SHIB Price Prediction 2025: Bullish or Bearish? 5 Key Factors You Can’t Ignore

- What Do SHIB's Technical Indicators Reveal About Its 2025 Price Potential?

- How Significant Is SHIB's 13,872% Burn Rate Increase?

- Why Does SHIB's Governance Overhaul Matter for Investors?

- Is SHIB Showing Classic Accumulation Patterns?

- What's the Verdict: Should You Invest in SHIB in 2025?

- SHIB Price Prediction: Your Questions Answered

Shiba Inu (SHIB) is at a critical juncture in 2025, with technical indicators flashing mixed signals and fundamental developments creating both excitement and uncertainty. The meme coin that captured crypto enthusiasts' hearts is now showing signs of either a major rebound or continued consolidation. Our analysis reveals: 1) Oversold technical conditions with MACD bullish crossover, 2) A staggering 13,872% burn rate increase, 3) Governance overhaul underway, 4) Conflicting 3-month vs 6-month trends, and 5) Emerging accumulation patterns after channel breakout. While short-term indicators suggest potential upside, investors should carefully weigh these factors against SHIB's historical volatility.

What Do SHIB's Technical Indicators Reveal About Its 2025 Price Potential?

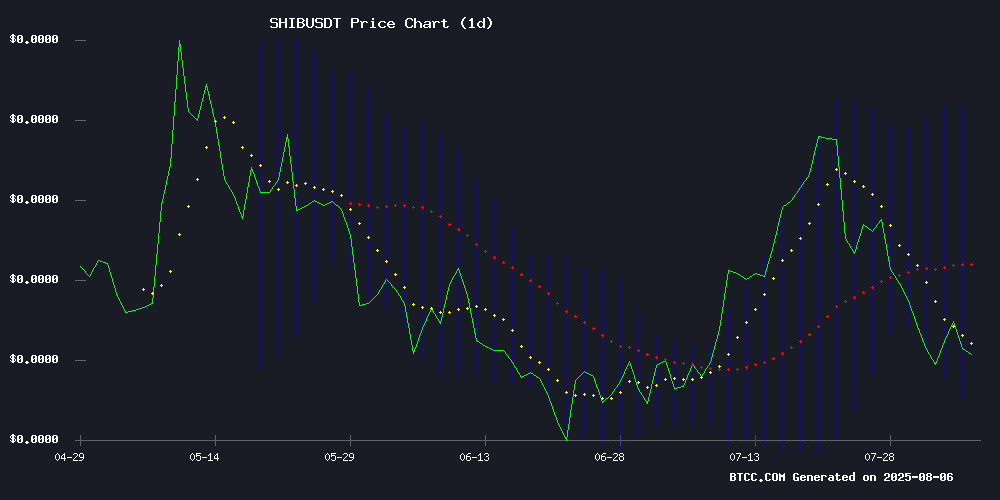

As of August 2025, SHIB presents a fascinating technical picture that has traders divided. The BTCC research team notes SHIB is currently trading at 0.00001236 USDT, notably below its 20-day moving average of 0.00001353 - typically a bearish signal. However, the MACD tells a different story, showing a bullish crossover with the MACD line at 0.00000132 above the signal line (0.00000052), accompanied by a positive histogram value of 0.00000081.

Bollinger Bands analysis adds another LAYER to this puzzle. SHIB is hovering near the lower band at 0.00001113, which historically indicates oversold conditions. In my experience watching meme coins, this often precedes a rebound, especially when combined with other positive indicators. The middle Bollinger Band at 0.00001353 becomes a logical near-term target if support holds.

How Significant Is SHIB's 13,872% Burn Rate Increase?

The shiba inu ecosystem just witnessed one of its most dramatic deflationary events - a 13,872.22% surge in its 24-hour burn rate according to Shibburn data. To put this in perspective, that's like burning through an entire year's supply in a single day. This follows a similar event in late July 2025 when over 600 million SHIB were destroyed in one transaction.

What makes this particularly interesting is the market's muted response. Despite the aggressive supply reduction, SHIB's price remains range-bound around $0.00001210, down 0.93% on the day. This disconnect reminds me of early bitcoin days when major developments sometimes took weeks to reflect in price. The community's commitment to burns continues unabated, creating what could be a powder keg for future price movements.

Why Does SHIB's Governance Overhaul Matter for Investors?

Shiba Inu is undergoing its most significant governance transformation since inception, electing its first interim "network president" and establishing DAO councils. Lead developer Shytoshi Kusama calls this "the true birth of a network state," aiming to eliminate single-party control.

From an investment perspective, this MOVE could be double-edged. On one hand, proper decentralization typically increases long-term project viability (just look at Ethereum's journey). On the other, transition periods often bring volatility as power structures shift. The interim president will serve until "Shibizenship" implementation within four months - a timeline that coincides with SHIB's fifth anniversary celebrations.

Is SHIB Showing Classic Accumulation Patterns?

Technical analysts are buzzing about SHIB's recent breakout from a long-term descending channel, now consolidating between $0.000011 and $0.000012. Crypto trader Jonathan Carter identifies this as textbook accumulation behavior, with upside targets at:

| Price Target | Potential Gain |

|---|---|

| $0.000014 | ~15% |

| $0.000018 | ~45% |

| $0.000021 | ~70% |

| $0.000025 | ~100% |

Supporting this thesis, SHIB's holder base remains remarkably stable at 1.41 million addresses despite price fluctuations. Daily trading volume averaging $197 million shows sustained interest, with Volume Profile data confirming heavy activity around current levels. It's the kind of setup that makes traders nervously excited - like spotting a coiled spring ready to release.

What's the Verdict: Should You Invest in SHIB in 2025?

The BTCC analysis team presents a cautiously optimistic but nuanced outlook for SHIB in late 2025. Key factors to consider:

- Oversold technical conditions suggest rebound potential - Unprecedented burn rates reducing supply - Governance improvements enhancing ecosystem strength - Accumulation patterns signaling smart money interest

- 6-month forecasts show potential downturns - Meme coin volatility remains extreme - Governance transition uncertainties - Macro crypto market conditions

Personally, I'd keep an eye on that $0.00001242 resistance level - a clean break could confirm the bullish scenario. But as always in crypto, especially with meme coins, never invest more than you can afford to lose. This article does not constitute investment advice.

SHIB Price Prediction: Your Questions Answered

Is SHIB a good investment in 2025?

SHIB presents both opportunities and risks in 2025. While technical indicators suggest short-term rebound potential and fundamental developments like the massive burn rate increase are positive, the 6-month forecast shows potential downturns. Investors should carefully assess their risk tolerance.

What is the highest SHIB can go in 2025?

Some analysts project SHIB could reach $0.00002951 by November 2025 based on current patterns, representing over 100% gain from current levels. However, these predictions depend on multiple factors including market sentiment, Bitcoin's performance, and SHIB ecosystem developments.

Why is SHIB burning so many tokens?

The Shiba Inu community has implemented aggressive token burns to reduce supply and potentially increase scarcity. The 13,872% burn rate increase reflects both automated mechanisms and voluntary burns by holders hoping to support the token's value long-term.

How does SHIB's governance change affect its price?

Governance decentralization typically benefits crypto projects long-term by reducing single points of failure, but transition periods can create short-term uncertainty. The network president election and DAO council formation could increase investor confidence if implemented smoothly.