High-Roller James Wynn Cashes In: First $500K Profit Since May Sparks Market Buzz

Risk pays off—again. James Wynn, the trader who treats stop-losses like optional speed bumps, just locked in his first half-million profit since May. The crypto wild west still has sheriffs, but they’re clearly outgunned.

The Comeback Kid (Or Just Lucky?)

Wynn’s playbook? Leverage, volatility, and a stomach of cast iron. While retail traders sweat over 5% dips, he’s turning market chaos into a personal ATM. No ‘safe assets’ here—just raw alpha hunting.

Timing Over Fundamentals

May’s crash wiped out weak hands. Wynn waited, then pounced when blood hit the streets. Classic ‘buy when there’s panic’—except most panic sellers are now driving for Uber.

The Cynic’s Footnote

Another win for the ‘high risk, high reward’ brigade. Meanwhile, your index fund returned 3% this year. Sleep tight.

James Wynn’s Trading Rollercoaster Ends in Green—for Now

In June, BeInCrypto reported on Wynn’s substantial $100 million loss on Hyperliquid. Despite the blow, he continued making high-stakes bets.

This month, the blockchain analytics platform Lookonchain highlighted that Wynn transferred 27,522 USDC to Hyperliquid and collected a referral bonus of $3,960.84 on July 10. He then opened a high-risk 40x leveraged short position on Bitcoin.

Nonetheless, once again, betting against the market did not prove favorable for Wynn. In less than 12 hours, Wynn’s high-stakes short was fully liquidated, resulting in a fresh loss of $27,921.63. One day later, Wynn deactivated his X (formerly Twitter) account.

“James Wynn has deactivated his X account! What happened? Did he blow up completely? All his wallets and Hyperliquid balance combined are down to just $10,176,” Lookonchain posted.

However, the silence didn’t last long. On July 15, Wynn reemerged, claiming a referral reward of 6,792.53 USDC. This time, he went long on Pepe with 10x leverage.

JAMES WYNN IS BACK

James Wynn found another $460K from Binance, reactivated his twitter account and MAX LONGED Bitcoin.

Are we about to see James Wynn’s comeback? pic.twitter.com/Ca0zDuIPtU

Lookonchain then observed that the trader added around 468,000 USDC into Hyperliquid. He took another bold step, opening a 40x leveraged long position on Bitcoin. Despite facing partial liquidation, Wynn managed to profit by shifting strategies.

“He flipped from long to short on BTC and HYPE — pulling in $473.9K in profits,” the firm added.

Hyperdash data further revealed that he made $105,948 and $345,456, respectively, on July 18 and 19, from his short Bitcoin positions. Furthermore, yesterday, Wynn deposited an additional 536,573 USDC into Hyperliquid. He then opened two new leveraged positions: a 25x long on ethereum and a 10x long on PEPE.

Today, he closed both trades, earning $33,386 from ETH and a staggering $521,313.86 from PEPE. The latter marks his most profitable single trade since his $18 million win on May 25.

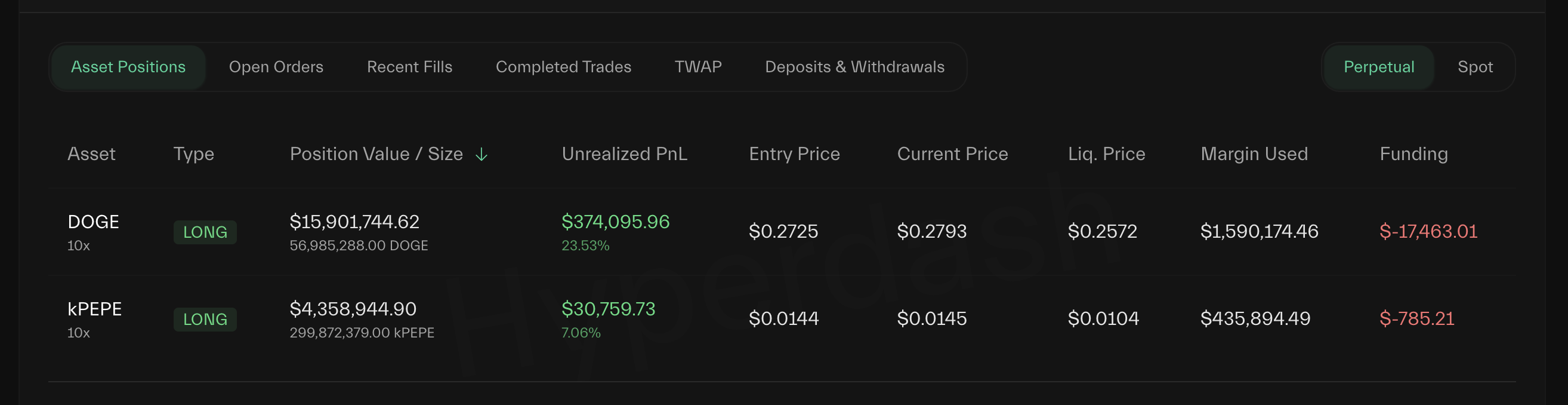

Wynn still has two open leveraged positions. This includes a 10× long on DOGE, which is sitting on an unrealized gain of $374,095. Another 10× long on PEPE currently shows an unrealized gain of $30,759.

Since returning to the market on July 15, the trader has had a mixed performance, with seven profitable trades and eight net losses recorded. At the time of writing, his win rate stood at 36.6%.

While none of these gains are enough to reverse his losses, they still offer a glimmer of hope for the trader.

Meanwhile, Lookonchain also highlighted another trader, not for heavy losses, but for a series of well-timed strategic bets that earned him nearly $30 million in just seven days.

“Meet ‘The WHITE Whale,’ a top trader on Hyperliquid with nearly $30 million profit in just one week! Over the past week alone, he used 4 wallets to long ETH and SOL—locking in nearly 30 million in gains and claiming the #1 spot on the leaderboard,” Lookonchain wrote.

Thus, the contrasting performances of James Wynn and the “White Whale” highlight the high-risk, high-reward nature of leveraged trading, where fortunes can be made or lost in a matter of hours.