Altcoins Bleed Out: Sharpest Pullback in Weeks as Traders Cash In Gains

Market carnage hits altcoins as profit-taking frenzy triggers steepest correction since June.

### Blood in the Crypto Streets

Mid-cap tokens got slaughtered Thursday as traders dumped positions en masse—classic 'buy the rumor, sell the news' behavior after last week's ETF hype. Ethereum derivatives led the sell-off, dragging down the entire altcoin complex.

### The Great Unwinding

Leverage got torched across perpetual swaps, with Binance's funding rates flipping negative for the first time in 18 days. Open interest? Evaporated. The usual suspects—SOL, ADA, DOT—all down 12-15%. Even memecoins weren't spared.

### Silver Lining Playbook

Veteran traders see this as healthy consolidation after June's parabolic moves. 'Market needed to shake out weak hands,' commented one hedge fund manager while adjusting his Rolex. Meanwhile, Bitcoin dominance creeps up—because when panic hits, everyone runs back to daddy BTC.

Corrections are crypto's version of spring cleaning: brutal, necessary, and always timed to maximize pain for retail bagholders.

Nearly $1 Billion Liquidated as Market Cap Falls in Final Week of July

According to TradingView data, the overall crypto market cap dropped by 5% this week, from nearly $4 trillion to $3.78 trillion. However, the altcoin market cap (TOTAL2) plunged more sharply. It fell almost 10%, from $1.57 trillion to $1.4 trillion.

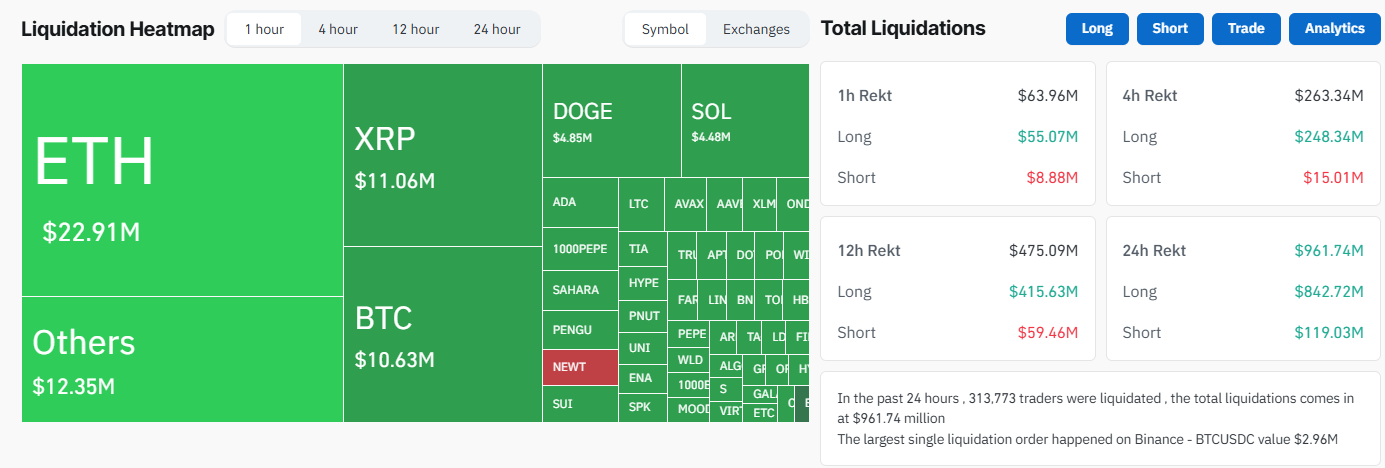

Altcoins corrected more steeply than Bitcoin, which caused losses for short-term derivatives traders. Coinglass reported nearly $1 billion in liquidations over the past 24 hours.

“In the past 24 hours, 314,302 traders were liquidated. The total liquidations come in at $966.04 million,” Coinglass reported.

Of the nearly $1 billion liquidated, over $840 million came from long positions, accounting for about 84%. This highlights the failure of many short-term traders who used leverage and expected prices to continue rising this week.

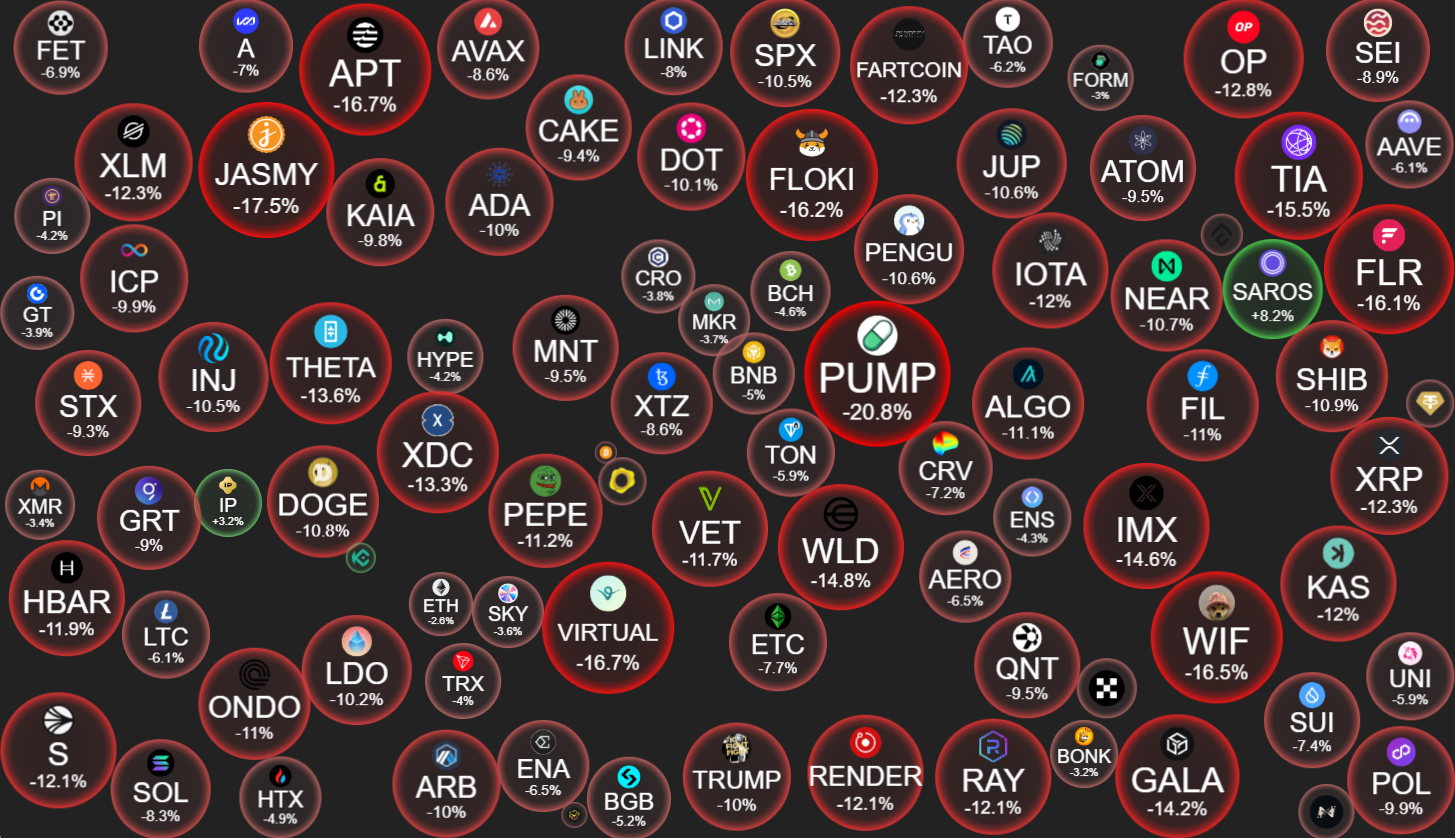

In addition, data from CryptoBubbles showed that nearly all altcoins dropped sharply today, with losses ranging from 6% to over 20%.

This MOVE could be seen as the first wave of profit-taking after four straight weeks of rising market cap.

Who’s Taking Profits?

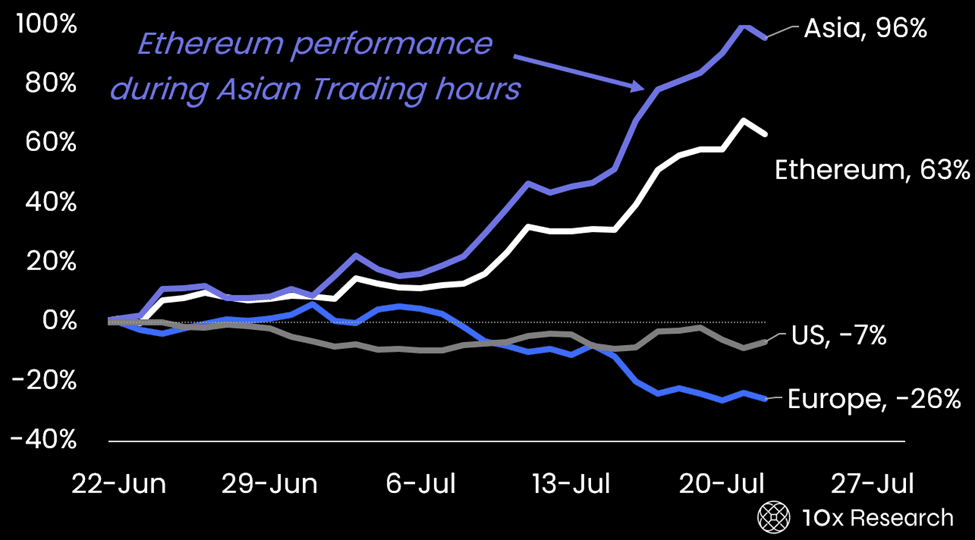

According to a new report from 10x Research, Asian trading hours were the main driver of the recent rally.

While Bitcoin posted a +16% gain overall, Asian hours alone contributed +25% to that rise. This means that both Europe (-6%) and the US (-3%) actually saw net selling, likely due to profit-taking.

A similar pattern emerged with Ethereum. ETH has surged 63% in the past month—an impressive gain. Yet nearly all of that (+96%) occurred during Asian trading hours. In contrast, Europe (-26%) and the US (-7%) sold as the price rose.

“Although some of this may be due to treasury-related news emerging after US market hours, the more likely explanation is heightened enthusiasm and aggressive buying from Asian traders,” the report explains.

According to the study, US and European investors may be locking in profits. Ironically, they were also the source of the positive news that fueled the strategic crypto accumulation narrative.

It seems Asian traders were FOMO-ing based on news from the other half of the world, only to be hurt today by the very same headlines.

However, this kind of pullback may not be enough to indicate a long-term downtrend. Many analysts see it as a natural profit-taking phase, believing the broader trend remains intact.

“Not concerned with the dip in alts today. It was a sensible sell-off considering how much everything has gained recently. The most important thing is BTC held strong. Alts will bounce soon enough—likely even harder than their last leg up. Patience pays. Be more bullish,” KALEO, investor and founder of LedgArt, predicted.

CZ, founder of Binance, also viewed this correction as simply “a dip again.”

At the time of writing, the market sentiment remains in “greed” territory. Despite nearly $1 billion in liquidations, there’s still no sign of panic.