Toncoin (TON) Primed for 40% Surge as Whale Activity and Bullish Signals Align

Whales are circling, charts are flashing green—Toncoin's gearing up for a potential breakout.

The Setup:

A cluster of technical indicators and on-chain data suggests TON could rally 40% from current levels. Whale wallets have been quietly accumulating, while a bullish pennant formation tightens on the daily chart. Classic pump fuel—if you ignore the fact that ‘whale accumulation’ is just rich folks playing hot potato with your exit liquidity.

The Catalyst:

Toncoin’s recent integration with Telegram’s ad revenue sharing system has added real utility—a rare feat in the ‘vaporware-to-moon’ crypto pipeline. Meanwhile, the RSI hasn’t hit overbought territory yet, leaving room for momentum traders to pile in.

The Catch:

This isn’t financial advice (obviously), but if history repeats, TON’s next stop could be a 40% climb… right before the inevitable ‘sell the news’ dump. Welcome to crypto—where the fundamentals are made up and the technicals barely matter.

With TON currently stabilizing above the $2.83 support level, analysts believe the token could surge as much as 40% in the NEAR term, especially if it breaches the psychological $3.00 resistance.

Toncoin Price Analysis: Holding Key Support as Buying Pressure Builds

At press time, Toncoin is trading at $2.89, maintaining a firm stance above a crucial TON support level of $2.83. This price zone has historically attracted consistent buying interest and appears to be a base for accumulation, even amid recent market volatility.

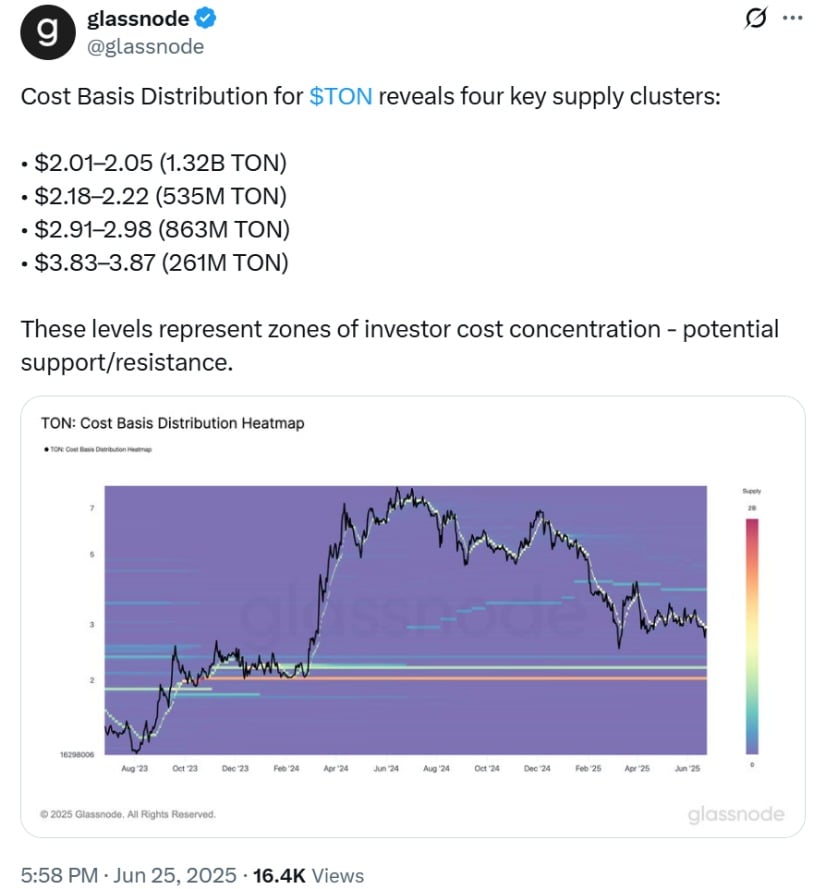

Toncoin’s cost basis distribution highlights four major supply clusters between $2.01 and $3.87, indicating key investor concentration zones that may act as future support or resistance levels. Source: Glassnode via X

Glassnode data highlights that 2.98 billion TON tokens are concentrated across four significant price zones between $2.00 and $4.00. Most notably, 863 million TON are held in the $2.91 to $2.98 range by what appears to be a single long-term entity. This kind of whale accumulation often signals strong confidence in a future price increase.

Technical Indicators Suggest a Toncoin Breakout Potential

Toncoin’s technical chart today shows moving simple averages converging, which is typically a harbinger of trend changes. While still under the 20, 50, 100, and 200-period simple moving averages, their proximity to the price suggests building momentum.

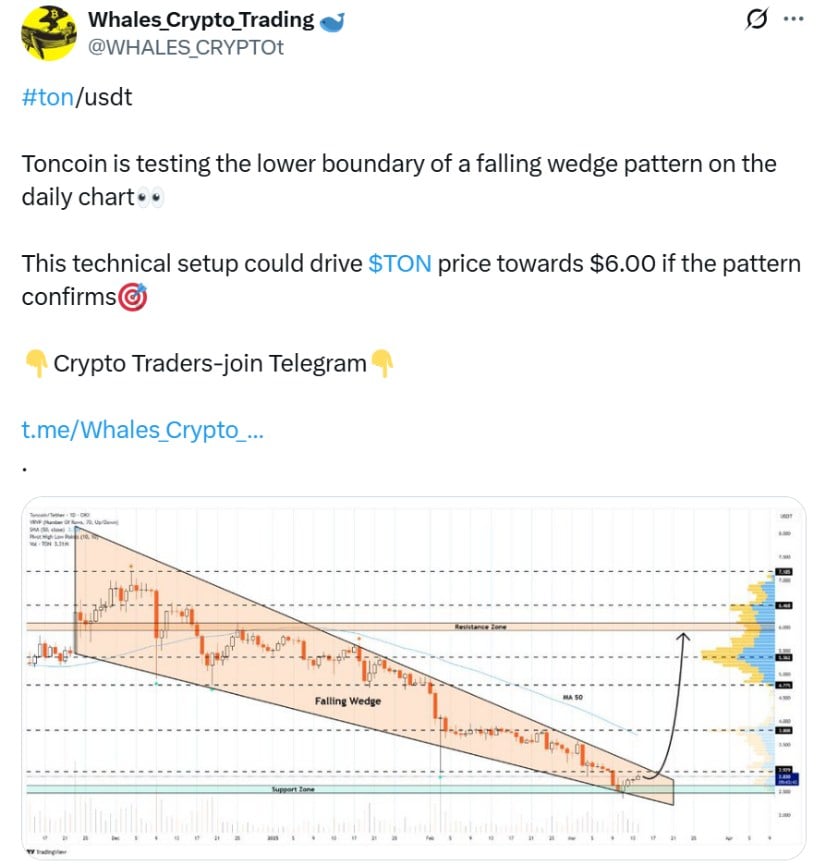

Toncoin is currently testing the lower boundary of a falling wedge pattern, which could trigger a MOVE toward $6.00 if confirmed. Source: @WHALES_CRYPTOt via X

A break above the 200 SMA at $3.07 WOULD signal a structural change and confirm bullish strength,” analysts say. In that case, Toncoin can take shots at resistance points at $3.39, $3.60, and even $3.90, as traders build volumes and investor sentiment is positive.

These levels are particularly important as they correspond to previous rejection zones during past rallies. A move toward the $4.00 price target would mark a 37–40% gain from current prices and establish a clear TON trend reversal.

TON Crypto Forecast: Will Accumulation Lead to a Major Upswing?

The accumulation pattern across Toncoin’s on-chain metrics is significant. According to trader Edge, the largest supply cluster resides in the $2.01 to $2.05 zone, but the area between $2.91 and $2.98 is the most recent focus of heavy buying.

Toncoin’s MACD and RSI divergences, along with a 78% retracement to key support, suggest a potential fifth-wave rally ahead. Source: jack_the_real_trader on TradingView

This suggests that large holders are accumulating TON just below the $3.00 level, anticipating a Toncoin breakout as the TON DeFi ecosystem expands and network usage grows through its integration with the Telegram blockchain project.

In the longer term, resistance levels at $4.54, $5.39, and $5.83 may come into play if the upward momentum continues and macro sentiment improves. These zones were historical tops, and reclaiming them would confirm a full bullish reversal for Toncoin.

Toncoin Future Outlook: Telegram Integration and Ecosystem Growth Fuel Optimism

Toncoin’s deep integration with Telegram continues to be a major growth driver. The TON blockchain news cycle has been busy, with a focus on driving TVL (Total Value Locked) on its decentralized applications and expanding TON crypto usage by users and developers.

Cryptonomist experts also point out that Open Network blockchain is well-positioned among the layer-1 competitors because it has community-driven development and strategically positioned adoption in the Telegram ecosystem.

The broader Toncoin future trend is also bullish, particularly if short-term technical levels are breached. A clean breakout above $3.00 with consistent volume might initiate a long-term uptrend, which could take TON to the $4.00+ area by Q3 2025.

TON Coin Prediction: Cautious Optimism Amid Consolidation

Despite the encouraging setup, investors remain cautious. Some market indicators such as the MACD remain in the process of stabilizing, and an ADX of 18 shows a weak trend, pointing to further consolidation within $2.40 and $3.15.

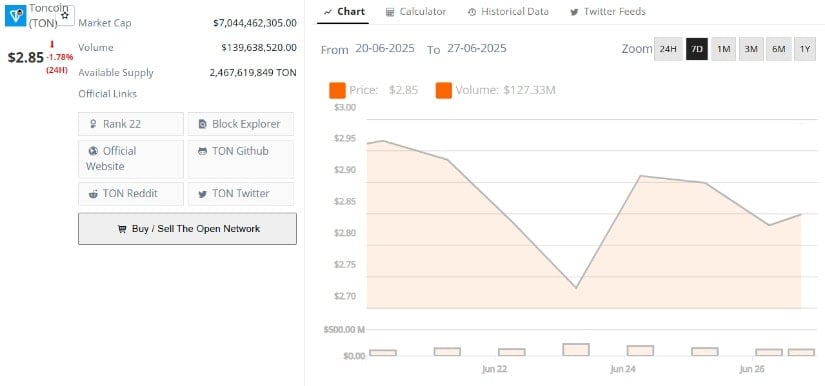

Toncoin (TON) was trading at around $2.85, down 1.78% in the last 24 hours at press time. Source: Brave New Coin

However, investor sentiment appears to be picking up. Telegram use is growing, and volume in TON has shown signs of a pick-up, especially on price bounces. If the accumulation trend holds and volume supports a breakout, Toncoin could blow past near-term targets and break into new territory.

Final Thoughts

Toncoin is at a pivotal technical and fundamental crossroads. Whale accumulation, growing interest from the Telegram user base, and tightening chart patterns are aligning in favor of the bulls. A breakout above $3.00 could pave the way for Toncoin to surge 40% or more, making it one of the top altcoins to watch in the coming weeks.

As always, traders should monitor key TON chart patterns, support zones, and volume shifts to confirm the next directional move in the TON token price.