Stellar’s Bleeding Wallets: Can XLM Dodge a Price Meltdown in 2025?

Stellar's liquidity pipes are springing leaks—and traders are scrambling for lifeboats. The once-buzzy blockchain now faces its toughest stress test since the last crypto winter.

Outflows hit escape velocity

Network data shows capital fleeing faster than a DeFi founder facing SEC subpoenas. XLM's price charts now look like an EKG flatlining—just as cross-border payment rivals eat its lunch.

The institutional exodus

Whales aren't just dipping toes—they're cannonballing out. Custodial balances dropped 22% last quarter, because nothing screams 'safe bet' like bankers pulling the fire alarm.

Technical breakdown ahead?

Key support levels loom like tripwires. Break below $0.08 and we're watching a replay of 2023's death spiral—complete with overleveraged retail bagholders crying foul.

Silver lining or fool's gold?

Stellar devs promise protocol upgrades 'soon' (crypto's favorite vaporware timeline). Meanwhile, XLM maximalists cope by blaming 'market manipulation'—as if crypto wasn't built on it.

One thing's certain: in this market, even 'stable' coins have more drama than a Netflix docudrama. Stellar either innovates or becomes another cautionary tweet.

Stellar Investors Pull Back

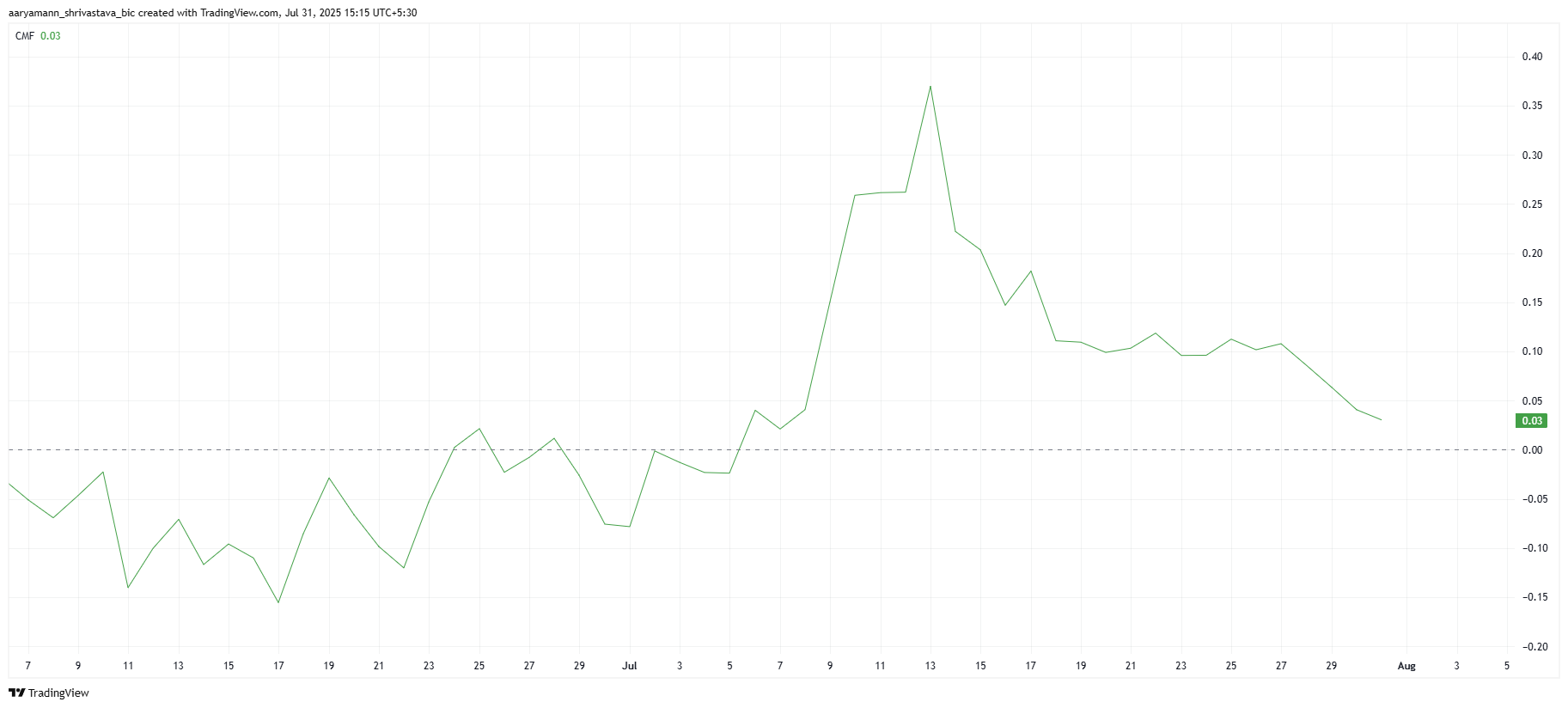

The Chaikin Money Flow (CMF) indicator has been showing a sharp decline, currently sitting at a three-week low. This suggests that outflows from stellar are rising, which is a negative signal for the asset.

Rising outflows indicate that traders are less confident in Stellar’s short-term prospects, which is impacting the price action. Although the CMF is still in the positive zone, it is dangerously close to crossing into the negative zone.

If CMF slips into this zone, it WOULD signal that outflows are outweighing inflows, which would further push down the price of XLM.

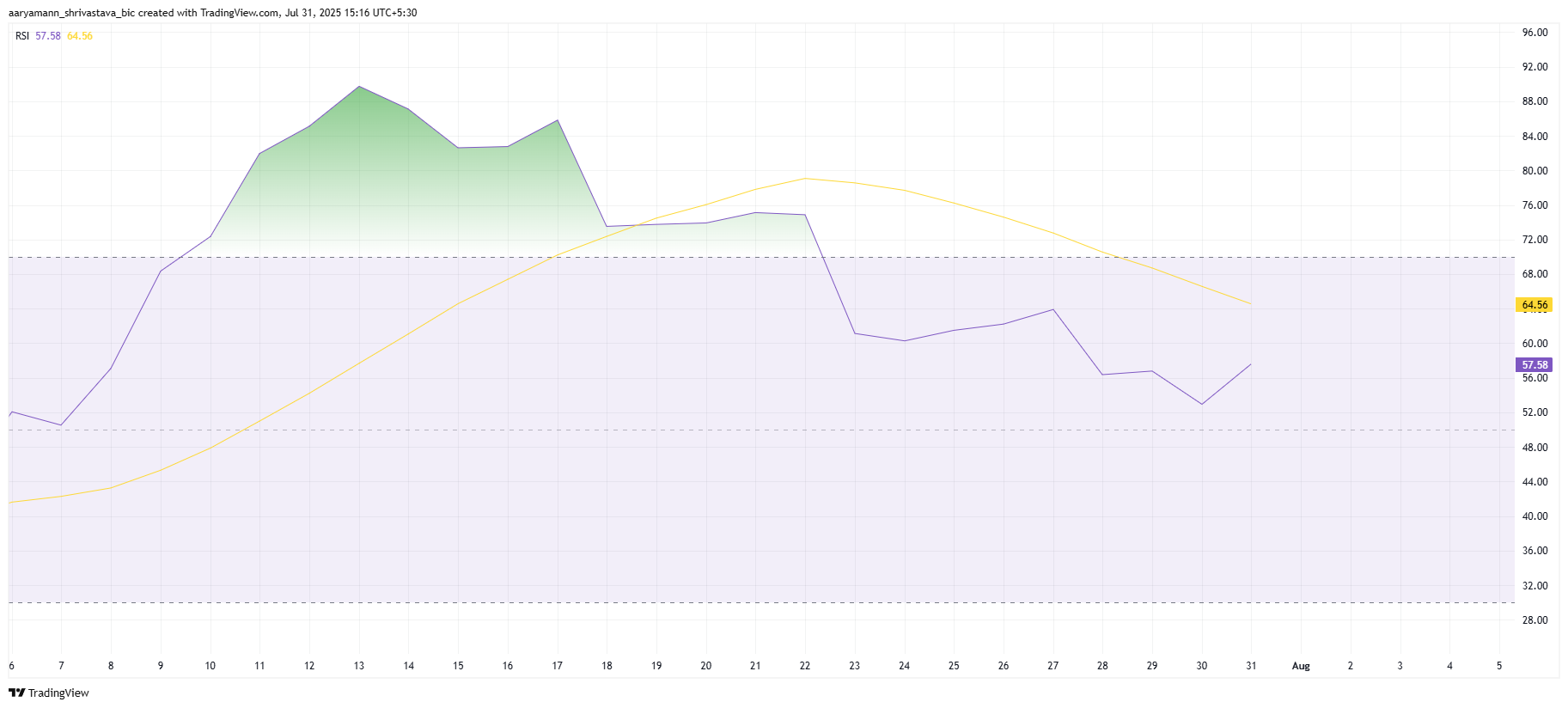

Despite the bearish trend, there are still some bullish signs in the broader market. The Relative Strength Index (RSI) for Stellar remains above the neutral 50.0 level, suggesting that the bullish momentum has not completely dissipated.

The RSI has even noted a slight uptick, indicating that there is still some buying interest in the market, especially when compared to the broader market cues. The ongoing positive momentum in the broader crypto market could help mitigate some of Stellar’s outflows.

XLM Price Needs A Push

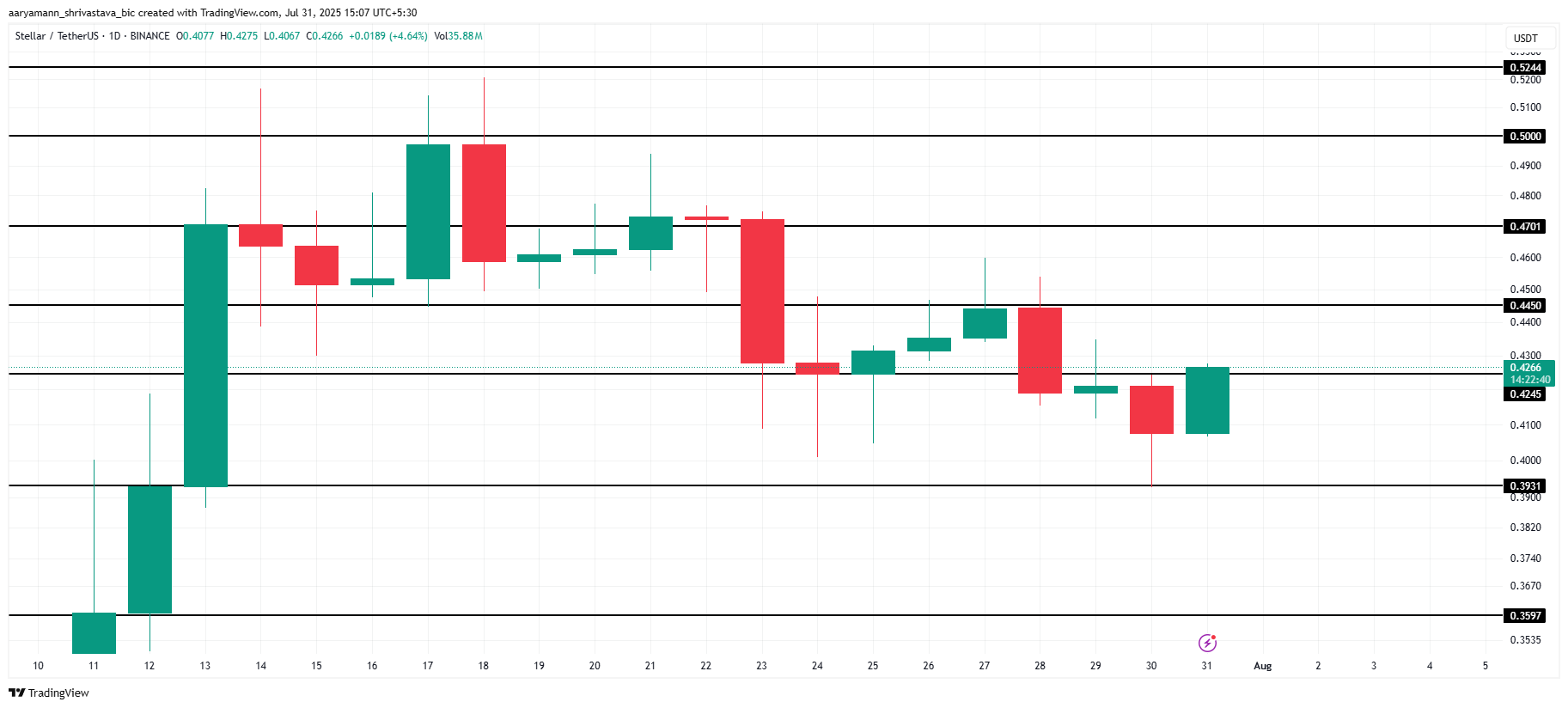

XLM price is currently at $0.426, and it is attempting to hold above the support level of $0.424. The downtrend observed over the past two weeks has threatened to reverse the significant gains made earlier this month.

If outflows continue and selling pressure builds, Stellar’s price could fall to $0.393, a crucial support level. Losing this support could push XLM’s price even lower, potentially reaching $0.359. This would wipe out much of the recent gains, further impacting investor confidence.

On the other hand, if broader market conditions remain positive, XLM may find support at $0.393, preventing further declines.

The only way to fully invalidate the bearish thesis is for XLM to reclaim $0.445 as support, although this seems unlikely under the current market conditions.