🚀 Ethereum (ETH) Price Prediction: Bitwise CIO Warns of Supply Crunch – Is a 100% Rally Imminent?

The crypto market's sleeping giant might be waking up—with its leash snapped. Ethereum's supply dynamics are flashing bullish signals so hard even Wall Street can't ignore them.

The squeeze is coming

Bitwise's chief investment officer just went on record predicting a major ETH rally, citing a perfect storm of shrinking supply and institutional demand. We're talking about the same 'experts' who missed Bitcoin at $3K, but hey—even broken clocks etc.

Numbers don't lie (but analysts do)

With staking yields sucking up liquidity and Layer 2 adoption exploding, Ethereum's circulating supply is tightening faster than a VC's purse strings during a bear market. The math is simple: when demand outstrips shrinking supply, price goes brrr.

Will this finally be Ethereum's year to flip Bitcoin? Probably not—but watching the 'flippening' crowd cope will be almost as entertaining as the gains.

Bitwise CIO Matt Hougan believes ethereum is primed for a rally as ETH treasuries and ETFs continue to outpace newly issued supply by a massive margin.

Market Overview: ETH Rallies, Faces Resistance Near $3,800

Ethereum has risen more than 160% over the past three months, fueled by steady inflows into spot ETH ETFs and accumulation by crypto treasury firms. Currently hovering around $3,618, the ETH price briefly tested resistance near $3,800 before pulling back due to overbought technical signals.

Ethereum (ETH) has been trading at around $3,618, down 2.33% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Despite this near-term rejection, ETH remains bullish in broader context. The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) suggest short-term exhaustion, but not a trend reversal. Key support levels now lie at $3,470, followed by $3,200 and $2,850, based on exponential moving averages.

Supply Crunch in Focus: Bitwise CIO Highlights Demand Surge

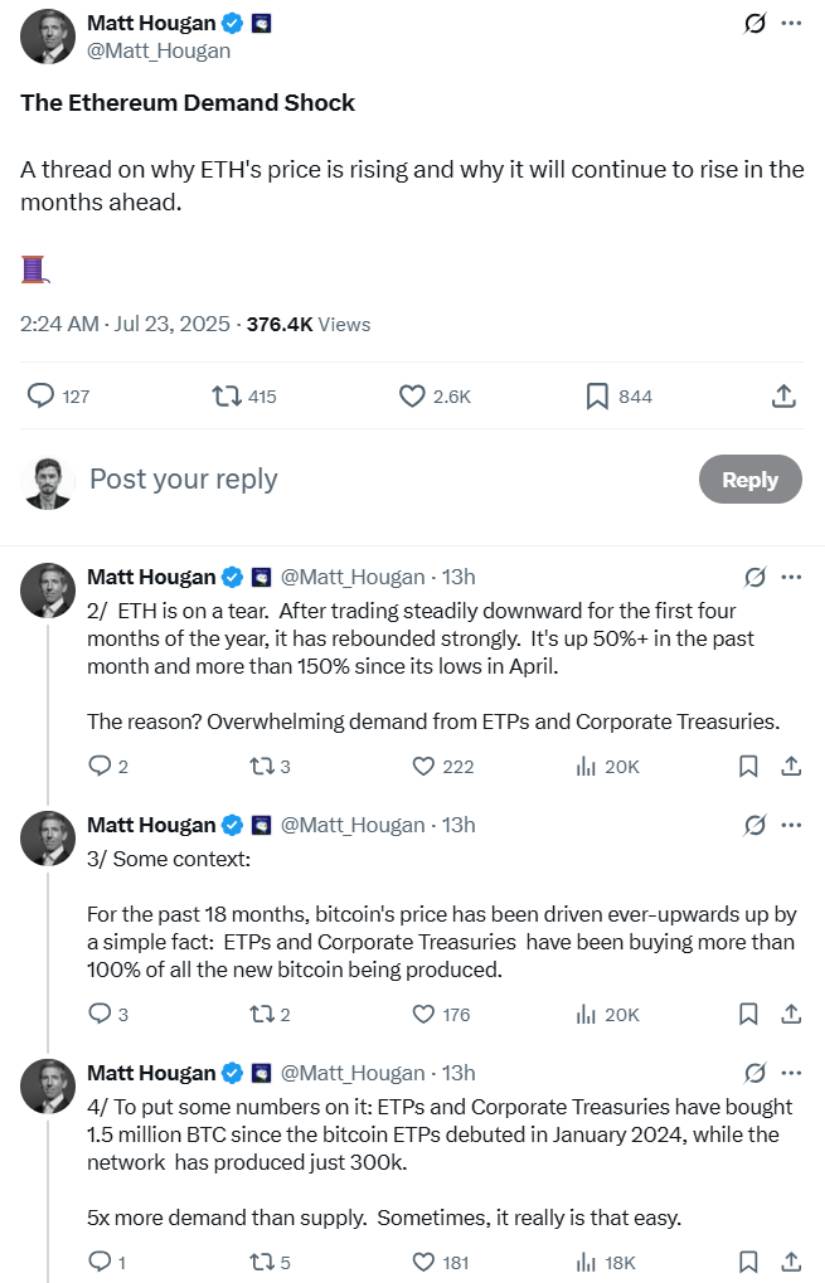

According to Bitwise CIO Matt Hougan, Ethereum is in a strong position to continue its upward momentum. Hougan emphasized that ETH ETFs and treasury firms have acquired over 2.83 million ETH since mid-May—32 times more than the newly issued ETH in the same period. “In the short term, the price of everything is set by supply and demand, and right now, there is more demand for ETH than supply,” said Hougan.

Ethereum has rebounded sharply, gaining over 50% in the past month and more than 150% since its April lows after a sluggish start to the year. Source: Matt Hougan via X

He estimates that institutional entities could add $20 billion worth of ETH to their holdings over the next year, potentially seven times more than the expected ETH issuance. If this trajectory holds, Hougan believes Ethereum could finally outperform Bitcoin after lagging behind the top cryptocurrency for nearly two years.

Ethereum ETF Momentum Builds

Ethereum ETF news continues to inject Optimism into the market. According to SoSoValue, ETH ETFs saw $296.5 million in net inflows on Tuesday alone, marking 12 straight days of positive flows. These ETFs are now regarded as pivotal instruments channeling institutional capital into Ethereum.

The rise of crypto treasuries is also notable. Companies like BitMine (BMNR), Bit Digital (BTBT), and SharpLink Gaming (SBET) have recently added over 840,000 ETH to their reserves, signaling strong long-term conviction.

ETH Technical Outlook: Symmetrical Triangle Nearing Breakout

Ethereum is currently challenging the $3,850–$4,100 resistance zone, the upper boundary of a multi-year symmetrical triangle that dates back to late 2021. A decisive weekly close above $4,100 WOULD signal a breakout and potentially open the door to $5,200 in the coming months.

Ethereum is testing the upper boundary of a multi-year symmetrical triangle pattern that has been forming since late 2021. Source: Trendytrend on TradingView

So far, technical indicators like the parabolic SAR have flipped bullish on the weekly timeframe. Ethereum’s reclaim of the $2,300 ascending trendline earlier this quarter has served as the base for this sustained climb.

However, failure to break above $4,100 could result in a pullback toward $2,800 or even $2,300, maintaining the triangle pattern’s hold on Ethereum’s macrostructure.

Derivatives and Sentiment Indicators Point to Upside

Derivatives data paints a bullish picture. ETH options open interest ROSE to $14.07 billion, while 24-hour trading volume jumped 15.25% to $155.11 billion, according to Coinglass. The long-to-short ratio among Binance’s top traders stands at 2.57, reflecting broad optimism.

Ethereum appears to be forming a corrective wave pattern, and if support at $3,615 holds, a strong and swift upward MOVE in wave C of (B) could follow. Source: Yafrosi88 on TradingView

Meanwhile, over $175 million in liquidations were recorded in the past day, largely from short positions—indicating rising bullish momentum is shaking out bearish bets.

Ethereum Layer 2 and Fundamental Strength

Beyond price action, Ethereum’s fundamentals remain robust. Activity on Layer 2 networks like Arbitrum, Optimism, and zksync continues to grow, lowering gas fees and expanding Ethereum’s usability.

Moreover, Ethereum staking and validator rewards continue to support network security and provide incentives for long-term holders.

Looking Ahead: Ethereum Prediction Hinges on Breakout Confirmation

The next move for Ethereum hinges on its ability to break above the key $4,100 resistance. If it succeeds, ETH could retest all-time highs and potentially move toward $5,200, supported by strong ETF inflows, treasury accumulation, and a structural supply shortage.

While short-term pullbacks remain possible due to overheated indicators, the broader outlook remains constructive. Ethereum’s capped issuance, rising demand, and expanding ecosystem suggest it may finally be poised to catch up—or even outperform—Bitcoin in the next market cycle.