XRP Price Alert: Pullback After ATH—Bullish Accumulation Hints at Next Rally

XRP takes a breather after skyrocketing to record highs—but don't call it a retreat. On-chain whispers point to strategic accumulation, setting the stage for another explosive move.

The Dip Before the Launch

Traders are playing chess while weak hands panic-sell. Whale wallets keep stacking, undeterred by short-term volatility—because in crypto, corrections are just discounts with extra steps.

The Institutional Wink

Meanwhile, legacy finance still debates whether XRP is 'real money.' Spoiler: it's outrunning their beloved SWIFT network while they argue.

Watch those order books. When the suits finally catch on, they'll FOMO in—right after retail bags the prime entries.

While the pullback raised short-term caution, multiple indicators now suggest that the xrp price may be gearing up for another leg higher.

The recent surge followed a wave of pro-crypto legislation passed in the U.S. House of Representatives, which improved investor sentiment around Ripple and the broader digital asset market. Despite the dip from its high, XRP’s ability to recover and hold above key levels has many traders remaining bullish.

Key Levels and Accumulation Zones Support XRP Price Stability

XRP’s price action on July 19 revealed significant trading activity between $3.34 and $3.47, a zone that analysts now identify as a major accumulation level. According to CoinDesk, volume spikes exceeding 308 million XRP at these prices hint at strong institutional interest, rather than panic selling.

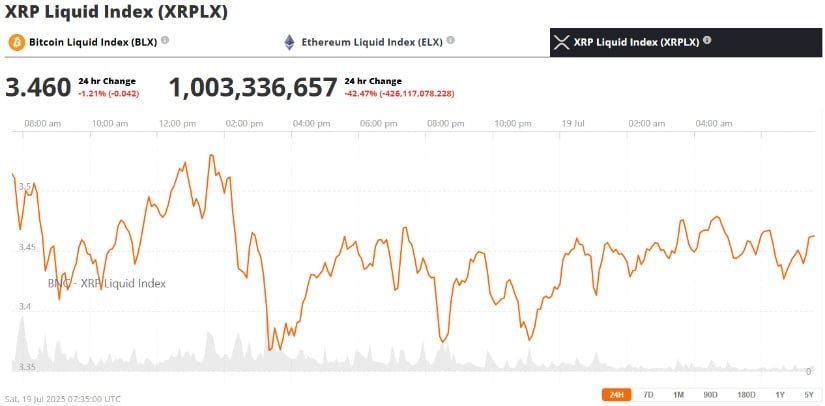

XRP was trading at around $3.46, down 1.21% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

“Despite the aggressive selloff from ATHs, XRP’s ability to defend the $3.34–$3.37 zone and recover toward $3.45 points to ongoing institutional support and a bullish medium-term structure,” wrote CoinDesk reporter Shaurya Malwa.

Market watchers are now closely eyeing $3.47–$3.48 as short-term resistance. A confirmed breakout above this zone could see XRP re-challenge the $3.60–$3.66 range, potentially initiating a new price discovery phase.

Legislative Tailwinds Boost Ripple and XRP Sentiment

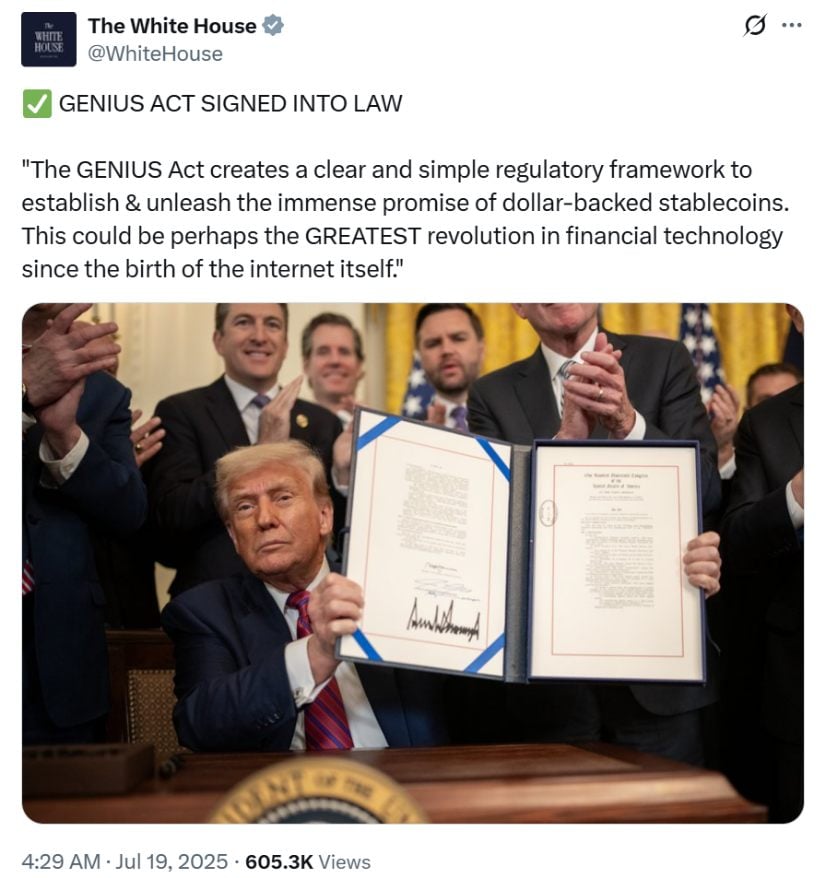

XRP’s recent momentum was largely driven by regulatory clarity out of Washington. The U.S. House passed three key crypto bills—the GENIUS Act, CLARITY Act, and Anti-CBDC Act—each designed to define the role of digital assets and stablecoins in the U.S. financial system.

Ripple CEO Brad Garlinghouse praised the legislative win on social media:

“The signing of the GENIUS Act cements the US’s future in being a leader in truly innovative financial technology—stablecoins.”

The ripple effect was immediate. Apart from XRP’s own rally, traders began anticipating approval of an XRP ETF, with 12 major asset managers filing XRP-related products. Analysts now project an 88% probability that a spot XRP ETF will be approved by the end of 2025.

The GENIUS Act sets a clear framework for dollar-backed stablecoins, marking a potential financial breakthrough on par with the internet revolution. Source: The WHITE House via X

Meanwhile, Ripple CTO Stuart Alderoty added:

“At long last, there’s movement on workable, clear frameworks for crypto and stablecoins that will both foster innovation and protect consumers.”

Technical Indicators Support XRP Price Prediction for More Upside

From a technical standpoint, XRP’s chart remains bullish despite short-term cooling. A Golden Cross—where the 50-day EMA crosses above the 100-day EMA—formed on July 11, confirming upward momentum. The MACD indicator has also signaled a strong buy zone since June 28.

XRP may have completed wave 3 with a MOVE above its all-time high, signaling a potential wave 5 toward $4 after a shallow pullback to previous key levels. Source: Maddox_Metrics on TradingView

While the Relative Strength Index (RSI) is elevated at 86, suggesting possible near-term exhaustion, analysts believe the neutral spot volume creates room for further growth.

A daily close above $3.50 WOULD further solidify the uptrend. Should XRP convincingly break its current all-time high, analysts predict upside levels between $3.80 and $4.00 with upside targets underpinned by sustained accumulation and positive macro sentiment towards crypto.

What’s Next for XRP?

With such a solid support level of $3.34, continued ETF interest, and regulatory tailwinds, XRP is poised for additional strength. Barring major outside shocks, traders and analysts will be watching closely to see if XRP can reclaim $3.60 and break into new highs.

XRP shows upward momentum NEAR $3.70, but if the price dips, key support zones at $3.30, $3.00, and $2.60 could become crucial areas for potential reversals. Source: easyMarkets on TradingView

The XRP price prediction 2025 perspective remains skewed in favor of the bulls, especially if institutional inflows and regulatory clarity keep pushing forward. Meanwhile, the precedence remains XRP’s ability to hold key support levels and reclaim near-term resistance convincingly.

As always, investors are advised to monitor the unfolding Ripple vs. SEC lawsuit, as any update in the XRP lawsuit can significantly impact price action.

Final Thoughts

While XRP has pulled back somewhat from its all-time high, accumulation patterns and favorable technicals suggest this may only be a pause—not a peak. With institutional interest on the rise and Optimism building toward regulatory clarity, XRP today is among the most widely watched assets in the digital currency space.