Sei Price Primed for Explosion: Cup and Handle Breakout Looms as TVL Shatters Records

Sei network's token charts scream bullish—classic cup-and-handle formation points to a potential price surge just as total value locked (TVL) hits unprecedented highs.

When technicals meet fundamentals. The pattern—beloved by crypto traders for its reliability—suggests accumulation phase completion. Meanwhile, TVL's relentless climb hints at growing DeFi adoption... or maybe just yield farmers chasing the next shiny object.

Breakout watch. A decisive close above the handle's resistance could trigger algorithmic buying frenzies. But remember kids: in crypto, 'patterns' work until they don't—usually right after you YOLO your savings.

Contrarian take. While the setup looks textbook, remember 2023's 'sure thing' breakouts that pancaked. Still, with TVL confirming network utility (or at least speculation), this might be one chart play that doesn't evaporate like a meme coin's promises.

While price action has remained volatile in recent sessions, the underlying ecosystem metrics suggest increasing investor confidence.

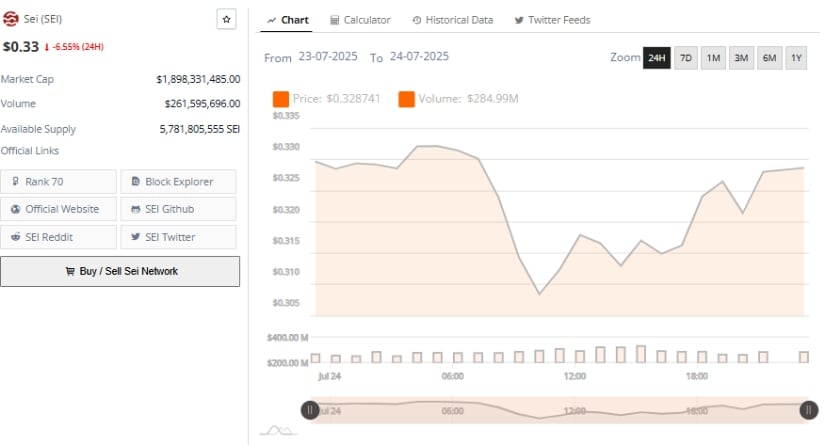

A sharp rise in Total Value Locked (TVL) and a classic “cup and handle” pattern forming on the chart may provide the foundation for a bullish breakout. At the time of writing, SEI is trading at $0.3273, marking a 6.55% daily decline, but continues to consolidate within a broader upward structure.

TVL Growth Signals Expanding Ecosystem Confidence

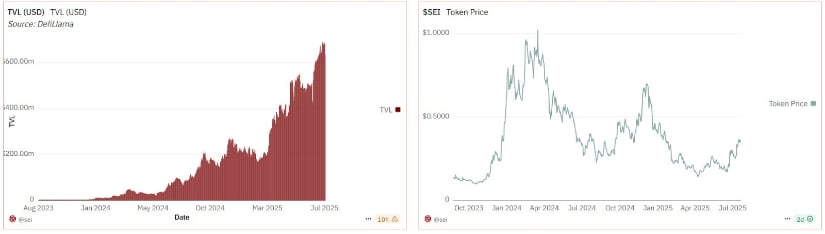

The left side of the chart shared by analyst @DeFiDecoder_ illustrates Sei’s Total Value Locked (TVL) climbing from under $20 million in early 2024 to nearly $600 million by July 2025. This steady rise reflects long-term capital inflow and robust user engagement across DeFi protocols on Sei.

The growth has been consistent, with few extended pullbacks, suggesting sustained demand for Sei’s infrastructure—particularly its integration of stablecoins like USDC and USDY and support for cross-chain retail payments.

Source: X

The network’s fundamentals indicate ongoing development traction, which could support further token valuation gains. The increase in TVL is not yet reflected in the price action, signaling a bullish divergence often seen in maturing LAYER 1 networks.

As institutional and retail attention turns toward utility-backed protocols, Sei may stand to benefit from this foundational growth. The current TVL trend sets a supportive backdrop for any upcoming price breakout.

Technical Structure: Cup and Handle Formation in Play

While the SEI token experienced significant volatility, the daily price chart is shaping into a cup and handle pattern—a classic bullish continuation formation.

After peaking NEAR $1.00 in early 2024, the price declined steadily and formed a rounded base that concluded near $0.25 in mid-2025. The recent recovery to $0.39 created the top of the “cup,” while the current retracement is forming the “handle,” typically the final phase before a breakout.

Source: BraveNewCoin

Analysts are monitoring the $0.33–$0.35 zone as a key retest area. If this handle formation holds above the lower boundary near $0.30, and volume begins to rise again, it could trigger a breakout rally toward the $0.50 resistance zone.

This measured move WOULD align with the height of the cup projected from the breakout point. However, a breakdown below $0.30 could invalidate the pattern and suggest further consolidation near prior support around $0.27.

Momentum Indicators Show Caution as Volume Holds Steady

At the time of writing, SEI trades at $0.3273, retreating from recent highs of $0.3903. The MACD (12, 26) has crossed into negative territory, with the MACD line at 0.0228 below the signal line at 0.0263, forming a small histogram of -0.0036.

This bearish crossover indicates fading upward momentum and raises the likelihood of a consolidation phase. Confirmation of this signal would depend on whether the histogram continues to deepen or reverses back toward neutrality.

Source: TradingView

The Chaikin Money FLOW (CMF) reading sits at 0.00, reflecting a neutral stance between buying and selling pressure. Earlier bullish inflows seen during SEI’s rally toward $0.39 have tapered off, mirroring cautious sentiment across broader markets.

A renewed rise in CMF above +0.10 would be needed to confirm fresh capital inflows and justify a bullish breakout. Until such confirmation emerges, price may oscillate between $0.30 and $0.35, offering a range-bound opportunity while the broader trend remains intact.