Gen Z Goes Full Cyborg: 67% of Young Crypto Traders Now Let AI Tame Market Chaos (MEXC Data)

Move over, hedge funds—Zoomers are deploying algorithmic artillery against crypto's wild swings. A bombshell MEXC study reveals two-thirds of Gen Z traders now automate their battle plans against volatility.

AI or Die Trying

These digital natives aren't just HODLing through the storm. They're weaponizing machine learning to predict pumps, dodge dumps, and—let's be honest—outsmart the 'diamond hands' boomers still manually drawing trend lines.

The Quant Kids Take Over

Forget moon-shot memecoins. The real revolution? A generation raised on TikTok algos now training AI models to sniff out alpha. Though we'd bet half these 'trading bots' are just glorified Excel macros.

Wall Street's nightmare scenario: a army of 19-year-olds with better tech than their quant teams. Cue the institutional FOMO—and the inevitable copycat 'AI-powered' crypto ETFs coming soon to a Bloomberg terminal near you.

AI Adoption Soars Among Gen Z Traders on MEXC

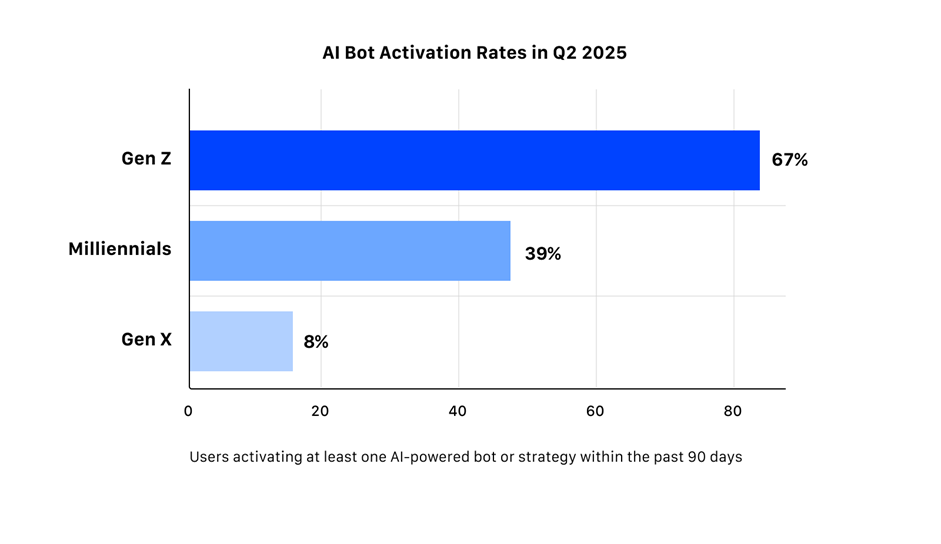

MEXC’s Q2 2025 behavioral intelligence report shows that two-thirds of Gen Z users activated at least one AI bot or rule-based strategy in the last 90 days.

However, usage goes deeper than bot deployment. These users actively incorporate AI into their trading behaviors, with 22.1% engaging with AI tools at least four times a month.

Based on the report, Gen Z now accounts for 60% of all AI bot activations on the platform.

This cohort averages 11.4 days per month interacting with AI tools, which is more than twice the engagement of users over 30.

Their usage is also intentional, with the study showing 73% of Gen Z traders activate bots during volatility spikes but shut them off during low-volume or sideways markets. For them, AI is not a blanket solution. Rather, it is a selective, situational advantage.

Emotional Regulation and Delegation: The Gen Z Edge

MEXC Research’s findings suggest that, beyond trusting AI, Gen Z uses it as a psychological buffer. Traders using bots saw a 47% reduction in panic sell-offs during market stress, compared to those trading manually.

Rather than reacting to every market twitch, Gen Z configures automated strategies with clear rules, then steps back.

This method, described in the report as “structured delegation,” reduces decision fatigue and cognitive overload and mirrors broader digital behaviors in the workplace.

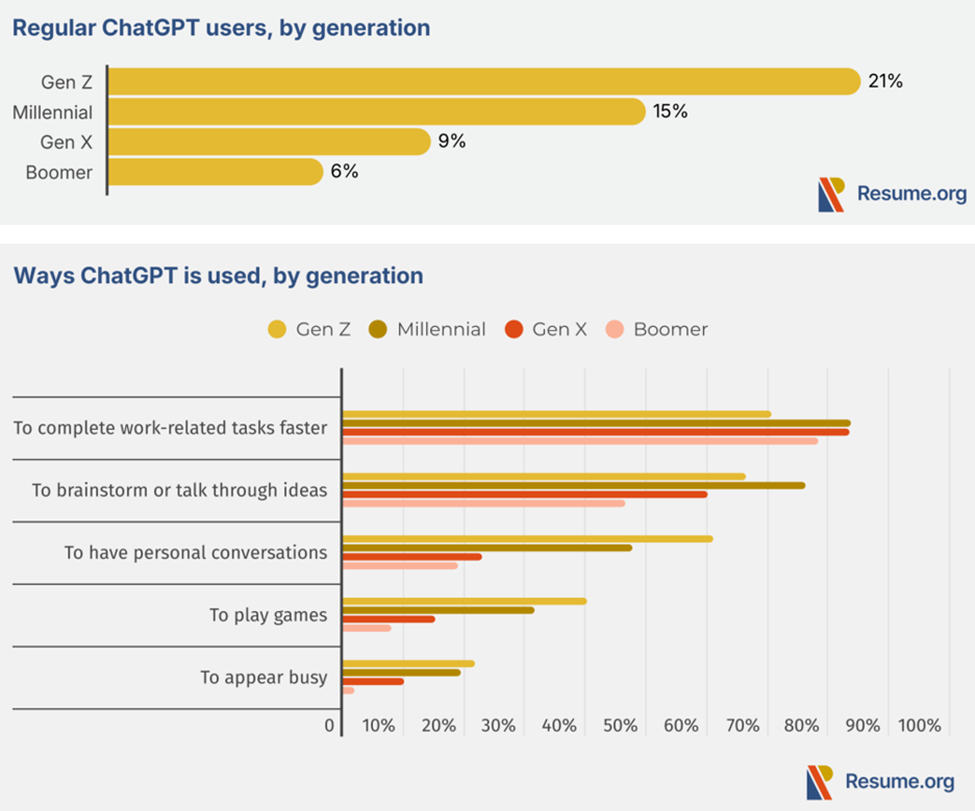

According to a May 2025 survey by Resume.org, over 50% of Gen Z workers view ChatGPT as a co-worker or “friend.” AI is going beyond replacing human judgment to enhance emotional discipline for these users.

Risk Management Reimagined

The shift toward AI is also transforming how risk is managed. Gen Z users who engage with AI trading tools are:

- 1.9x less likely to make impulsive trades within the first three minutes of major market events

- 2.4x more likely to implement stop-loss and take-profit strategies

- 58% of Gen Z bot usage occurred during spikes in MEXC’s internal volatility index

These patterns reflect a new style of semi-automated trading, where bots act as fail-safes in moments of high emotion or uncertainty. AI is going beyond accelerating trades, enforcing discipline when it matters most.

Gen Z vs Millennials: Two Trading Operating Systems

Further, MEXC’s cross-generational analysis reveals a fundamental divergence in trading psychology. On the one hand, millennials lean toward structured, thesis-driven approaches that heavily use charts, research, and manual oversight.

On the other hand, Gen Z approaches trading like they use Discord or TikTok — rapid, reactive, and interface-dependent.

Rather than long-form strategies, Gen Z favors modular, customizable tools that allow for flexible control. Their trading activity is shaped by emotional bandwidth and attention cycles.

They toggle automation on and off based on market mood and personal stress levels, a behavior foreign to the older cohort’s more static strategies. This reflects broader patterns in copy trading, influencer-led decision-making, and social-driven investment communities.

This report suggests that Gen Z is already building the future of crypto trading rather than waiting for it. However, in their pursuit of prioritizing speed, clarity, and emotional control, users must also be wary of blind trust.

Overreliance on AI tools can introduce new risks, including algorithmic bias, flawed datasets, and model opacity, posing systemic threats.