Optimism Coin Defies Market Pressure - Bulls Target $0.47 Breakout After Holding $0.45 Support

Optimism shows remarkable resilience as it maintains crucial $0.45 support level

The Battle for Breakout

Traders are watching the $0.47 resistance like hawks - a clean break above could trigger significant momentum buying. The current consolidation pattern suggests accumulation is happening right under our noses.Market Mechanics at Play

Volume patterns indicate smart money positioning for the next leg up. While traditional finance wrestles with paperwork and compliance, crypto markets move at light speed - proving once again that decentralized finance doesn't wait for permission.Technical Setup Favors Bulls

The steady hold at $0.45 creates a solid foundation for upward movement. Market sentiment suggests traders are tired of watching from the sidelines as this Layer-2 solution demonstrates real utility beyond the hype.Remember when Wall Street analysts said crypto was just a fad? Meanwhile, Optimism continues building while they're still figuring out their PowerPoint presentations.

Technical signals now hint at a potential bullish reversal if the token can reclaim key resistance levels in the coming sessions.

OP Price Eyes a Reversal After a Sharp Decline

In a recent post by Finora – Your AI Trade Buddy, Optimism was highlighted as entering a consolidation phase after a steep correction. The 6-hour chart shows that price action has paused between support and resistance, with bearish momentum still present but gradually weakening.

Finora notes that a decisive push above the $0.4710 resistance could confirm the start of a corrective rally, with upside targets NEAR $0.4970 and potentially $0.6337 if buying pressure intensifies.

Source: X

On the downside, failure to sustain a breakout above $0.4710 could lead to renewed selling pressure, testing support around $0.3906. Finora emphasized the importance of confirmation signals, such as a bullish engulfing pattern or a strong retest, before entering any long positions. This cautious approach reflects the mixed sentiment currently surrounding the coin market, as traders await a clear directional shift before committing significant volume.

Market Data Shows Modest Uptick in Buying Activity

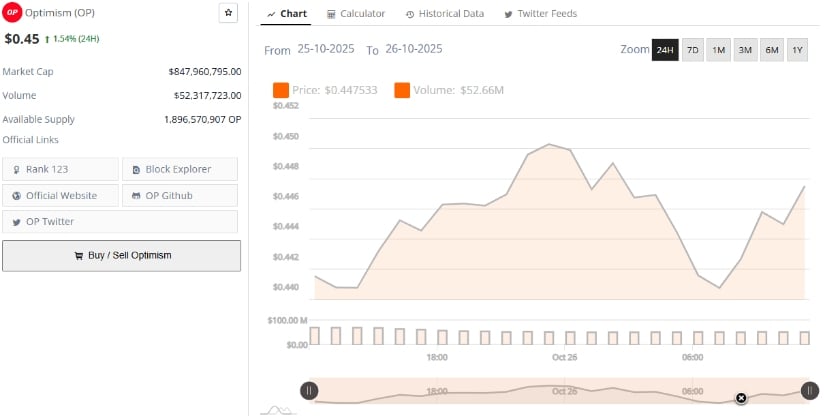

According to BraveNewCoin, Optimism is currently trading at $0.45, marking a 1.54% gain in the past 24 hours. The token’s market capitalization stands at $847.96 million, with a daily trading volume of $52.31 million and a circulating supply of 1.89 billion tokens. The modest recovery comes as the token attempts to reclaim lost ground following its prolonged downtrend.

Source: BraveNewCoin

Despite broader market uncertainty, the asset’s steady performance reflects growing confidence among holders, particularly near the $0.44–$0.45 range. Price data shows consistent trading activity within this consolidation zone, suggesting that market participants may be accumulating ahead of a potential trend reversal. With volatility subdued, a breakout above resistance could be the trigger for renewed bullish momentum across the coin ecosystem.

Technical Indicators Signal Early Signs of Recovery

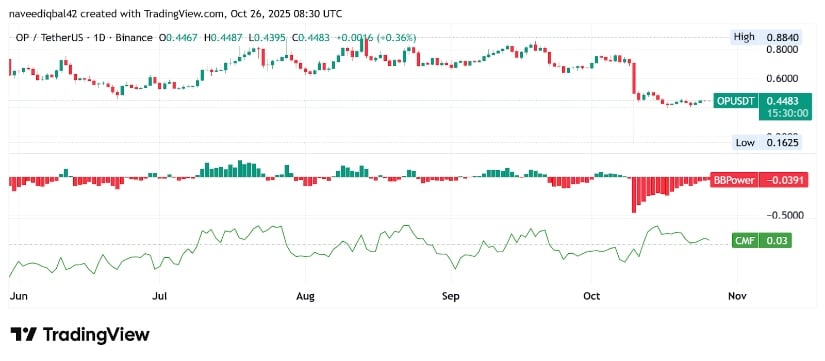

On TradingView, Optimism’s daily chart shows the token stabilizing near $0.4483 after a sustained decline from the $0.88 resistance. The Bollinger Band Power (BBPower) reading of -0.0391 reflects weak but fading bearish momentum, implying that selling pressure has cooled and volatility is narrowing. This could mark the early stages of a reaccumulation phase, with buyers gradually positioning for a potential recovery toward the $0.55–$0.60 range.

Source: TradingView

Meanwhile, the Chaikin Money FLOW (CMF) indicator stands at +0.03, signaling modest capital inflows and a gradual return of buying interest. This positive CMF reading suggests that liquidity is shifting back into the market as selling slows.

A sustained MOVE above $0.47 could confirm renewed strength, potentially setting the stage for a rebound. However, if momentum weakens again, the asset may continue consolidating within its current range before making a decisive move.