Public Companies and Bitcoin: Strategic Acquisitions or Shareholder Dilution Tactics?

Wall Street’s latest obsession? Hoarding Bitcoin—or is it just creative accounting?

The Bitcoin Gold Rush: Real or Recycled?

Public companies are diving headfirst into crypto, but the real question isn’t *if* they’re buying—it’s *how*. Are they deploying cash reserves, or just printing new shares to fund the frenzy?

Dilution or Dedication?

When a firm announces a Bitcoin purchase, check the fine print. Share issuances—aka ‘free money’—are becoming the backdoor to crypto exposure. Investors cheer the headline, while their stakes get quietly watered down.

The Cynic’s Take

Nothing says ‘bull market’ like companies using shareholder capital to chase volatile assets—while billing it as ‘treasury innovation.’ Bonus points if the CEO tweets moon memes afterward.

Treasury Firm Trades Bitcoin for Shares

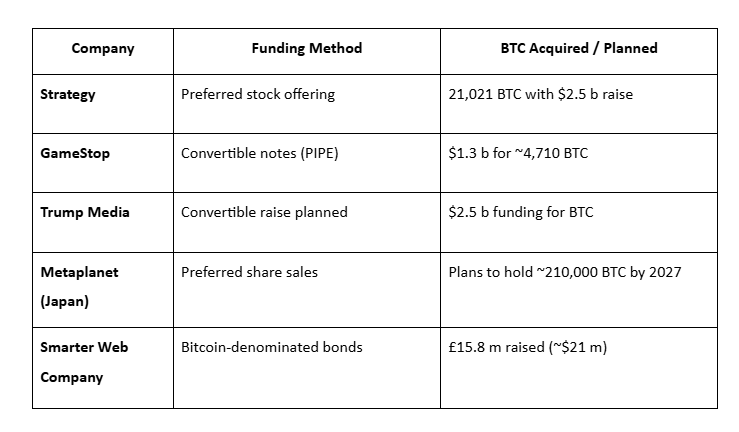

Companies around the world are building massive Bitcoin treasuries, led by firms like Strategy, which are fiercely committed to the plan.

However, a growing rumor in the community suggests that many of these firms aren’t actually buying BTC in the way investors assume. Instead, they may be acquiring it through direct trades.

Many bitcoin treasury companies aren't buying BTC. They are gifted BTC in exchange for discounted shares. pic.twitter.com/RsRrvGhiKa

— Pledditor (@Pledditor) August 6, 2025Earlier today, Satsuma Technology, a British firm, announced a $217 million fundraising round to fuel a Bitcoin treasury.

However, a closer look at company documents reveals a more complicated story. The majority of this fundraising round, $128 million, consisted of direct BTC donations. In other words, fiat currency didn’t change hands in these deals.

Could This Dilute Retail Holdings?

So, why would this matter to the crypto market? Essentially, most companies with Bitcoin treasuries are trading at significant premiums to their net BTC assets.

Strategy (formerly MicroStrategy), Metaplanet, and GameStop have raised billions through stock dilution to buy Bitcoin, inflating BTC-per-share while eroding equity value.

But what if these companies didn’t need to buy BTC on the open market? Building these corporate treasuries might not increase the demand for Bitcoin.

Moreover, the process is very opaque, leading some to compare it to premined tokens. If these companies offer a discount for shares purchased in this manner, it could dilute retail investors’ holdings.

The lack of transparency is at the heart of the issue here. To be clear, Satsuma’s press release didn’t directly claim that it traded shares at a discount for Bitcoin. That will retroactively be true if the share prices go up soon, since retail investors didn’t have access to this fundraising round.

Nonetheless, this is a case of clever financial engineering. The situation is very ambiguous, and it’s hard to make definitive claims without more information.

Investors seem less concerned with earnings or fundamentals and more with a new benchmark—. Companies that can increase the amount of Bitcoin backing each share often see their stock outperform peers.

It’s a feedback loop: raise capital, buy BTC, increase BTC/share, watch the stock climb, repeat.

However, this only works in a rising BTC market. If Bitcoin corrects sharply, these same companies could face significant equity drawdowns, while shareholders are left holding diluted stock and paper losses.

Overall, there is a lot of misunderstanding about how quickly some companies raise capital and deploy it into BTC, creating the appearance of “instant” BTC ownership. But the dilution is real, and clearly documented in regulatory filings.