Worldcoin Defies Gravity: Open Interest Surge Signals Major Market Comeback

Worldcoin isn't just holding steady—it's building momentum as traders flood back into the market.

The Open Interest Revival

Market participation isn't just ticking up—it's exploding. Open interest data reveals what seasoned traders already know: when smart money moves, prices follow. This isn't random volatility; it's calculated positioning.

Unlike traditional finance where institutions take weeks to make decisions, crypto markets move at light speed. The renewed participation signals something fundamental shifting beneath the surface—while Wall Street analysts are still writing their Monday morning reports, crypto traders have already positioned for the next leg up.

Worldcoin's resilience amid broader market uncertainty proves one thing: in crypto, sometimes the strongest play is simply holding while everyone else panics. After all, in traditional finance they call that 'strategic patience'—and charge you 2% annually for the privilege.

With open interest remaining steady and trading activity increasing, market sentiment suggests a cautiously bullish recovery for the privacy-focused token.

Open Interest Indicates Strengthening Market Confidence

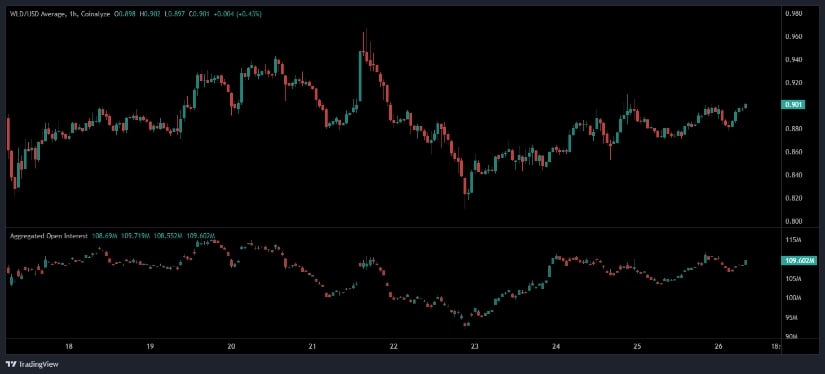

The one-hour chart of Worldcoin shows the asset trading near $0.901, marking a modest +0.43% gain over the past 24 hours. After fluctuating between $0.80 and $0.94, the token is forming a series of higher lows, a pattern that suggests improving sentiment and gradual accumulation. Bulls are attempting to reclaim dominance, but a confirmed breakout above $0.92 remains key to signaling a stronger bullish reversal.

Source: Open Interest

According to market data, aggregated open interest sits at approximately 109.6 million, reflecting a notable return of participation following recent liquidations. This steady open interest, paired with rising price action, often signals that buyers are re-establishing long positions.

If the current structure holds, the coin could retest resistance between $0.93–$0.95, though any sustained MOVE below $0.88 could invite renewed selling. The overall setup points toward cautious optimism, supported by gradual capital re-entry into the market.

Market Data Shows Moderate Price and Volume Growth

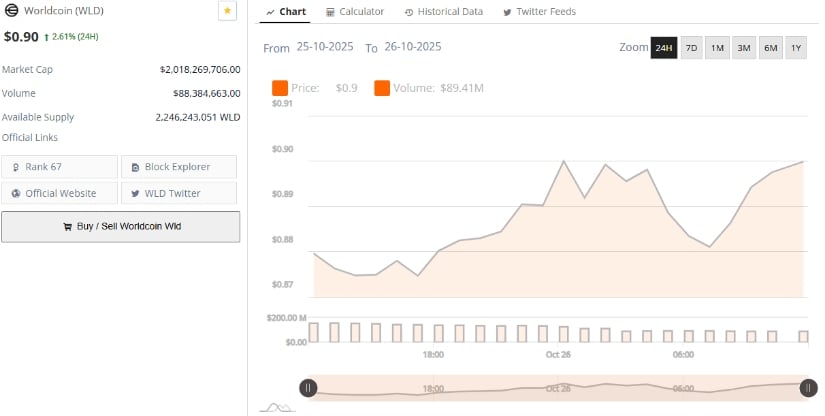

Data from BraveNewCoin places Worldcoin’s current price at $0.90, up 2.61% in the last 24 hours. The project maintains a market capitalization of $2.01 billion, ranking 67th globally with an available supply of 2.24 billion tokens. Over the same period, trading volume reached $88.38 million, indicating increased turnover amid growing activity in mid-cap altcoins.

Source: BraveNewCoin

The modest uptick in both price and volume highlights renewed market interest following a recent period of stagnation. Although the token remains below its earlier 2025 highs, the consistency in volume data suggests steady accumulation. Should this momentum persist alongside improving technical indicators, the token could establish a firmer base NEAR current levels before attempting a broader recovery in the weeks ahead.

Technical Outlook: Sideways Movement With Weak Bullish Signals

On the other hand, the daily WLD/USDT chart on TradingView displays a volatile structure marked by sideways movement and sharp fluctuations. Price movements over recent months peaked at approximately 2.211 USDT before correcting to lows of 0.264 USDT, with the asset now stabilizing just below 1 USDT. The pattern reflects consolidation following heavy sell-offs earlier in the year.

Source: TradingView

From a technical standpoint, the BBPower indicator oscillates near the neutral zone, occasionally showing short-lived bullish surges during price spikes. However, current values remain mostly negative, indicating limited bullish strength and prevailing selling pressure.

The Chaikin Money FLOW (CMF) indicator sits slightly positive at 0.02, hinting at mild capital inflows and tentative accumulation. This subtle improvement suggests that while some buyers are stepping in, conviction remains low, and a confirmed upward trend will depend on sustained strength in both BBPower and CMF.