Solana Whales Feast on $367M SOL Fire Sale as Prices Dip—Bullish or Desperate?

Solana holders just went on a $367 million buying spree—turning a market slump into a discount buffet. Here's why this could be rocket fuel... or pure hopium.

The SOL fire sale you didn't hear about

While retail investors panicked over red candles, deep-pocketed traders vacuumed up SOL tokens at bargain prices. That $367 million buy-in happened in just seven days—equivalent to a mid-sized hedge fund going all-in.

Contrarian play or trapped liquidity?

Some see this as a classic 'buy when there's blood in the streets' move. Others whisper about VC bags getting heavier. After all, nothing makes a billionaire happier than averaging down with your money.

The cynical take

Wall Street calls it 'accumulation.' Crypto Twitter calls it 'wen lambo.' Both camps agree on one thing: someone's betting big that SOL's infrastructure play beats ETH's legacy baggage. Place your bets—the blockchain casino never closes.

Solana Investors Move To Accumulate

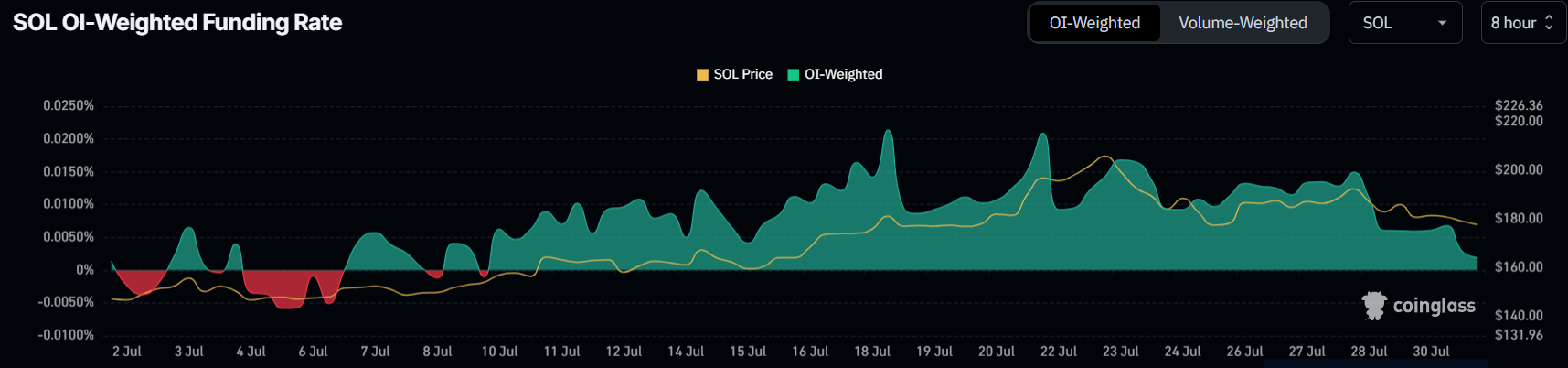

Throughout July, Solana’s funding rate had remained positive, signaling trader confidence in the cryptocurrency’s potential. However, the funding rate is now nearing the point of turning negative. If this occurs, it would reflect waning Optimism among traders.

The shift in sentiment is crucial, as a negative funding rate WOULD signal that traders are no longer betting on a price rise. Instead, they may anticipate further declines, which could lead to a higher concentration of short positions. This change would likely push the price lower in the short term.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

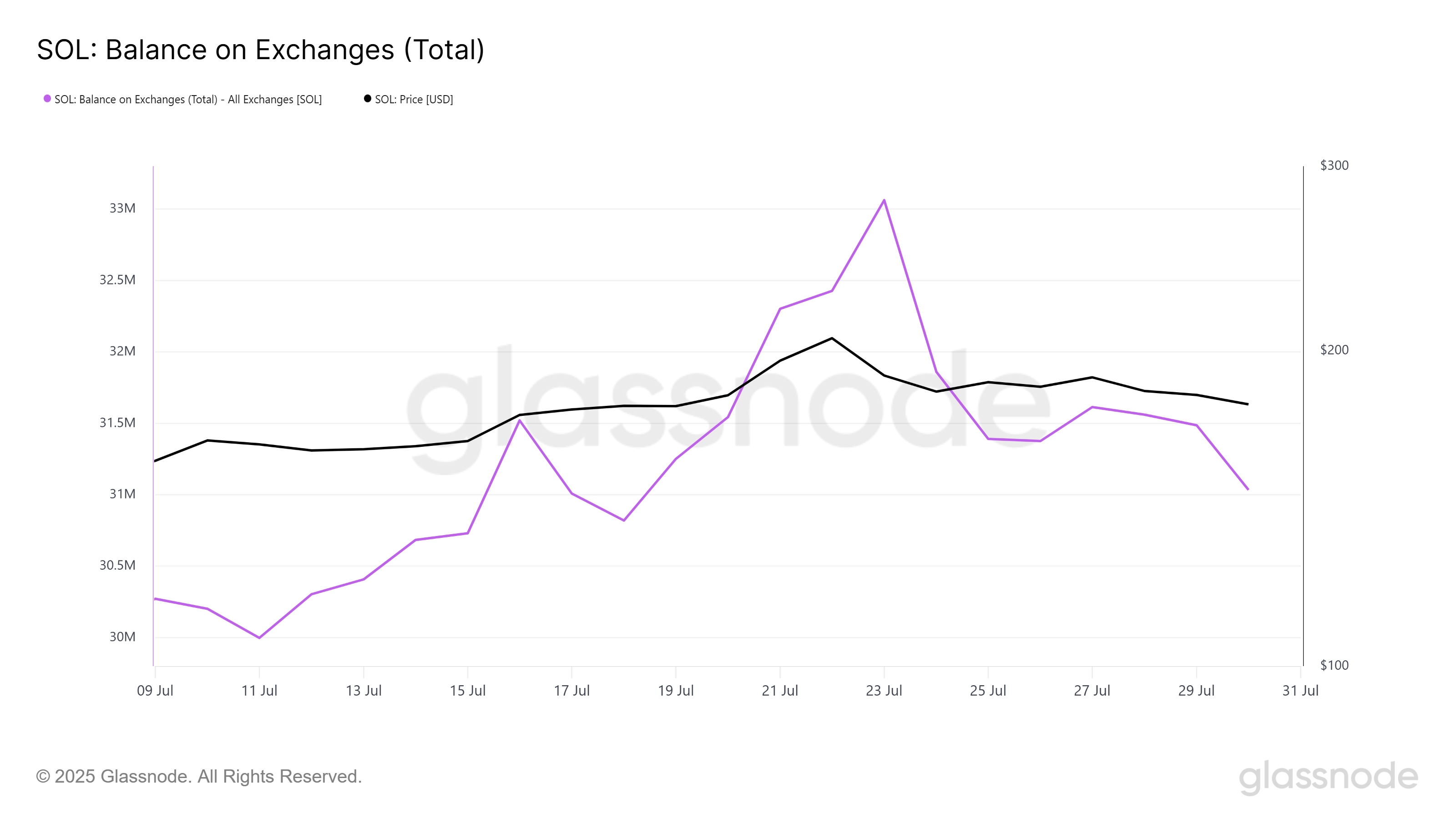

Solana’s balance on exchanges has dropped by 2.03 million SOL in the past week, signaling increased accumulation. This is indicative of investors purchasing $367 million worth of SOL, likely in anticipation of future gains. As the price of solana declined, many investors have accumulated tokens.

This accumulation, however, shows that investors are expecting Solana to recover eventually. With more SOL leaving exchanges, there is a growing belief that prices could rise again, with investors preparing to book profits once the price rebounds.

SOL Price Has Not Lost A Lot

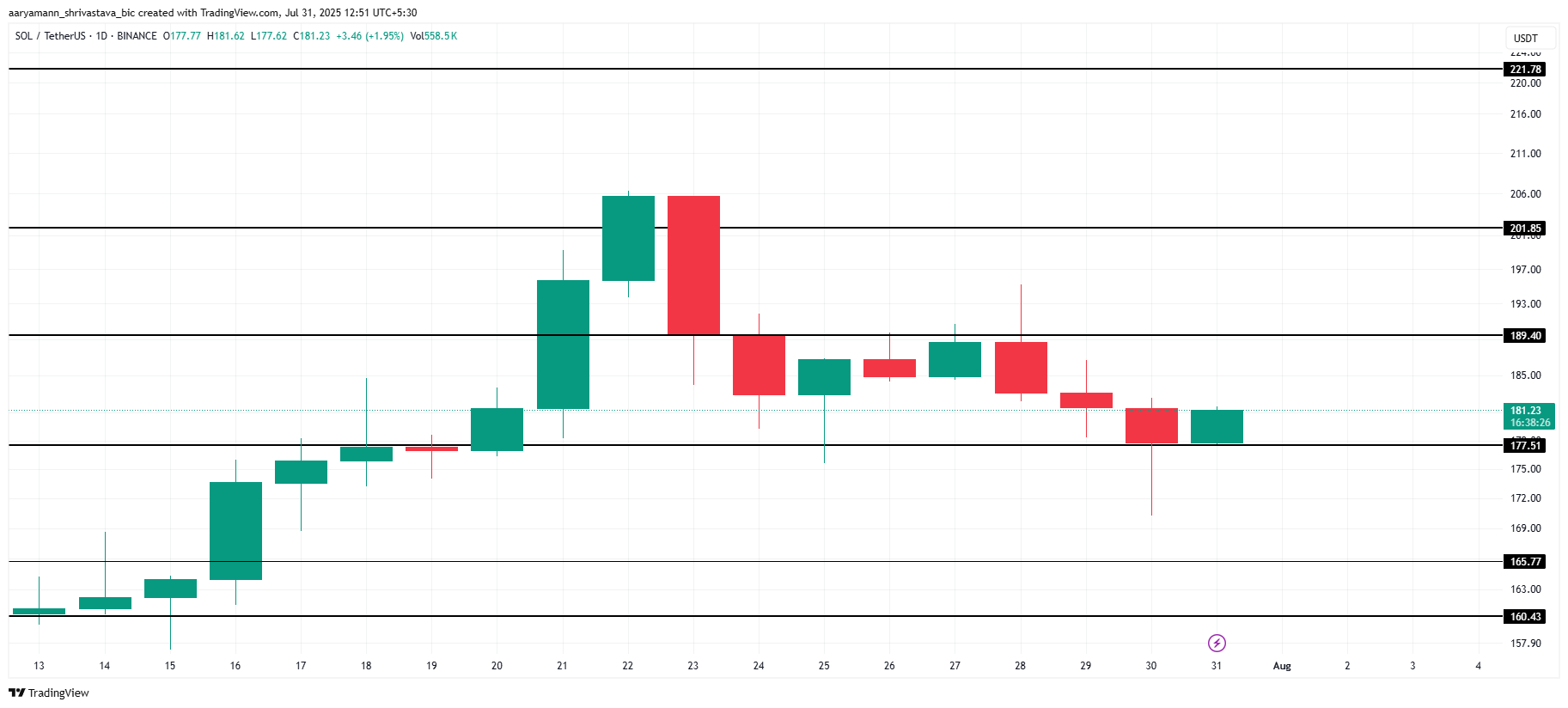

Solana’s price currently sits at $181, holding above the crucial support level of $171. While the spot market remains optimistic, mixed signals from the derivatives market suggest that the SOL price may face downward pressure in the coming days.

If the bearish trend continues, Solana’s price could decline further to the $165 range or remain in a consolidation phase between $189 and $177 until a clear direction is established. This period of uncertainty may persist until market conditions stabilize.

However, should the accumulation continue to outweigh the bearish pressure from shorts, Solana could break through $189 and convert it into a support level. This shift would allow the altcoin to rise toward $201, potentially invalidating the bearish outlook and reigniting bullish momentum.