🚀 Bitcoin (BTC) Price Prediction: Michael Saylor’s $1 Million 2030 Target as Whales Enter ’Buy Zone’

Michael Saylor just dropped a bombshell—Bitcoin could smash the $1 million mark by 2035. Meanwhile, on-chain sleuths spot a historic accumulation pattern that screams 'last chance discount.' Here's why the smart money's loading up.

The Saylor Effect: From 'Crypto Skeptic' to Bitcoin's Cheerleader-in-Chief

The MicroStrategy CEO—once a vocal Bitcoin critic—now claims BTC's scarcity will dwarf gold's market cap. His $1 million price target assumes institutional FOMO meets hyperbitcoinization. Traders are listening: his previous calls nailed BTC's 2024 rally.

Whale Watching: The Stealth Accumulation Phase

Analysts pinpoint a critical support zone where long-term holders are hoarding coins. Exchange reserves are drying up faster than a DeFi rug pull—supply shock incoming. 'This isn't accumulation, it's a bank heist in slow motion,' quips one trader.

Wall Street's Dilemma: Fight the Fed or Ride the Lightning?

While traditional finance debates rate cuts, Bitcoin's network hash rate just hit an all-time high. The math is simple: adoption curves don't care about CPI prints. As one hedge fund manager grumbles, 'We're stuck explaining digital scarcity to clients who still fax orders.'

The clock's ticking. Either you understand why a 21 million hard cap changes everything—or you'll be stuck buying the ETF at a 500% premium.

Meanwhile, analysts are closely watching current accumulation patterns as Bitcoin consolidates below recent highs. These technical signals suggest that despite the near-term cooldown, Bitcoin’s next major rally could be forming beneath the surface.

Bitcoin News Today: Saylor’s Bold $1M Forecast

MicroStrategy Executive Chairman Michael Saylor reiterated his long-standing bullish stance on Bitcoin, forecasting that the leading cryptocurrency could reach $1 million by 2035. Speaking at the Bitcoin 2025 conference, Saylor claimed, “When Wall Street is 10% Bitcoin, Bitcoin will be $1,000,000 a coin.”

Passive capital is increasingly flowing into Bitcoin, with Michael Saylor suggesting it could drive the price beyond $1,000,000. Source: Michael Saylor via X

Saylor’s outlook is based on Bitcoin’s limited supply of 21 million coins, institutional adoption trends, and its appeal as a hedge against inflation. He previously predicted that bitcoin could hit $200,000 to $250,000 by 2026, a stepping stone toward his longer-term targets.

Bitcoin Technical Analysis: Market Overview

Bitcoin recently pulled back after its new ATH, signaling a consolidation phase. Michael Harvey, Head of Franchise Trading at Galaxy Digital, noted: “Consolidation around current prices is my base case given the large rally and new ATH.”

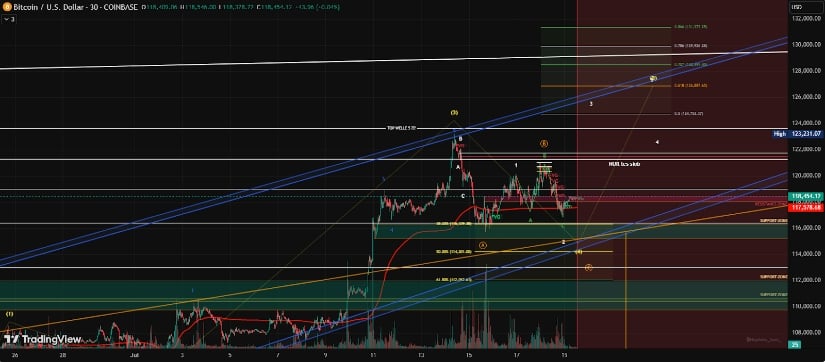

Bitcoin’s extended Wave C could target $113,679, with potential for a liquidity retest NEAR $107,326 before a Wave 5 rally toward $130,000. Source: Jorgebatista8twcp on TradingView

Despite short-term resistance, technical indicators show strength. Analysts are closely watching accumulation zones forming around the $110,000 to $118,500 range. The Bitcoin RSI indicator remains elevated but has yet to flash strong bearish divergence, suggesting that another leg up is plausible.

Bitcoin Halving 2025 and Whale Activity

The next Bitcoin halving, expected in 2025, continues to be a bullish catalyst for long-term investors. Historically, halvings have preceded major price surges due to reduced new supply. Additionally, on-chain data has shown significant Bitcoin whale alerts, signaling large holders are accumulating during this price lull.

According to Nansen data, Bitcoin treasury firms and ETFs have maintained strong inflows, while Coinbase’s rising App Store ranking points to increasing retail curiosity. However, broader retail demand still appears to be lagging, as reflected in relatively low Google search interest.

Expert Insights: Bitcoin as an Inflation Hedge

Saylor’s thesis on Bitcoin as the “digital gold” continues to resonate. “Bitcoin is not going to zero,” he emphasized. “It’s going to $1,000,000… eventually $13M.” He believes Bitcoin’s scarcity, decentralization, and secure protocol make it a viable long-term store of value.

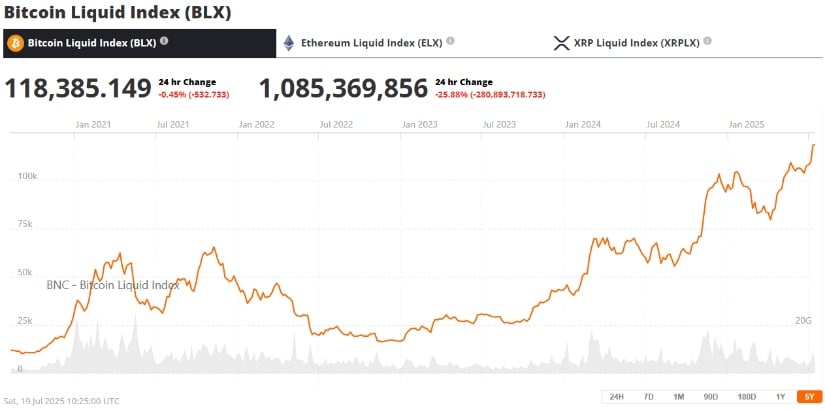

Bitcoin (BTC) was trading at around $118,385, down 0.45% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Analysts note that if major financial institutions allocate just 2-10% of their portfolios to Bitcoin, it could drive massive demand. This narrative is reinforced by MicroStrategy’s continued Bitcoin accumulation, now exceeding 580,000 BTC.

BTC Next Move: Long-Term Outlook

While short-term volatility remains, analysts maintain a generally bullish stance. Harvey expects Bitcoin to be “trending higher into the year-end,” with a potential “slow melt-up” through July, if ETF flows and treasury adoption remain strong.

Bitcoin hit a new all-time high at $122,000 before pulling back toward key mean support zones, with the next primary uptrend targeting $126,500, $132,200, and $135,000. Source: TradeSelecter on TradingView

For now, the $110,000 level is the key support, with a break below it being the short-term bear case. To the topside, a decisive break above $123,000 WOULD be the trigger for the launch of the next breakout phase.

As Bitcoin matures as an asset class and becomes more included in institutional portfolios, the $1 million target—ambitious though it is—points to growing confidence in its long-term role in the global financial system.