Solana Price Prediction: Bullish Cup-and-Handle Pattern Targets $300 Breakout as Bulls Charge Back

Solana's price action is painting a textbook cup-and-handle pattern—the kind that makes traders lick their lips. With bulls regaining control, all signs point to a potential breakout toward $300.

Technical traders are circling like sharks. The pattern's completion could trigger a wave of algorithmic buying, though skeptics whisper about 'TA astrology' as usual. Meanwhile, SOL holders are quietly stacking—proving once again that in crypto, hope springs eternal even when fundamentals take a coffee break.

Solana’s latest partnership with SoFi Bank has stirred Optimism just as the SOL chart begins to show signs of strength near the $154 support zone. This area has historically acted as a strong base for reversals, and with RSI flattening, momentum seems to be cooling off before a potential bounce.

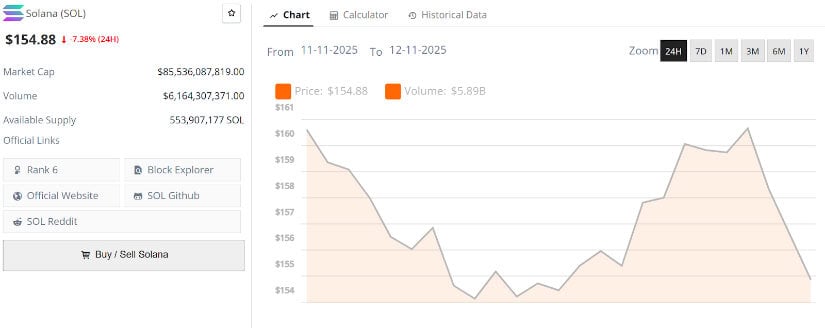

Solana current price is $154.88, down -7.38% in the last 24 hours. Source: Brave New Coin

Solana Moves Closer to Mainstream Adoption

Solana’s latest partnership with SoFi Bank marks a major turning point for crypto accessibility in the U.S. For the first time, users can now buy SOL directly from their checking accounts, bridging the gap between traditional banking and decentralized finance. This integration eliminates several barriers to entry, making it easier for retail users to participate.

Solana’s partnership with SoFi Bank brings direct fiat access. Source: solana via X

ETFs and other products have already attracted sizable demand for Solana, but this development is likely to open mainstream inflows even for smaller retail. This access is going to be supportive for the Solana price action as well.

Solana Bottom Formation Near Key Support Zone

Solana price points to $154 as the key level of interest for a potential bottom. The area aligns with a strong daily support zone and prior accumulation range, where buyers have historically stepped in to absorb sell pressure.

Solana price structure shows price strength around the $154 support zone. Source: Jacob via X

Both the equilibrium range NEAR $174 to $180 and the compression in RSI indicate that downside momentum is waning. If price continues to respect the $154 base, a gradual reversal could follow, with targets at $250 and $300 aligning with previous high-volume nodes.

This confluence of horizontal support and lower-band compression makes $154 a pivotal price floor. A sustained rebound from here WOULD mark the start of Solana’s next impulsive wave, aligning with Jacob’s mid- to long-term bullish targets.

Solana Price Prediction: Cup-and-Handle Setup in Play

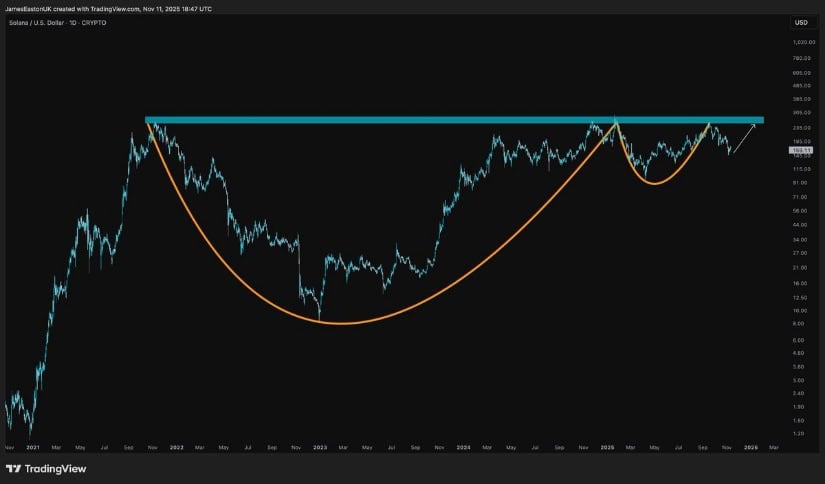

Famous crypto analyst James highlights a large cup-and-handle formation that has been developing for months on Solana’s macro chart. The neckline sits near $256, a critical resistance that, once broken, could ignite a sharp upside continuation. The pattern resembles a textbook accumulation-to-breakout setup, with each consolidation leading to higher lows.

Solana’s macro chart forms a clear cup-and-handle pattern, with a breakout above $256 potentially unlocking upside targets between $300 and $320. Source: James via X

Once solana price breaches this neckline, the measured move suggests potential upside towards $300–$320, completing the full technical projection of the pattern. This formation not only emphasizes a bullish continuation but also strengthens the argument for a long-term trend reversal, as Solana begins reclaiming major cycle highs.

Solana Short-Term Technical Analysis

Short-term charts show Solana trading inside a narrow ascending channel, respecting both its midline and short-term EMAs. The key level remains $185, which marks both a technical and psychological resistance. If price can flip this level into support, a quick rally towards $198 to $205 becomes plausible.

Solana holds above $170 as bulls eye a breakout above $185 within its short-term rising channel. Source: BlockchainBaller via X

Below that, $170 to $172 serves as local support, and holding this area keeps the short-term bias intact. Momentum remains moderate, showing that buyers are active but not overly aggressive. Unless the market loses $170 on a daily close, the short-term trend continues to lean in favor of gradual upside progression.

Final Thoughts: Fundamental and Technicals Align for Solana

As Molu noted, Solana’s ecosystem is entering a defining phase, ETF inflows surpassing $340M, SoFi’s banking integration, and record USDC transfer activity all signal that institutional confidence and real-world utility are converging. These are no longer isolated milestones; they reflect a maturing network with both liquidity depth and mainstream accessibility.

From a Solana price perspective, market watchers are aligning on a similar outlook. Jacob’s setup highlights $154 as the key base level, which has consistently acted as the market’s defensive line. Meanwhile, SOL’s short-term view suggests a liquidity sweep near $155 to $158 could trigger a rebound towards $176.

Together, these signals form a unified picture, fundamentals are validating what SOL’s technicals have been hinting at. With institutional inflows, regulatory access points, and resilient support levels all in play, solana price prediction is pointing towards a bullish move.