Ethereum ETFs Bleed for Second Straight Week as Capital Floods Back to Bitcoin

Digital asset investors are voting with their wallets—and Ethereum's losing the election.

The Great Rotation

Another week, another exodus. Ethereum-focused exchange-traded funds just posted their second consecutive week of outflows as institutional money makes a beeline back to Bitcoin's familiar embrace. The numbers don't lie—while Bitcoin products soak up fresh capital, ETH funds are watching it walk out the door.

Safety First Mentality

When uncertainty creeps in, crypto's old guard becomes the default parking spot. Bitcoin's institutional recognition and simpler narrative are trumping Ethereum's complex smart contract promises—at least for now. Traders appear to be prioritizing perceived stability over technological potential.

Wall Street's Fickle Affection

Just months after everyone wanted exposure to 'the next big thing' in crypto, the smart money's retreating to the original—proving once again that when the waters get choppy, even professional investors chase the same safe harbors as retail. Because nothing says sophisticated portfolio management like following the herd during turbulence.

Read us on Google News

Read us on Google News

In brief

- Ether ETFs post $243.9M in outflows for the week, marking the second straight week of investor redemptions.

- Bitcoin ETFs surge with $446M in new inflows, driven by strong institutional demand and renewed confidence.

- BlackRock’s IBIT and Fidelity’s FBTC lead Bitcoin ETF inflows, managing over $110B in assets combined.

- Analysts note investors favor Bitcoin’s stability amid uncertainty, while Ethereum sees fading institutional interest.

Ether ETF Outflows Continue, Signaling Shift in Investor Sentiment

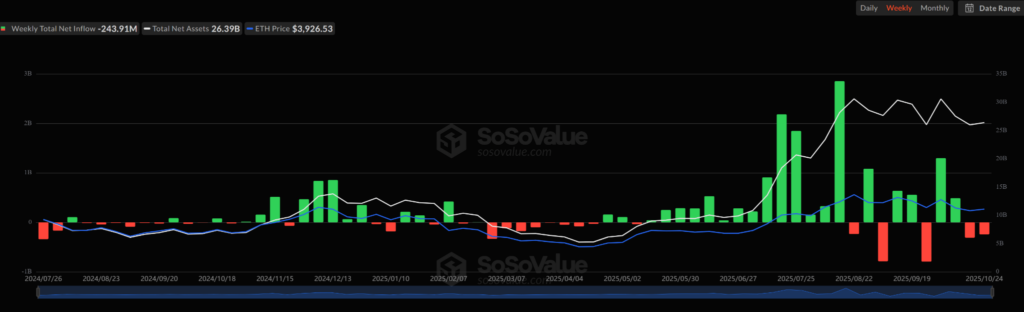

According to data from SoSoValue, Ether ETFs posted $243.9 million in net redemptions for the week ending Friday, following $311 million in outflows the previous week. The back-to-back withdrawals mark a clear reversal after months of steady inflows earlier this year. On Friday alone, Ether ETFs recorded $93.6 million in redemptions.

Meanwhile, key Ether ETF performance for the week included:

- BlackRock’s ETHA ETF led withdrawals, with $100.99 million in outflows during the latest trading session.

- Grayscale’s ETHE fund showed a slight contrast, posting a modest $7.40 million in inflows amid broader sector redemptions.

- Overall, weekly outflows reflect waning investor appetite for Ethereum-based products following a strong inflow cycle earlier this year.

- Despite short-term weakness, cumulative inflows across all Ether spot ETFs remain robust at $14.35 billion, underscoring sustained long-term investor interest.

- Collectively, Ethereum ETF net assets now total $26.39 billion, representing roughly 5.55% of Ethereum’s market capitalization.

The total trading volume across Ether ETFs reached $1.41 billion for the week, signaling a decline in activity compared to prior periods of elevated demand.

Institutional Demand Drives $446 Million Inflows Into Bitcoin ETFs

While Ethereum-focused products continue to lag, spot bitcoin ETFs have rebounded sharply. The funds attracted $446 million in net inflows for the week, signaling renewed institutional enthusiasm.

Friday’s data shows that:

- Bitcoin ETFs added $90.6 million in new inflows, reflecting continued institutional participation.

- Cumulative inflows across all spot Bitcoin ETFs have reached $61.98 billion.

- BlackRock’s iShares Bitcoin Trust (IBIT) led daily activity with $32.68 million in inflows, maintaining its dominant position among Bitcoin funds.

- Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed closely, attracting $57.92 million.

- IBIT remains the largest Bitcoin ETF, holding $89.17 billion in assets, while FBTC manages $22.84 billion.

Following this strong performance, total net assets of Bitcoin investment vehicles stand at $149.96 billion, representing about 6.78% of Bitcoin’s market cap. Meanwhile, total trading volume among Bitcoin ETFs reached $3.34 billion for the week.

Kronos CIO Notes Waning Ethereum Activity as Institutions Favor Bitcoin

Vincent Liu, Chief Investment Officer at Kronos Research, said the latest trends show a clear shift toward Bitcoin as investors favor its digital Gold appeal during a period of global market uncertainty. He noted that Bitcoin’s resilience, combined with expectations of monetary easing, has strengthened its appeal as a store of value.

In contrast, Ethereum’s ongoing ETF outflows highlight softening demand and declining on-chain activity. Liu added that institutional investors may be waiting for clearer catalysts before re-entering the Ether market.

At the time of writing, Bitcoin trades at $111,383, while ethereum stands at $3,948—both showing limited movements as markets await next week’s macroeconomic developments.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.