Pi Coin Hits Rock Bottom: The Shocking Forces Behind Its Historic Price Collapse

Pi Coin's freefall isn't just a dip—it's a full-blown crypto crisis. What started as a 'mine-from-your-phone' dream has become a masterclass in how not to launch a digital asset.

The hype cycle implodes

Remember when your Uber driver asked if you were 'mining Pi'? That was the top. Now the network's 'easy money' promise reads like a bad Yelp review for Web3 economics.

Liquidity? What liquidity?

With fewer trading pairs than a dating app for hermits, Pi's price discovery mechanism makes penny stocks look like blue chips. Mainnet launch delays haven't helped—turns out 'soon' means something different in crypto years.

The VC exit that wasn't

Early backers are stuck holding bags heavier than a Bitcoin maximalist's ego. No ICO meant no quick dump—just a slow bleed that'd make even stablecoin issuers blush.

Pi's collapse proves even 'free' crypto isn't risk-free. But hey—at least it's not Terra/Luna. Yet.

Pi Coin Holders Are Choosing Not To Hold

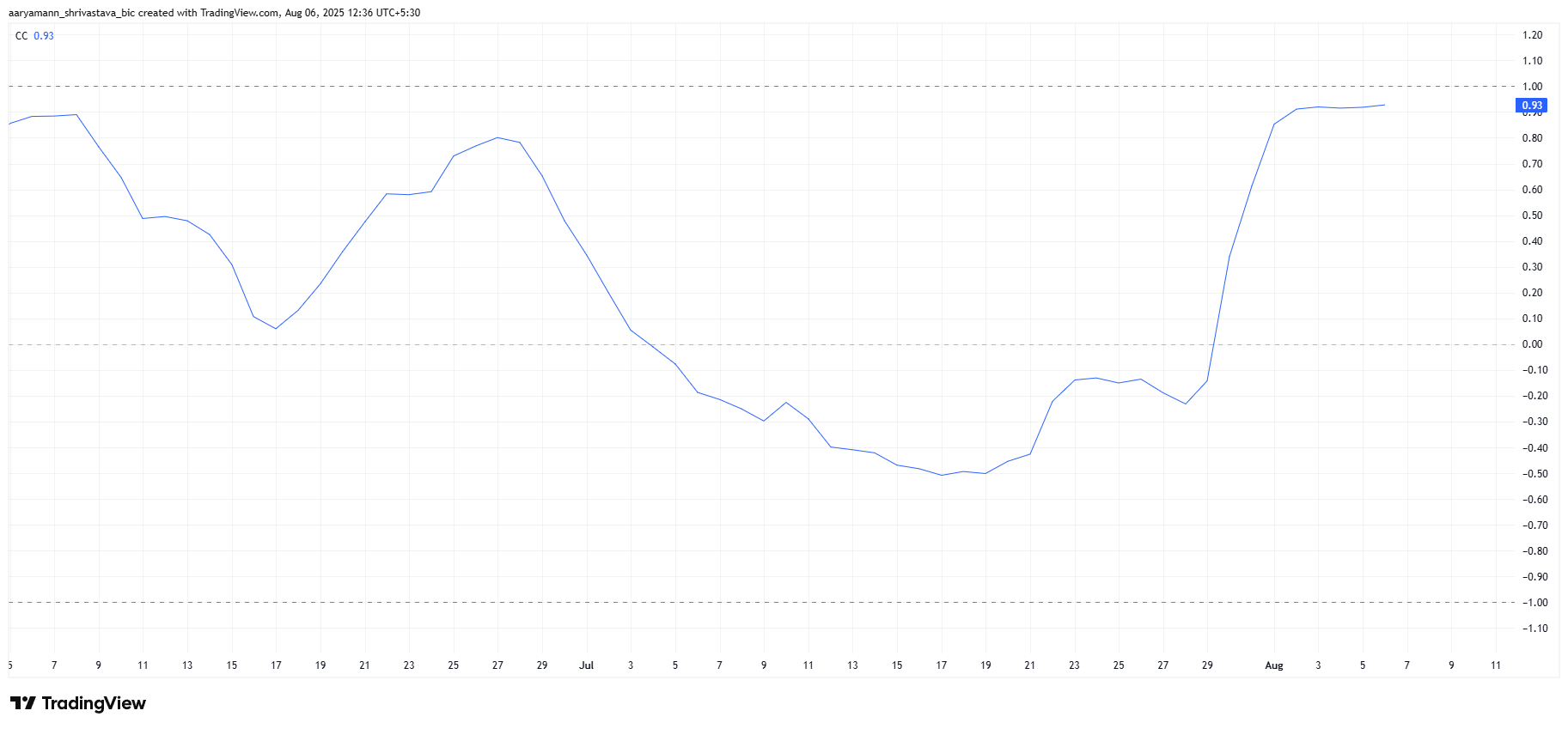

The correlation between Pi Coin and Bitcoin currently stands at 0.93, indicating a strong connection between the two assets. As Bitcoin experiences volatility and uncertainty, Pi Coin tends to follow its trajectory.

With Bitcoin’s price wobbling in recent days, Pi Coin’s price remains susceptible to the same market conditions. Bitcoin’s price uncertainty is a critical factor, as it often drives Pi Coin’s movements.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

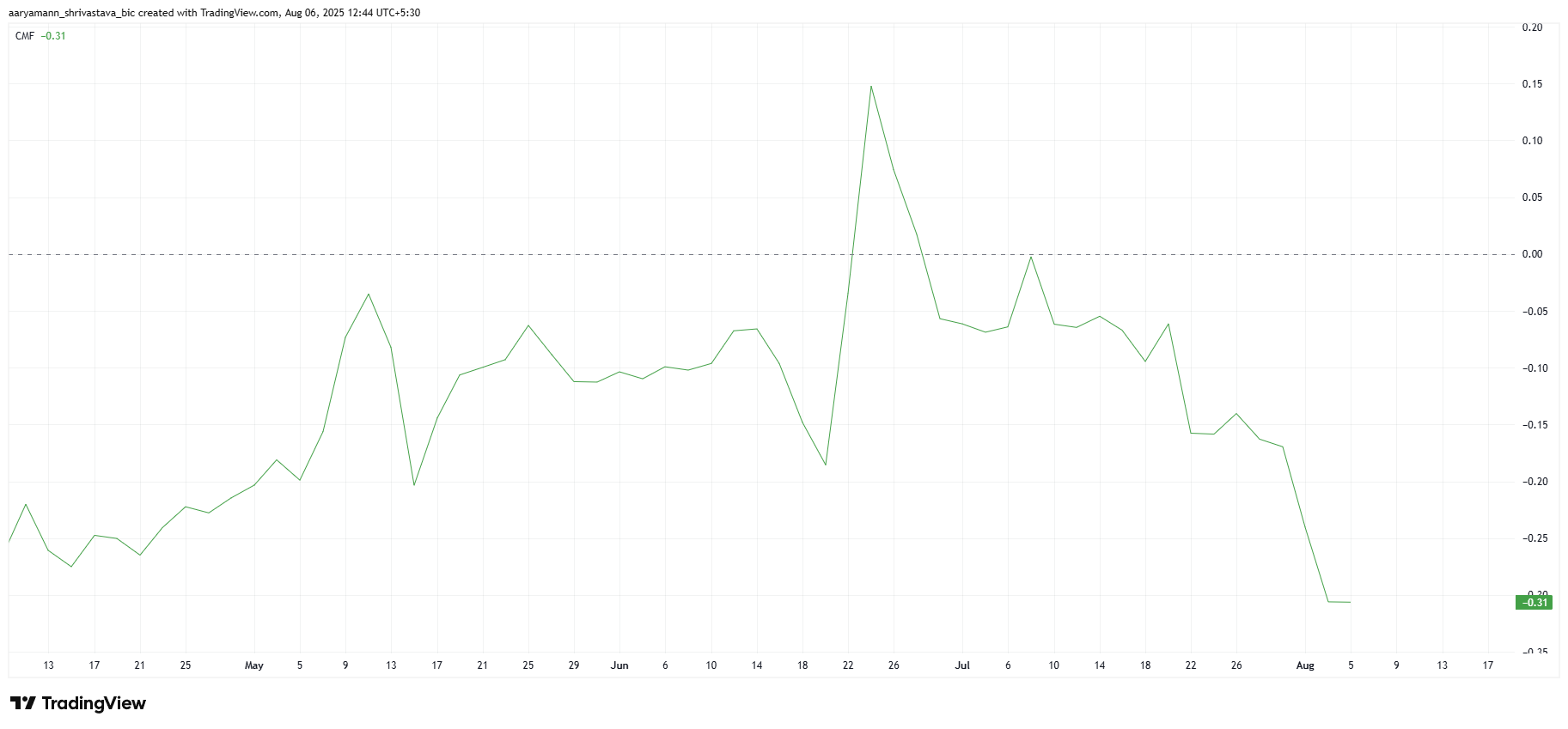

Pi Coin’s macro momentum is dominated by negative investor sentiment, as evidenced by the Chaikin Money FLOW (CMF) indicator. The CMF has been steadily declining, showing that outflows are overwhelming inflows.

The continued decline in investor confidence is contributing to the overall negative momentum. This suggests that investors are bearish toward PI Coin, with a significant portion of the market opting to sell their holdings.

Can Pi Price Bounce Back?

Pi Coin’s price is currently at $0.340, just 5.54% away from revisiting its recent ATL of $0.322. Given the current market conditions, Pi Coin remains under significant pressure, making it likely that the price will continue to decline. A new ATL below the current $0.310 could be in the NEAR future.

Given the ongoing outflows and the correlation with Bitcoin’s price movements, Pi Coin’s price trajectory appears bleak. It’s expected that the price will maintain its downtrend unless a shift in investor sentiment occurs. A decline through the support levels is highly probable, pushing the price toward further losses.

However, in the unlikely scenario that Pi Coin experiences a reversal, it WOULD need to secure $0.362 as a support floor to initiate a rally. If the price manages to break this barrier, it could rise to $0.401, invalidating the current bearish outlook and offering hope for a price recovery.