🚀 Uniswap Rockets to $8.20 Amid $770M Bullish Frenzy – DeFi Summer 2.0?

Uniswap's native token defies gravity as trading volume explodes—proving once again that crypto markets love a good liquidity party.

The pump no one saw coming

While traditional finance was busy shorting itself into oblivion, UNI bulls pushed past resistance levels like they were paper walls. The $770M volume surge smells like institutional money finally figuring out what 'APY' means.

When in doubt, zoom out

This isn't 2021's reckless retail rally—today's action shows sophisticated players stacking positions. Though let's be honest, half those 'sophisticated' funds probably still keep passwords in Excel sheets.

Will this hold? Who knows. But for now, the DEX king wears its crown sideways—and Wall Street's still trying to pronounce 'impermanent loss.'

The recent uptrend follows the successful breakout from a bullish pennant formation, adding to the credibility of the rally. With a consistent surge in trading activity and rising capital inflows, technical indicators show increasing market participation.

UNI appears to be building on this structure, holding above key support levels as traders eye higher resistance zones.

Pennant Breakout Leads to Precision Target Hit

Uniswap’s short-term price movement confirmed a classic bullish pennant breakout, as highlighted by analyst CryptoJoe (@CryptoJoeReal). The 30-minute chart revealed a strong flagpole formed by a swift rally from $6.85 to $7.27, followed by a consolidation phase that produced converging trendlines.

This setup culminated in an upward breakout NEAR $7.27, which was accompanied by stronger bullish candles and increasing volume. The price surged toward the projected target of $7.80, fulfilling the measured move outlined by the pattern.

Source: X chart by CryptoJoe (@CryptoJoeReal).

Volume confirmation played a crucial role in validating the breakout. Trading activity accelerated during the breakout window, suggesting committed buying interest rather than speculative movement. After reaching the target, UNI retraced slightly but maintained levels above $7.40, turning previous resistance into short-term support.

The 200-period moving average also acted as a dynamic support near $7.278, further reinforcing the bullish sentiment. As long as the price holds above this average, continuation on higher timeframes remains plausible.

UNI Rallies Above $8.00 as Volume Hits $773M

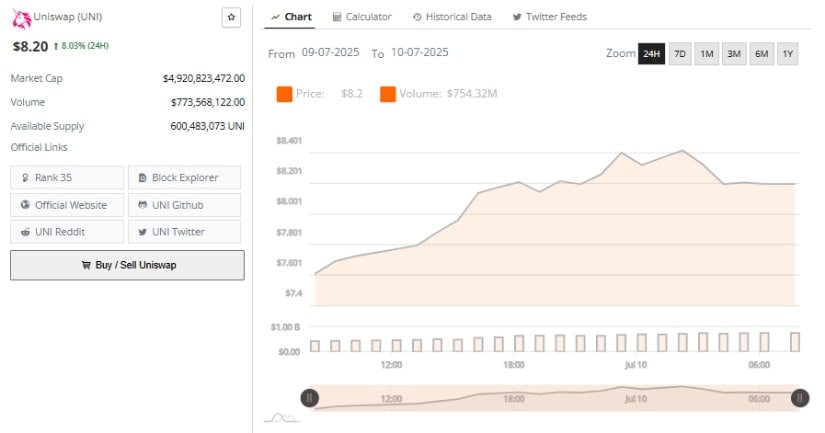

Data from BraveNewCoin shows an 8.03% price gain over the last 24 hours, with Uniswap now trading at nearly $8.20. The session began with UNI priced at approximately $7.45 and saw a continuous rise to a session high near $8.40, before stabilizing around the $8.20 level. This sustained rally has elevated market interest in UNI, particularly after the asset crossed the psychological $8.00 barrier.

Source: Chart by BraveNewCoin

Trading volume surged in alignment with the upward price action, reaching $773.57 million across major platforms. The strongest participation was recorded between late evening on July 9 and the early hours of July 10, coinciding with the breakout move.

This increase in volume during price expansion is typically viewed as a positive signal, reflecting conviction behind the rally. If this level of volume persists, it may support continued bullish momentum and pave the way for testing the $9.00 resistance zone.

Indicators Suggest Uptrend May Extend to $9.00

According to TradingView data, the daily chart for UNI/USDT maintains a steady bullish structure, with the token currently priced at $8.215. Recent price action has broken out of a consolidation range held between May and June, establishing a pattern of higher lows. With resistance expected near the late April high of around $9.00, the market is watching for follow-through momentum to challenge that level.

Source: Chart by TradingView

The MACD indicator confirms underlying bullish momentum, with the MACD line positioned above the signal line and positive histogram bars in place. This setup supports the ongoing trend, with the slope suggesting further upside is possible.

In parallel, the Chaikin Money Flow (CMF) reading at 0.04 indicates capital inflow and buying pressure. As long as UNI maintains its price above $8.00 and key indicators remain supportive, the asset may continue its MOVE toward the $8.50–$9.00 zone in the short term.