Bitcoin’s Grip Weakens: Altcoin Season Lurking as Dominance Hits 4-Month Low?

Bitcoin’s throne is wobbling. For the first time in 120 days, its market dominance slips below key levels—fueling speculation that altcoins are primed for a takeover.

The king isn’t dead, but the courtiers are getting restless. Ethereum, Solana, and other major alts have already started nibbling at BTC’s market share. Traders are rotating profits faster than a hedge fund intern pours coffee.

Will history rhyme? The last time dominance cracked like this, altcoins rallied 300% in 90 days. This time, the smart money’s watching stablecoin liquidity—currently parked at sidelines like overpriced sports cars.

One cynical truth remains: In crypto, ‘seasonal shifts’ mostly mean bagholders praying for a second chance. But when the tides turn, they turn fast. Tick-tock.

Altcoin Season Is Around The Corner

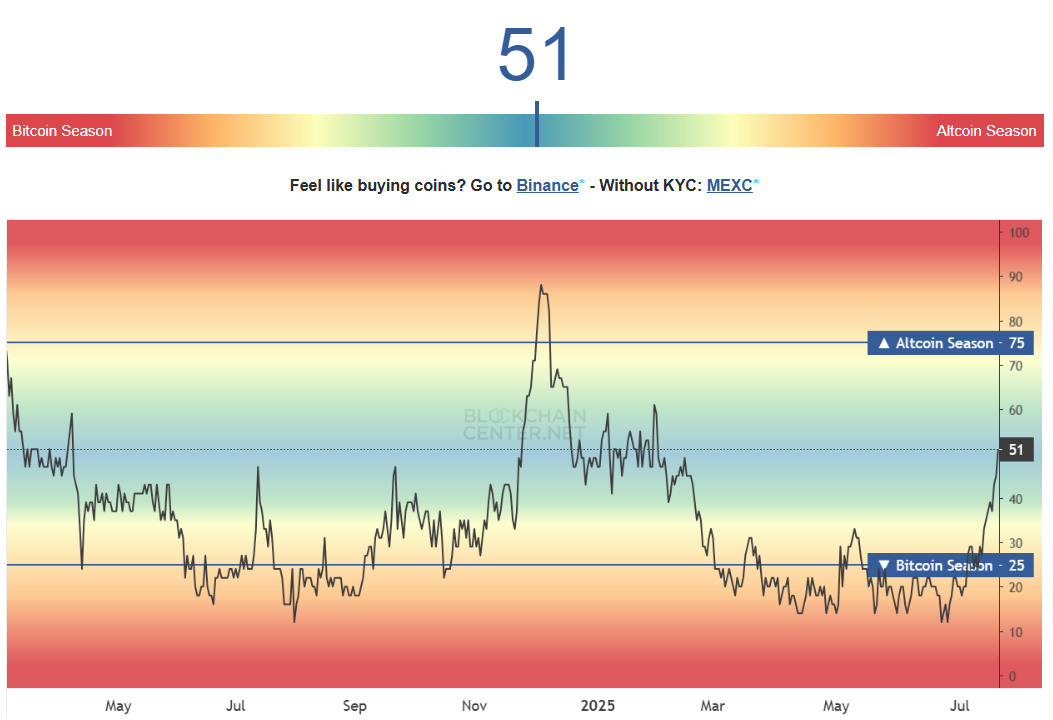

The altcoin season index is currently approaching the critical altseason threshold. The index tracks the performance of altcoins relative to Bitcoin.

It signals whether the broader crypto market is entering a phase where altcoins outperform BTC. At the time of writing, the indicator sits at the midpoint, warranting stronger performance from the altcoins to breach the threshold, indicating an altcoin season.

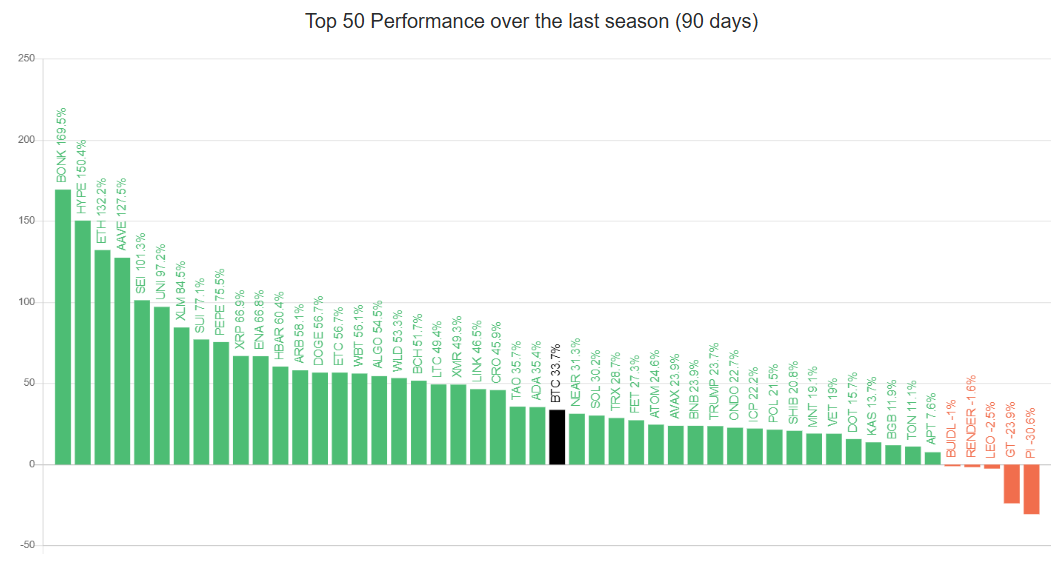

Capital inflows are now favoring altcoins over Bitcoin, further validating the positive sentiment. An altcoin season is confirmed when 75% of the top 50 cryptocurrencies—excluding stablecoins and asset-backed tokens—outperform bitcoin over 90 days.

Currently, only 50% of these altcoins have surpassed Bitcoin’s returns, which shows that there is room for further growth before a full-fledged altcoin season begins.

However, Ethereum’s 27% surge this week alone has pushed many other tokens to multi-month highs. If more altcoins follow Ethereum’s lead and outperform Bitcoin over the next few weeks, the necessary threshold for altseason could be reached by early next month.

Bitcoin’s Domination Wavers

Bitcoin’s dominance has dropped sharply over the past five days, falling 5.6% from 64.5% to 60.9%. This decline marks the lowest point in four and a half months and reflects the market’s growing preference for altcoins.

A falling dominance is often the first sign of an incoming altcoin season.

Ethereum’s rally has contributed significantly to this drop, as BTC’s price remains largely flat at $118,301. Despite the loss in market share, Bitcoin’s price has not declined, signaling a healthy market shift rather than a sell-off. The asset continues to consolidate just below $120,000.

Still, caution is warranted. If altcoin investors begin taking profits due to recent gains, selling pressure could stall the rally. Many tokens are at multi-month highs, and any sharp sell-off could reverse gains.

This might delay the onset of a true altcoin season, pushing it further into Q3 2025.