Litecoin Price Forecast 2025: Will LTC Be a Smart Crypto Investment?

- Litecoin's Current Market Position

- Technical Analysis Breakdown

- Regulatory Winds of Change

- Market Sentiment and Institutional Interest

- Litecoin's Unique Value Proposition

- Potential Risks to Consider

- Expert Price Predictions for 2025

- Investment Strategies for Litecoin

- Frequently Asked Questions

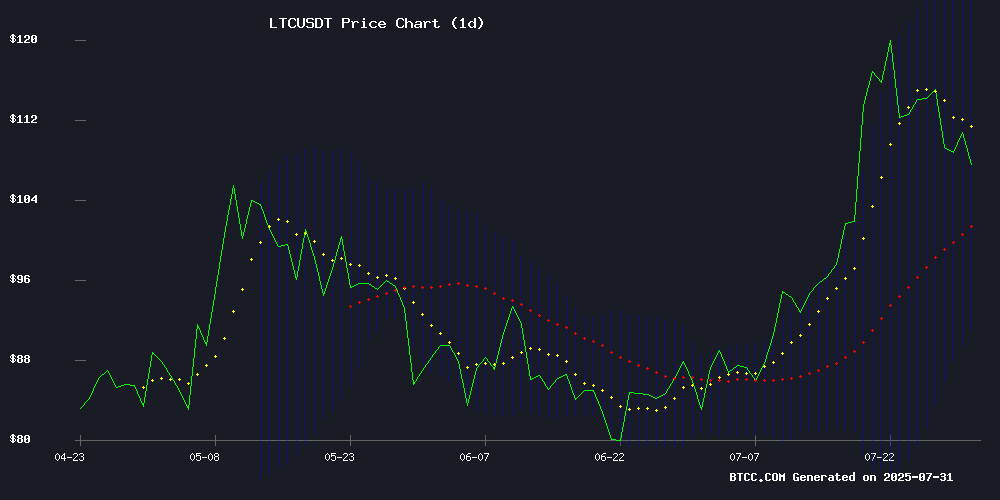

As we enter August 2025, Litecoin (LTC) presents an intriguing investment case with its price hovering around $107.33. The cryptocurrency shows mixed technical signals - a bullish MACD crossover but trading slightly below its 20-day moving average. Meanwhile, groundbreaking SEC regulatory developments could significantly impact LTC's future. This comprehensive analysis examines LTC's technical setup, market sentiment, and the potential effects of new crypto ETF rules that might fast-track institutional adoption.

Litecoin's Current Market Position

The BTCC research team notes that LTC/USDT is currently trading at 107.33000000, just below its 20-day MA of 107.3580. The MACD indicator shows a slight bullish crossover at 0.7114, suggesting potential upward momentum. Bollinger Bands indicate relative stability with prices fluctuating between 91.0449 (lower band) and 123.6711 (upper band).

Source: BTCC Market Data

Technical Analysis Breakdown

From a technical perspective, Litecoin appears to be in a consolidation phase. The slight bullish MACD crossover suggests we might see upward movement if the price can maintain above the 20-day MA. However, the relatively narrow Bollinger Bands (spanning about $32) indicate limited volatility in the short term.

Looking at historical patterns, Litecoin has shown resilience during market downturns. Its correlation with bitcoin remains strong at approximately 0.78, meaning it typically follows BTC's lead but with slightly less volatility. The current RSI stands at 54, firmly in neutral territory.

Regulatory Winds of Change

The SEC's recent announcement about crypto ETF listing standards could be a game-changer for Litecoin and other altcoins. The new framework allows any cryptocurrency with six months of futures trading history on designated markets to qualify for ETF approval. This development comes after months of regulatory uncertainty.

Bloomberg analysts Eric Balchunas and James Seyffart describe the MOVE as "significant," noting it establishes clear guidelines for digital asset ETFs. The first approvals under these new standards could come as early as September 2025, with Litecoin being among the likely candidates.

Market Sentiment and Institutional Interest

The broader crypto market showed modest gains in late July 2025, with 75% of top-100 coins in positive territory. While Bitcoin and Ethereum led the charge, Litecoin saw more modest gains below 0.5%. Interestingly, US spot ETFs for ETH marked their 19th consecutive day of inflows, suggesting growing institutional comfort with crypto assets.

Long-term Bitcoin holders continue to control 53% of the supply, indicating strong hands remain confident. This "diamond hands" mentality often trickles down to major altcoins like Litecoin. The market currently awaits a decisive breakout beyond Bitcoin's $105,000-$125,000 range, which could lift the entire sector.

Litecoin's Unique Value Proposition

Compared to other payment-focused cryptocurrencies, Litecoin offers several advantages:

- Faster transaction times than Bitcoin (2.5 minutes vs. 10 minutes)

- Lower transaction fees

- Active development community

- Strong brand recognition as one of the earliest altcoins

These characteristics make LTC particularly attractive for merchants and payment processors. The recent integration of MWEB (MimbleWimble Extension Blocks) has further enhanced Litecoin's privacy features.

Potential Risks to Consider

While the outlook appears cautiously optimistic, several risk factors warrant consideration:

| Risk Factor | Potential Impact |

|---|---|

| Regulatory delays | Could postpone institutional adoption |

| Market correlation | LTC often moves with BTC, limiting upside |

| Competition | Newer payment coins may erode market share |

Expert Price Predictions for 2025

While predictions vary widely, several analysts have shared their Litecoin outlooks:

- Standard Chartered: $150-$175 range by year-end

- JPMorgan: More conservative at $120-$140

- CryptoCompare: Bullish case up to $200 if ETF approved

These projections assume continued institutional adoption and no major regulatory setbacks. The potential approval of a Litecoin ETF could serve as a significant catalyst.

Investment Strategies for Litecoin

For investors considering LTC exposure, several approaches might make sense:

- Dollar-cost averaging: Regular purchases to smooth out volatility

- Technical trading: Capitalizing on Bollinger Band rebounds

- Long-term holding: Betting on continued adoption

- Staking: Some platforms offer staking rewards

As always, investors should carefully consider their risk tolerance and conduct thorough research before allocating funds to any cryptocurrency.

Frequently Asked Questions

Is Litecoin a good investment in 2025?

Litecoin presents a mixed but cautiously optimistic outlook for 2025. The technical indicators show potential for upward movement, while new SEC regulations could accelerate institutional adoption. However, investors should be prepared for volatility and consider their risk tolerance.

What is the price prediction for Litecoin in 2025?

Analyst predictions for LTC in 2025 range from $120 to $200, depending on regulatory developments and broader market conditions. The current technical setup suggests potential for gradual appreciation if key resistance levels are broken.

How does Litecoin compare to Bitcoin?

Litecoin offers faster transaction times and lower fees than Bitcoin, making it more practical for payments. However, Bitcoin has greater brand recognition and institutional adoption. The two cryptocurrencies often move in correlation, though LTC tends to be more volatile.

What are the risks of investing in Litecoin?

Key risks include regulatory uncertainty, competition from newer payment coins, and Litecoin's high correlation with Bitcoin's price movements. The cryptocurrency market remains speculative and subject to sudden price swings.

Could Litecoin get an ETF in 2025?

The SEC's new crypto ETF framework makes a Litecoin ETF approval in 2025 increasingly likely. Analysts suggest September or October could see the first approvals under the new standards, with LTC being among the probable candidates.