatory and technological shifts like the GENIUS Act.

Final Thoughts: Can Ethereum Realistically Hit $8,000?

Ethereum may not be at $8,000 yet, but multiple signals—growing ETF demand, macro liquidity expansion, technical patterns, and institutional accumulation—are lining up. Even skeptics are beginning to acknowledge that the current price may undervalue Ethereum’s future utility and dominance in crypto finance.

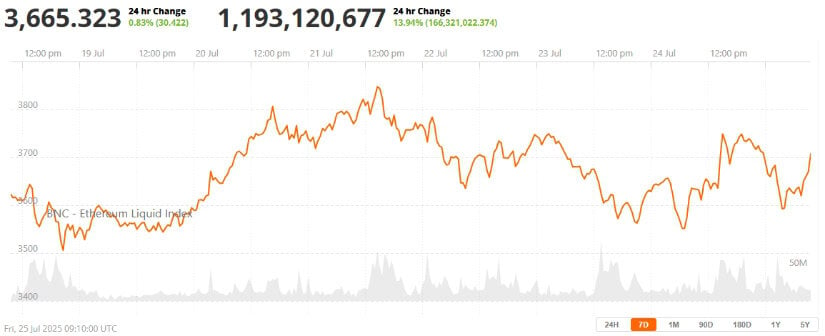

Ethereum (ETH) has been trading at around $3,665, up 0.83% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

If current trends hold, ETH could break past $4,500 resistance in the coming months and challenge the $5,000–$8,000 range before the end of the year. While price predictions are speculative by nature, one thing is clear: Ethereum’s bullish momentum is building faster than many anticipated.