Ethena (ENA) Primed for 30% Explosion to $0.62 as $0.46 Support Defies Gravity

Ethena's ENA token builds momentum for another major breakout while traditional finance scrambles to keep up.

Support Holds Strong

The $0.46 support level refuses to break—creating a solid foundation for ENA's next leg up. This isn't just technical analysis; it's market psychology playing out in real time.

Targeting New Heights

Traders eye the $0.62 resistance as the next logical stop—representing a clean 30% surge from current levels. The pattern suggests this isn't hopeful thinking but mathematical probability.

Market Mechanics at Work

While Wall Street debates quarterly earnings, crypto markets move at light speed. ENA's consolidation phase appears to be ending—setting the stage for what could be another textbook breakout.

Another day, another crypto asset defying traditional valuation models while bankers still try to figure out blockchain basics.

The token’s price action has shown resilience in recent weeks, with key technical indicators suggesting a possible upward trajectory. Investor confidence, insider activity, and community events have all contributed to a growing bullish sentiment around Ethena crypto.

Key Support for Bullish Momentum

Support and resistance levels are critical price zones where market reactions are historically observed. For Ethena (ENA), these levels are drawn from previous price action and weekly candlesticks, giving them more weight than short-term intraday levels.

If ENA/USDT holds its key weekly support, a 30% rise toward $0.62 appears technically reasonable. Source: MadWhale on TradingView

Support represents the price floor where buyers step in, often preventing further declines. Conversely, resistance marks the ceiling where selling pressure typically emerges. Analysts emphasize that understanding these levels can provide traders with valuable insight into potential price movements for Ethena crypto.

The ENA/USDT pair has recently tested a crucial support level around $0.46. Holding this level is key, as it indicates strong buyer activity and could FORM a base for the next upward move. If the support fails, the token might face short-term downward pressure.

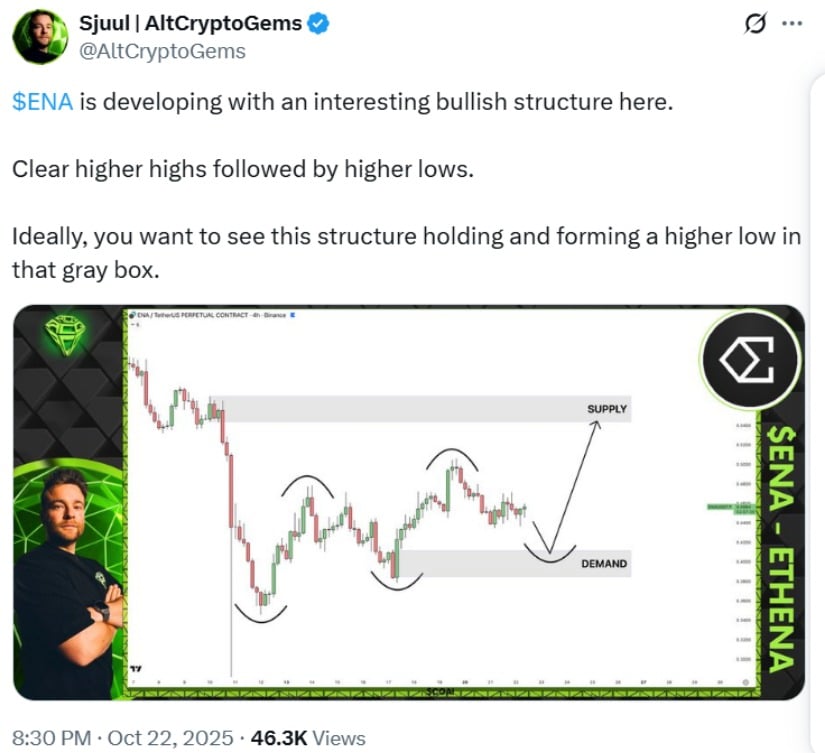

Market observers note that the structure of ENA has been bullish recently, with higher highs and higher lows forming an ascending channel on the 4-hour chart. This pattern suggests the potential for continued upward momentum if the support remains intact.

Technical Overview

Technical analysis indicates that if ENA maintains the $0.46 support, a rally toward $0.62 is plausible. This represents roughly a 30% potential gain, calculated relative to the current price level. Weekly candlestick trends support this outlook, reinforcing the token’s bullish potential in the NEAR term.

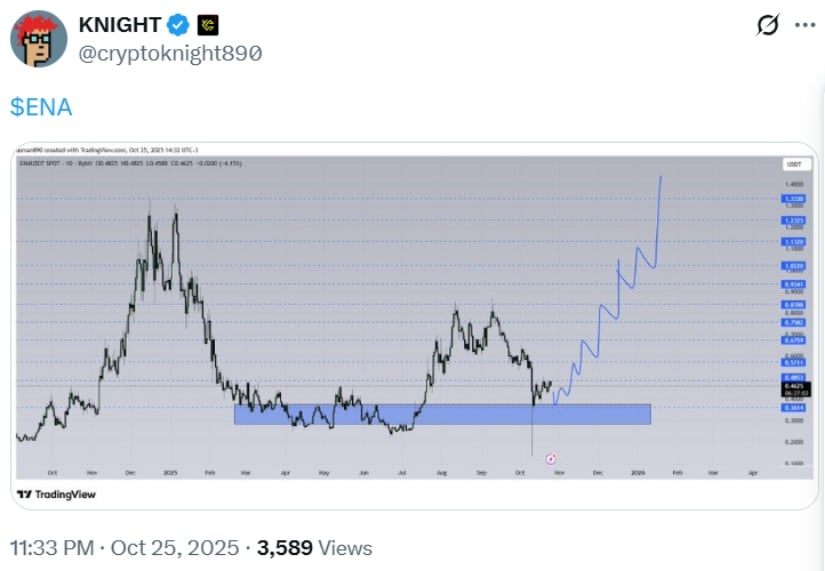

ENA/USDT holds strong near $0.46, backed by Ethena’s USDe surpassing DAI, a $25M co-founder buyback, and MEXC’s high-reward “ENA Extravaganza” event. Source: KNIGHT via X

As KNIGHT, a crypto analyst, observed, the daily TradingView chart highlights a horizontal support zone at $0.48 after a year of volatility, with the price rebounding from $0.3 lows following a 2025 peak near $1.3.

Insider Activity and Market Confidence

The recent market developments have also been bolstered by insider activity. Ethena founder Guy Young executed a $25 million open-market buyback of ENA tokens in October 2025. This MOVE signals strong confidence in the project and contributed to a short-term 5-10% rebound in the token’s price.

ENA is showing a bullish structure with clear higher highs and higher lows, ideally maintaining this pattern by forming another higher low within the key support zone. Source: Sjuul | AltCryptoGems via X

Additionally, Ethena’s USDe stablecoin recently overtook DAI’s market cap on October 24, highlighting growing adoption and investor trust in the ecosystem. Such developments often strengthen overall market sentiment around Ethena crypto.

Market Events and Community Engagement

Community-driven initiatives, such as MEXC’s “ENA Extravaganza” event running from October 21 to November 20, have further boosted participation. The campaign offers zero-fee trading, up to 600% APR staking, and a $1 million prize pool, providing additional incentives for traders to engage with ENA.

Analysts say even with a $51 million token unlock that can be bearish in the short term, the bullish formation is still intact. Estimates are for ENA to hit $0.50-$0.52 first and then move further to $0.62 if support is strong.

Final Thoughts

In. To summarize, Ethena (ENA) appears poised for a potential 30% boom because the most important $0.46 support level remains intact. The token’s technical charts, its ascending channel, and higher lows all promise firm support. Additionally, insider sentiment, as manifested in the founder’s $25 million buyback, bolsters investor confidence.

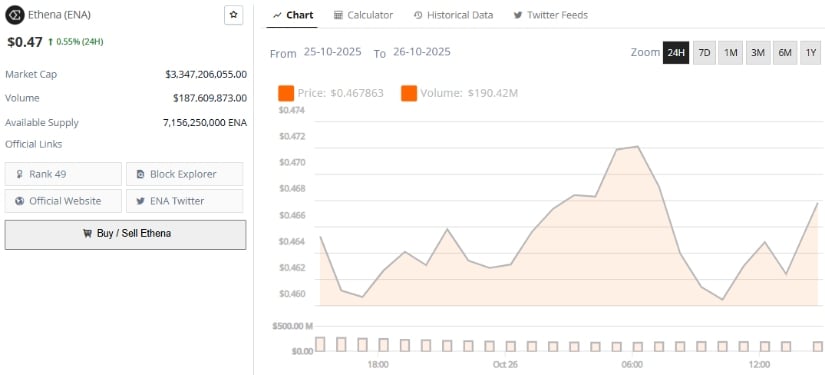

Ethena was trading at around $0.47, up 0.55% in the last 24 hours at press time. Source: Brave New Coin

Beyond technicals, community engagement and market developments also support a bullish outlook. Initiatives like MEXC’s “ENA Extravaganza” event and the growing prominence of Ethena’s USDe stablecoin contribute to wider adoption and market interest. Traders and investors should carefully watch key support and resistance levels, as these will likely determine the next significant moves for ENA.