Is Tether Abandoning Its US Market Dreams for USDT?

Tether's USDT—the controversial stablecoin that somehow keeps dodging regulators—might be backing away from its US ambitions. Again.

Why? Because playing nice with regulators is hard when your business model thrives in the shadows.

Here's the kicker: Tether's dominance isn't built on compliance—it's built on being everywhere regulators aren't. And right now, that's definitely not the US.

So while Wall Street fiddles with 'approved' stablecoins, Tether's quietly eating the world. Just don't ask how.

Why Doesn’t Tether Want US Treasuries?

Tether, the world’s largest stablecoin issuer, has been making some very diversified investments lately. According to a recent report, interest from the firm’s US Treasury bonds allowed it to invest in over 120 companies.

Today, Tether released its Q2 2025 Attestation Report, confirming a slight increase in Treasuries holdings.

Tether just released its quarterly attestation for Q2 2025.

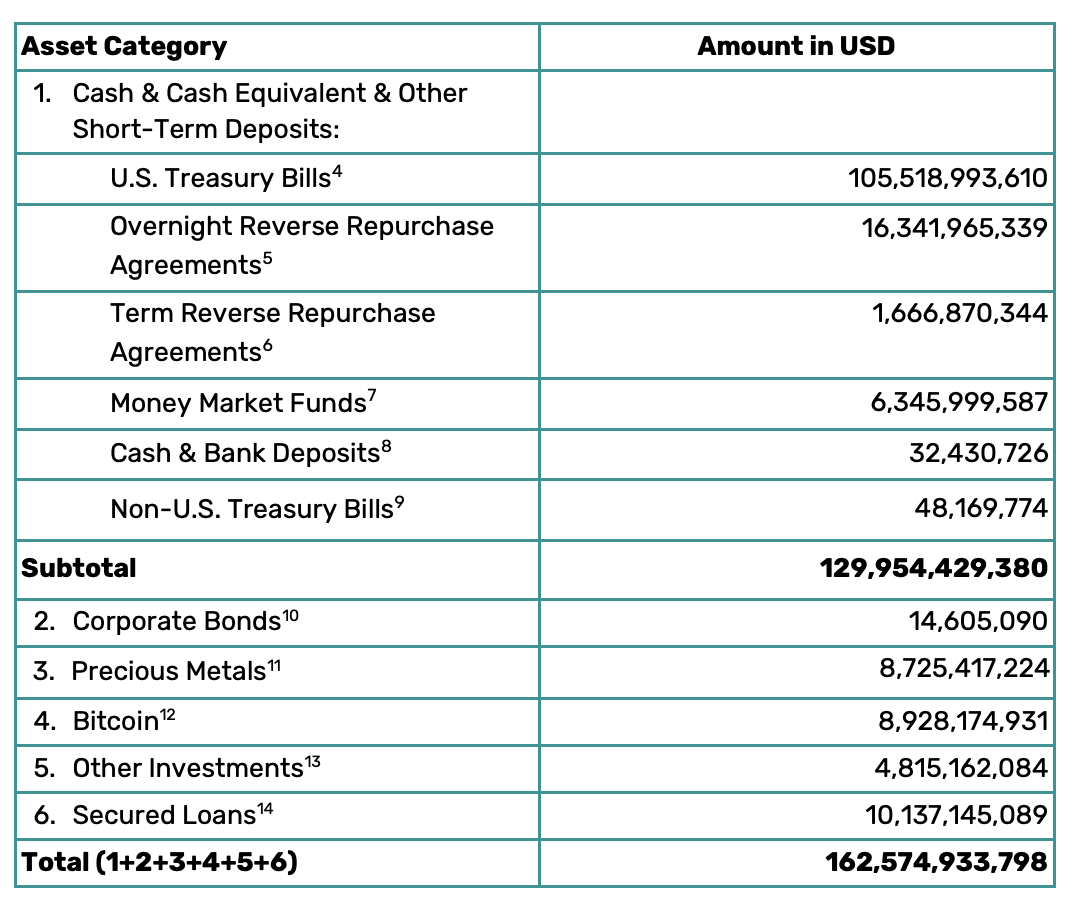

Highlights as of 30th June 2025:

* 157.1B total issued USDt, end of Q2 2025.

* 162.5B total assets/reserves, end of Q2 2025.

* 5.47B excess reserves, on top of the 100% reserves in liquid assets that back all issued… https://t.co/bejhVFkMYt pic.twitter.com/XYVmueWZ0G

![]()

According to the report, Tether currently holds $105.5 billion in US Treasuries and another $24.4 billion in indirect exposure. This includes Overnight Reverse Repurchase Agreements and non-US Treasuries, which may refer to EU bonds for MiCA compliance.

There’s a simple reason why Tether has been buying so many Treasury bonds: stablecoin regulations. The GENIUS Act mandates that stablecoin issuers hold asset reserves in Treasuries, which may cause problems for the firm.

Still, Tether lobbied hard to pass this legislation, so it seems likely that it’s prepared to reach compliance.

However, there is an interesting piece of data here. Since MiCA first took effect, Tether has bought astronomical quantities of Treasury bonds.

In Q4 2024, it purchased $33 billion, and added a whopping $65 billion in Q1 2025.

Today’s report, however, shows less than a $7 billion increase in direct Treasuries holdings throughout all of Q2.

Tether’s non-US Treasury holdings decreased by around $17 billion, and all other “cash equivalents” either fell or ROSE by less than $1 billion.

Sure, the firm has been buying gold, Bitcoin, and these diverse corporate investments, but its rampant hunger for Treasuries seems to be tapering off. Tether’s holdings are growing, but its strategy is changing.

It’s unclear what to make of all this. According to CEO Paolo Ardoino’s post, Tether has issued over $50 billion more USDT tokens than corresponding US Treasuries. Couldn’t this cause problems for future GENIUS Act compliance?

Ultimately, it’s hard to say whether potential bond market issues caused this change in tactics. It could be very significant, though.