Dogwifhat (WIF) Nears $1 Breakout: Price Surges 14.75% to $0.93 – Next Stop Moon?

Dogwifhat (WIF) isn’t just barking—it’s biting into the market with a 14.75% rally. The meme coin claws its way to $0.93 as traders eye the psychological $1 threshold.

The Meme Coin Momentum Play

No fundamentals? No problem. WIF’s latest pump proves crypto’s golden rule: hype beats logic every time. Retail traders pile in, fueled by the siren song of ‘number go up.’

The $1 Make-or-Break

All eyes on that round-number resistance. A clean breakout could trigger FOMO; a rejection might send bagholders chasing the next shiny meme coin. Either way, brokers win.

Memo to ‘serious investors’: the same degenerates who made Dogecoin a thing are now back in force. Buckle up—or step aside.

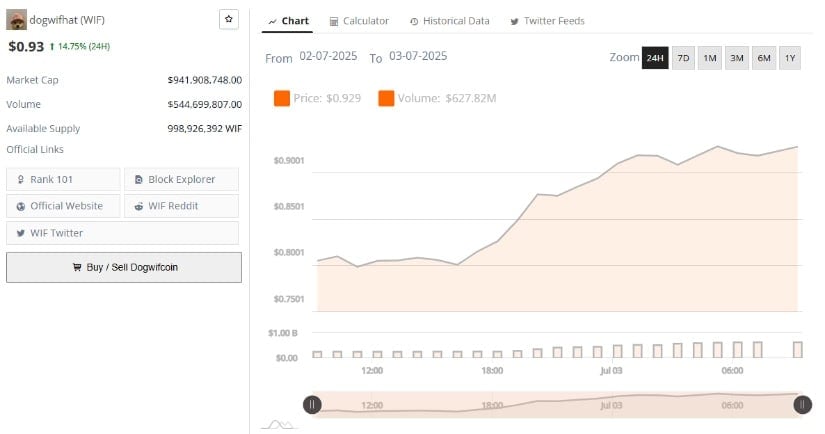

Dogwifhat (WIF) has registered a notable price increase, climbing 14.75% to reach $0.93 within the past 24 hours, based on data from Brave New Coin.

Analysts are now observing whether WIF can sustain momentum and target a breakout above the $1 mark. With multiple indicators showing bullish setups, the coming sessions will be critical for confirming directional strength.

Dogwifhat Market Overview and On-Chain Momentum

Dogwifhat currently holds a market capitalization of approximately $941.9 million, placing it at position 101 among cryptocurrencies by total value. The asset’s circulating supply is just under one billion tokens, with 24-hour trading volume exceeding $544 million. This surge in volume points to growing market participation and is often associated with momentum shifts.

Source: Brave New Coin

The price action shows that WIF has recovered from prior support NEAR $0.79 and is now retesting resistance around $0.93. This level has acted as both resistance and support over the past month. If maintained, it could become a strong foundation for upward continuation. Buyers are closely watching the $1.00 level, which not only serves as a psychological target but also coincides with resistance from previous market structures.

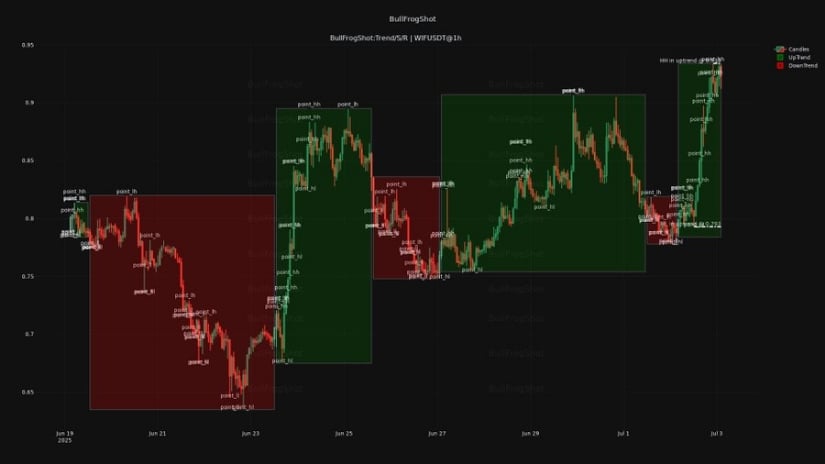

Dogwifhat Price Prediction: Analyst Insights and Technical Patterns

In a recent X post, analyst BullFrogShot highlighted that WIF is trading between support at $0.793 and resistance at $0.934, emphasizing a narrow but active trading range. His data noted that the candle opened at $0.931 and closed slightly lower at $0.923, suggesting short-term indecision but maintaining a bullish bias. This aligns with Brave New Coin’s data showing ongoing accumulation near these levels.

Source: X

Another analyst, AltWolf, posted a 4-hour chart analysis, pointing out a long-standing descending channel from which WIF has recently broken out. The breakout occurred after the token moved above the 200 EMA positioned at $0.84, a level that had previously acted as dynamic resistance.

Source: X

The price is now testing the top boundary of this channel and attempting to flip the $0.90 level into support. If this structure holds, the next major resistance lies between $1.03 and $1.05. AltWolf identified a potential 15.15% upside target at $1.039, while a downside risk remains around $0.63 should the pattern fail.

The technical pattern is further supported by the structure of lower highs and higher lows, forming a contracting range that typically leads to a breakout. Green arrows on the chart suggest that previous reactions at this level were met with renewed buying activity, reinforcing the significance of the $0.90 to $0.93 zone as a pivot area.

Indicators Supporting Potential Breakout

On the daily chart from Coinbase, dogwifhat is currently trading at $0.935, with a positive daily change of 2.86%. The Awesome Oscillator (AO) has shifted from negative to positive territory and now reads 0.014. This transition often signals that buyers are regaining control after a period of weakness. If the histogram continues to print green bars above the zero line, it may indicate a strengthening trend.

Source: TradingView

The Balance of Power (BoP) indicator is reading 0.45, suggesting buyers currently have a stronger grip on market direction. During previous price movements, BoP values above 0.40 have typically supported price rallies in WIF. The combination of rising BoP and AO levels adds technical confirmation that the asset could be preparing for a continuation move.

If current patterns hold and price closes above the key resistance zone between $0.96 and $1.00, WIF may confirm the beginning of a broader upward move. However, analysts advise watching volume and candle closes for confirmation before expecting further gains beyond the $1 threshold.