DOGE ETF Nears Reality as Bitwise Doubles Down with Updated Filing

The meme coin that refused to die just got a serious credibility boost.

Wall Street's Bark Meets Crypto's Bite

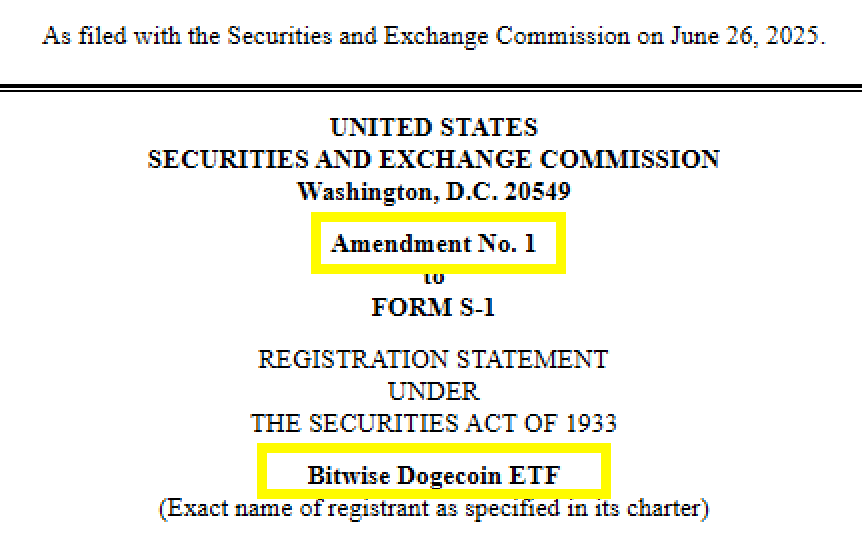

Bitwise Asset Management just reloaded its DOGE ETF application—and this time, the filing's got teeth. While traditional finance snickers at the Shiba Inu-themed asset, crypto's institutional gatekeepers keep forcing the joke into the regulatory spotlight.

From Meme to Mainstream?

The amended paperwork signals growing institutional appetite for even crypto's most 'unserious' assets. Because nothing says 'mature market' like billion-dollar funds chasing an asset born from a Twitter gag and Elon Musk's midnight posting habits.

As SEC lawyers undoubtedly groan through another round of DOGE-related paperwork, one thing's clear: in crypto's upside-down world, the line between parody and portfolio keeps blurring.

The asset manager filed an amended S-1 for its spot DOGE ETF, and here’s the kicker—it now includes in-kind redemptions. That means broker-dealers could soon be swapping DOGE directly for ETF shares and vice versa, cutting out the cash middleman. It’s a structural shift that could make crypto ETFs way more tax-efficient and actually usable. Bloomberg’s ETF oracle Eric Balchunas summed it up: “Near-lock at this point that in-kind will be allowed in spot ETFs across the board.”

Bitwise has filed amended S-1s for their spot Dogecoin ETF and their spot Aptos ETFs. Good signs as it indicates SEC engagement, and tracks with other spot approvals. Source: X

Historically, U.S.-based crypto ETFs have been limited to cash creation and redemption—an outdated process that means extra costs, friction, and yes, tax headaches. In-kind transactions open the door to smoother, leaner on-ramps to exposure, and this change suggests that the SEC is not just listening, but evolving.

Bitwise isn’t alone in the DOGE ETF race. 21Shares has its own application in play, and Grayscale has filed for a dogecoin trust with a chunky 2.5% fee—more expensive, but it shows that institutional players aren’t dismissing the meme coin anymore.

Meanwhile, Dogecoin’s price hasn’t caught the HYPE (yet). It’s down about 2% in the past day, sitting at $0.16. But price aside, utility is starting to tell a different story.

Enter GameFi

In a MOVE that actually does something with Dogecoin, DogeOS and PlaysOut just announced they’re launching 15 Dogecoin-integrated mini-games in August. That’s not just novelty—it’s a shift toward real-world use cases.

Think hypercasual gameplay (puzzles, sims, the works), with $DOGE rewards and Doginals—NFTs native to the Dogecoin blockchain—acting as tradable in-game assets. These games are more than just fun: they’re part of a strategy to reposition Doge as a legitimate tool in a broader digital economy.

Oh, and DogeOS just raised $6.9 million to build this out, with funding earmarked for Metafide, a prediction market where users can pit their price forecasts against AI. Welcome to crypto’s version of fantasy sports betting—only it’s real money, and DOGE is your ticket in.

PlaysOut says we’ve recently kicked off our global IP strategy with @DogeOS, launching the first series of Doge-themed mini-games. This is just the beginning: a matrix of IP-driven mini-game experiences, distributed at scale through PlaysOut. “The era of playable IP starts now.” Source: X

The SEC seems to be inching toward a spot DOGE ETF greenlight. Bitwise’s in-kind filing is a signal Flare for where crypto ETFs are heading—more efficient, more integrated, and finally catching up to traditional finance tools. And with GameFi heating up, Dogecoin might be shedding its meme-only identity faster than anyone expected.

DOGE is no longer just a joke. It’s becoming an asset class—and maybe even a platform. If that’s the case, then the Dogecoin price predictions will start again. Dogecoin to a dollar in 2025?