Uniswap’s UNI Targets $10 Comeback After 13% Dip—Here’s Why Traders Aren’t Sweating

UNI shakes off bearish pressure as DeFi's favorite DEX token eyes a rebound.

Subheader: The Pullback That Didn't Stick

A 13% retreat? Just a speed bump for Uniswap's governance token. While paper hands panic-sold, the UNI chart shows a coiled spring—liquidity pools are primed for the next leg up.

Subheader: $10 or Bust

Market structure suggests traders are treating this dip like a Black Friday sale. Funding rates hold steady, perpetual swaps aren't flashing red—smart money's accumulating, not capitulating.

Closing jab: Meanwhile, Wall Street still can't tell a DEX from a VIX futures contract. Your move, legacy finance.

Despite a 13% intraday decline, bullish sentiment from key market watchers suggests the coin may be setting up for a rebound toward the $10 level once volatility stabilizes.

Bulls Stay Patient as UNI Targets $10+

Analyst @moonbag shared an upbeat outlook on X, asserting that “$UNI going above $10+ soon. Patience…” The comment echoes growing market confidence following

The coin’s strong recovery from early November lows. The coin recently broke above its prior resistance NEAR $7.00, signaling that buying pressure remains active despite the latest correction.

Source: X

Momentum traders are closely watching whether the coin can reclaim the $9.50–$10 zone, which served as a key psychological barrier in recent sessions. A breakout above this range could trigger a fresh bullish wave, while sustained consolidation between $7.80 and $8.50 WOULD indicate accumulation before the next leg higher.

Market Overview and Fundamentals

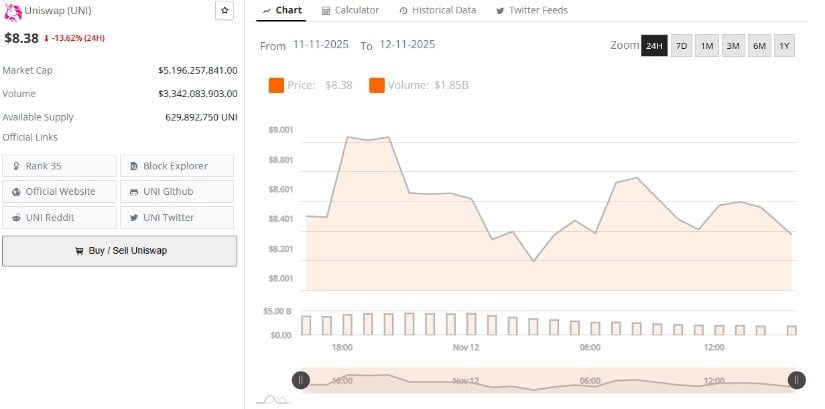

According to BraveNewCoin data, the coin is currently trading at $8.38, down -13.62% in the last 24 hours, with a market capitalization of $5.19 billion and 24-hour trading volume of $3.34 billion. Despite the steep decline, the coin remains among the top decentralized finance (DeFi) projects by total value locked (TVL), underscoring its resilience in a volatile market.

Source: BraveNewCoin

The recent price retracement likely reflects profit-taking after the crypto’s strong surge toward $9.50 earlier this week. With liquidity still robust, analysts believe the current correction could provide a healthier base for renewed upward movement if market sentiment improves and volume strengthens.

Technical Indicators Suggest Consolidation Before Next Move

TradingView data shows the crypto is trading near $8.31, recovering modestly after recent losses. The Bollinger Bands illustrate widening volatility, with the upper band at $8.50 and the basis line near $6.34. After briefly breaching the upper band, the token pulled back, signaling short-term exhaustion but retaining a higher-low structure.

Source: TradingView

The RSI sits at 63.51, reflecting mild bullish bias, though still shy of overbought conditions. If buyers defend the $7.80–$8.00 support range, the asset could regain upward momentum toward $9.50–$10.00. Conversely, a breakdown below $7.20 would expose downside risks toward $6.50, marking the next significant support area.