Bitcoin (BTC) Price Prediction: $110K Becomes New Support After Saylor’s ’Top Gun’ Move—$150K Incoming?

Bitcoin just pulled a Maverick—soaring past $110K like it's dodging lock-on missiles. Michael Saylor's cryptic 'Top Gun' tweet lit the afterburners, and now traders are eyeing $150K like it's the next checkpoint. Wall Street analysts? Still trying to short the dip.

Why $110K matters now

The line between support and resistance just evaporated. BTC isn't asking permission—it's rewriting the playbook while traditional finance plays catch-up. Retail FOMO hasn't even peaked yet.

The runway to $150K

No pullbacks. No apologies. Just pure algorithmic momentum meeting institutional demand. The only thing thicker than the bullish order books? The irony of goldbugs finally capitulating.

Remember: markets climb a wall of worry—but Bitcoin builds its own damn ladder. (And yes, that includes bypassing every 'overbought' RSI signal since $60K.)

The rally comes on the heels of rising institutional demand, stronger-than-expected ETF inflows, and a high-profile endorsement from Bitcoin advocate Michael Saylor—who dropped a “Top Gun”-themed tweet that fired up the crypto crowd. With momentum building, many are now asking: could Bitcoin (BTC) be on a direct flight to $150,000?

Market Overview: BTC Holds $110K as New Support

Bitcoin price today is hovering just above $110,000, its highest level in three weeks, following a powerful recovery from June’s low near $58,000. That’s a nearly 90% rebound in less than a month. On the technical side, bitcoin has broken through key resistance at $108K, supported by a rising RSI indicator and a bullish MACD crossover, both pointing to continued upside.

Bitcoin (BTC) was trading at around $110,505, up 2.41% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

Chart analysts are eyeing the $115K level as the next major resistance. “A clean break above $112K could open the gates to $120K and beyond,” said one analyst, highlighting the formation of a bullish continuation pattern. The breakout above the Gaussian Channel on the daily chart further confirms the shift in sentiment. Previous patterns like this one led to 20% surges—suggesting a similar MOVE could be underway.

Trend Drivers: Saylor’s Tweet, ETF Inflows, and Whale Activity

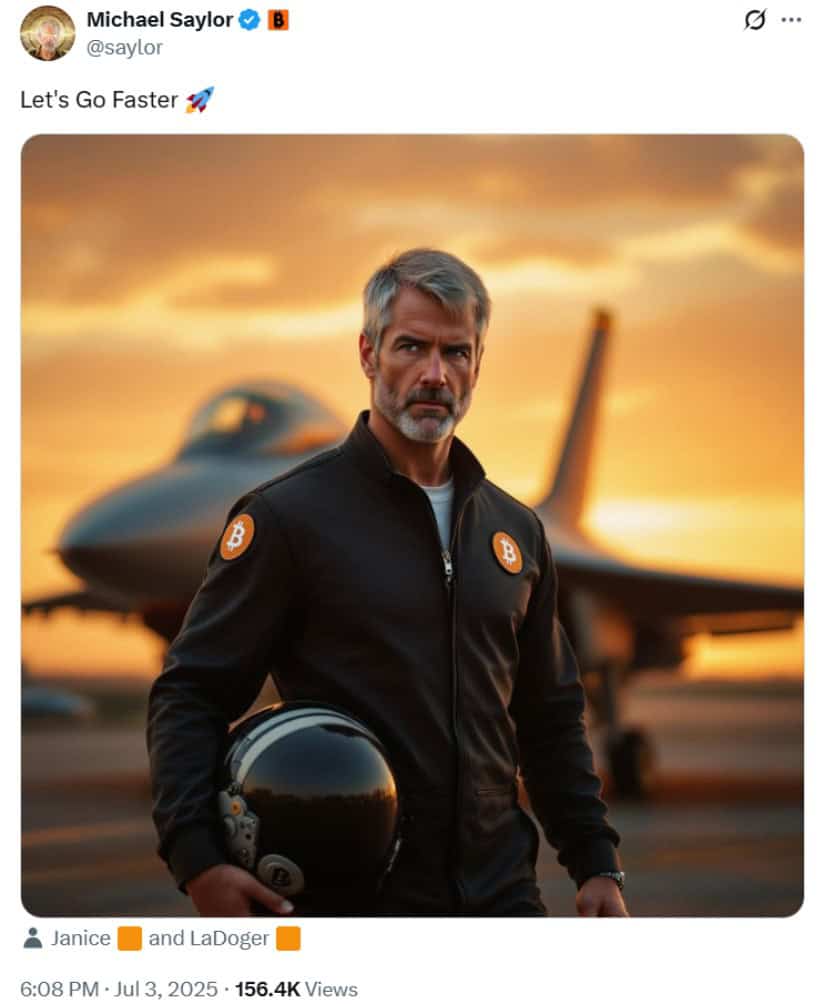

Adding fuel to the fire was Michael Saylor, Executive Chairman of Strategy, who posted a viral tweet featuring himself as a “Top Gun” pilot with the caption, “Let’s go faster.” The post came as Bitcoin flirted with the $110K level and reinforced bullish sentiment across the crypto market.

Michael Saylor’s “Top Gun” Bitcoin post highlights MicroStrategy’s $27.95B BTC bet, echoing models predicting a $220K–$330K surge and defying crypto skeptics. Source: Michael Saylor via X

Saylor’s company continues to double down on Bitcoin as a corporate reserve asset, and Strategy alone holds more than half of the 848,902 BTC currently owned by public treasury companies, according to CryptoQuant. The Bitcoin corporate treasury trend—where firms raise funds via securities to acquire BTC—is gaining popularity, with more than 50 firms now on board.

Meanwhile, spot Bitcoin ETFs are showing strong momentum. BlackRock’s iShares Bitcoin Trust (IBIT) continues to post consistent inflows, and June alone saw ETF net inflows push Bitcoin sharply higher. These signals confirm growing confidence from traditional finance players and a broader push to treat Bitcoin as an institutional-grade asset.

Expert Insights: Bitcoin as an Inflation Hedge and Forecasts

With central banks across the U.S. and EU expanding M2 money supply, investors are increasingly looking to Bitcoin as an inflation hedge. Analysts say the current economic environment—marked by expectations of interest rate cuts by the Federal Reserve—creates a tailwind for BTC.

Bitcoin (BTCUSD) is nearing completion of a Cup and Handle pattern after rebounding from the 1D MA200 support following a brief dip below the 1D MA50. Source: TradingShot on TradingView

“Bitcoin is emerging as the digital gold of the 2020s,” noted one analyst, who believes BTC is uniquely positioned to benefit from declining trust in fiat currencies and the global push for asset diversification. Forecasts for 2025 and beyond remain bullish, with several analysts calling for a $150,000 BTC price before the next Bitcoin halving in 2026.

Moreover, continued growth of the Bitcoin Lightning Network and adoption of the Taproot upgrade further enhance Bitcoin’s long-term utility and value proposition.

Looking Ahead: What’s Next for Bitcoin?

While Bitcoin news today focuses on the technical breakout above $110K and the buzz around Saylor’s social media antics, the larger story is institutional confidence. With ETF inflows, treasury accumulation, and macroeconomic catalysts aligning, the current price action could just be the beginning.

If Bitcoin can maintain its footing above $110K, the next stop could be $120K, followed by a push toward Bitcoin’s all-time high. Longer-term, the Bitcoin price prediction for late 2025 to early 2026 remains optimistic, with $150,000 no longer sounding far-fetched.

As investors weigh whether to enter or add to their positions, one thing is clear: Bitcoin’s breakout is being driven by more than just hype—it’s being built on real momentum.